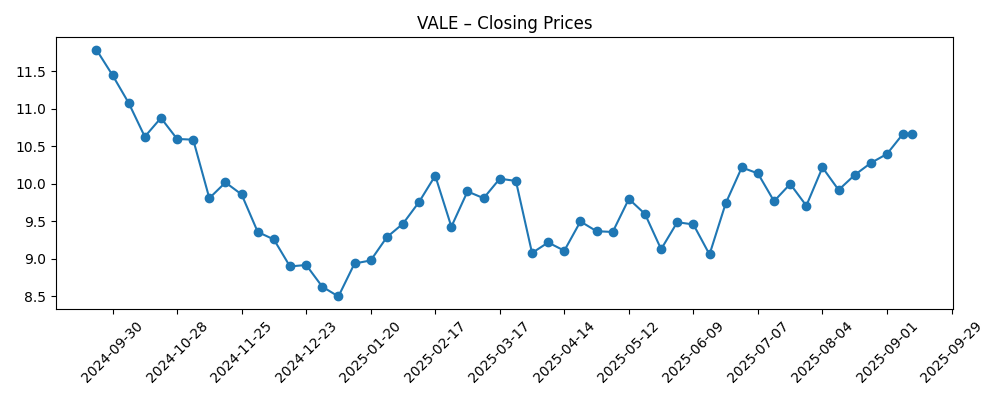

Vale S.A. (VALE) enters September 2025 balancing resilient margins with softer top-line trends and a rich dividend. Trailing-12-month revenue stands at 209.6B with a 25.10% operating margin and 13.81% profit margin, supported by 71.61B in EBITDA and 46.54B in operating cash flow. The stock has recovered from $8.50 in early January to $10.67 on September 12, 2025, within a 52-week range of $8.06–$12.05; its 50- and 200-day moving averages are $10.06 and $9.59. The forward dividend yield is 11.08% (payout ratio 68.40%). Notable developments include a Q2 pro forma EBITDA update, an Indonesian nickel project investment, and mixed institutional flows. Bernstein maintains a Hold with an $11.50 target. Against a 0.76% 52-week stock change versus the S&P 500’s 16.89%, the next three years hinge on iron ore demand, nickel execution, and capital discipline.

Key Points as of September 2025

- Revenue: TTM revenue 209.6B; gross profit 71.78B; EBITDA 71.61B.

- Profit/Margins: Profit margin 13.81%; operating margin 25.10%; ROE 12.84%; ROA 7.12%.

- Sales/Backlog: Quarterly revenue growth -3.70% yoy; quarterly earnings growth -17.20% yoy; operating cash flow 46.54B.

- Share price: Closed $10.67 on Sep 12, 2025; 52-week range $8.06–$12.05; 50D MA $10.06; 200D MA $9.59; beta 1.04.

- Analyst view: Bernstein maintains Hold with a price target of $11.50.

- Market cap: Not disclosed here; shares outstanding 4.27B; float 3.97B; short interest 58.23M (1.36% of float; short ratio 1.81).

- Dividend: Forward yield 11.08%; trailing yield 25.04%; payout ratio 68.40%; dividend date Sep 10, 2025; ex-div Aug 13, 2025.

- Balance sheet: Total cash 31.09B; total debt 110.78B; current ratio 1.22; debt/equity 50.13%.

- Performance context: 52-week change 0.76% vs S&P 500 16.89%; average volume (3M) 40.89M; (10D) 22.66M.

Share price evolution – last 12 months

Notable headlines

- Vale Reports Q2 Pro Forma EBITDA

- Bernstein Maintains a Hold on Vale S.A. (VALE) With a PT of $11.50

- Danantara To Invest In Vale-Gem’s $1.4 Billion Nickel Project In Indonesia

- When Yield Meets Strategy: Vale's Rare Combination

- State of Wyoming Cuts Stock Holdings in Vale S.A. $VALE

- Royal Bank of Canada Boosts Stake in Vale S.A. $VALE

Opinion

Vale’s latest pro forma EBITDA update underscores a familiar theme: earnings resilience amid cyclical softness. The company’s TTM operating margin of 25.10% and profit margin of 13.81% remain healthy even as quarterly revenue growth sits at -3.70% year over year and quarterly earnings growth is -17.20%. The share price, which rebounded from $8.50 in early January to $10.67 by mid-September, now trades above its 200-day moving average and around the 50-day, suggesting sentiment has stabilized after a volatile winter. With beta at 1.04, VALE has behaved roughly in line with the broader market, yet its 52-week change of 0.76% trails the S&P 500’s 16.89%. In our view, the market is weighing robust margins and cash generation against macro risks tied to China’s steel cycle and the trajectory of iron ore prices.

The generous income profile is both a feature and a debate. A forward dividend yield of 11.08% and trailing yield of 25.04% are eye-catching, but sustainability depends on commodity pricing and internal funding priorities. The payout ratio of 68.40% looks manageable against 46.54B in operating cash flow, yet levered free cash flow at -2.81B (ttm) and total debt of 110.78B argue for prudence, especially if prices weaken or growth capex rises. Management’s ability to sequence investments without stressing the 1.22 current ratio will be under scrutiny. We think a steadier iron ore tape and incremental cost discipline could keep distributions attractive, but investors should allow for variability in quarterly payouts and the possibility of tactical adjustments to preserve balance-sheet flexibility.

Strategically, the nickel portfolio remains a long-term differentiator. The reported plan for Danantara to invest in Vale-Gem’s $1.4 billion nickel project in Indonesia signals external confidence and could accelerate timelines while sharing risk. For Vale, successful execution would deepen exposure to EV supply chains and partially offset iron ore cyclicality. The trade-off is capital intensity and regulatory complexity—areas where governance and environmental standards must be demonstrably strong. If project partners help de-risk development and offtake visibility improves, VALE’s earnings mix could tilt toward higher-growth metals over the next cycle. Conversely, slippage in schedules or cost overruns would crowd out capital for dividends and buybacks at precisely the wrong point in the macro cycle.

Flows and signals remain mixed, as recent disclosures show the State of Wyoming trimming exposure while Royal Bank of Canada increased holdings. Sell-side tone is similarly balanced—Bernstein’s Hold and $11.50 target effectively frame $10–$12 as a near-term negotiation zone while the market awaits clearer catalysts. We think the next leg will be driven by: the durability of margins against a -3.70% revenue trend, the cadence of nickel project milestones, and discipline around debt (110.78B) and shareholder returns. If VALE can maintain cash generation and demonstrate credible progress in base metals, the stock’s income plus optionality setup looks compelling; if not, the yield could prove more signal of risk than reward.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like in 2028 | Implications for VALE |

|---|---|---|

| Best | Iron ore demand stabilizes as China stimulus supports steel, while Indonesian nickel projects hit key milestones with partner funding and offtake traction. Margins remain robust and balance-sheet metrics improve. | Dividend remains attractive and more predictable; valuation re-rates as the mix tilts toward base metals growth and cash returns are sustained. |

| Base | Iron ore prices oscillate but stay profitable; nickel development progresses incrementally with some delays. Cost control offsets modest topline pressure; cash returns are flexible and patterned to commodity cycles. | Range-bound share price around prevailing averages; yield continues to anchor total return with selective reinvestment in growth. |

| Worse | Prolonged iron ore downturn; nickel project setbacks raise capex needs and timelines. Cash generation tightens; leverage optics worsen and payout becomes more variable. | De-risking takes precedence over distributions; multiple compresses until visibility improves on demand and project execution. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Iron ore demand and pricing tied to China’s steel cycle and global construction activity.

- Execution on Indonesian nickel projects, including partner contributions, permitting, and timelines.

- Capital allocation balance between dividends (forward yield 11.08%) and growth capex amid -2.81B levered FCF (ttm).

- Balance sheet and liquidity: total debt 110.78B, current ratio 1.22, debt/equity 50.13%.

- Regulatory and ESG factors, including environmental compliance and operational safety.

- Institutional positioning and analyst sentiment (e.g., Hold rating, $11.50 PT) influencing near-term multiples.

Conclusion

VALE’s three-year setup is a classic commodity-income proposition with an embedded growth option. On one hand, the company’s 25.10% operating margin, solid EBITDA base, and 46.54B in operating cash flow provide ballast against cyclical revenue softness and a modest 0.76% 52-week share move. On the other, levered free cash flow at -2.81B and 110.78B in total debt argue for careful pacing of distributions and growth spending. The forward dividend yield of 11.08% and a Hold/11.50 target from Bernstein frame expectations: income remains central while valuation awaits clearer evidence that nickel can diversify earnings and that iron ore demand will stabilize. If management sustains margin discipline, advances nickel with credible partners, and keeps liquidity sound, total returns could be competitive. If these break down, the yield premium may reflect risk rather than opportunity.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.