America Movil’s ADRs (AMX) have rallied toward their 52‑week high, closing at 20.34 as of the week of September 12, 2025, versus a 52‑week range of 13.10–20.47. The business shows scale and resilience: trailing‑twelve‑month revenue is 926.22B with a 20.25% operating margin and 5.56% profit margin, supported by EBITDA of 312.26B and operating cash flow of 259.66B. Dividend appeal remains intact with a forward yield of 2.72% on a 0.55 payout and a 58.37% payout ratio. Leverage is meaningful (total debt 768.52B; debt/equity 172.75%) and liquidity is tighter (current ratio 0.75), making execution and funding discipline key. Institutional activity has ticked up, while a recent average price target of 18.12 sits below the current quote, framing a debate between momentum and valuation. This three‑year outlook weighs growth prospects, capital returns, and balance‑sheet risk.

Key Points as of September 2025

- Revenue: TTM revenue 926.22B; quarterly revenue growth (YoY) 13.80%; gross profit 559.38B; revenue per share 302.16.

- Profit/Margins: Operating margin 20.25%; profit margin 5.56%; EBITDA 312.26B; net income attributable to common 51.49B; diluted EPS 0.91.

- Sales/Backlog: Momentum supported by mobile data and fixed‑line upgrades; backlog not typical for telecom services.

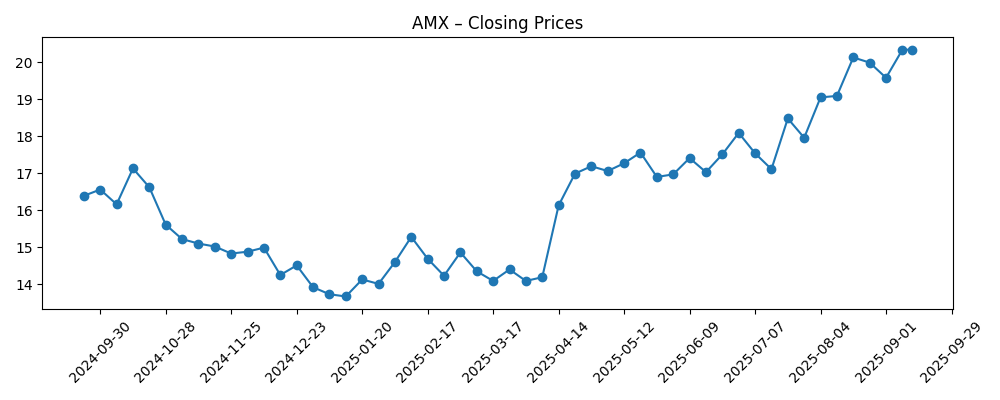

- Share price: Last weekly close 20.34; 52‑week range 13.10–20.47; 50‑day MA 18.71; 200‑day MA 16.22; beta (5Y) 0.34.

- Analyst view: Recent average target of 18.12; short interest moderate with 0.22% of shares outstanding and short ratio 3.42.

- Dividend: Forward annual dividend 0.55 (2.72% yield); trailing dividend 0.52 (2.57%); ex‑dividend date 7/11/2025; payout ratio 58.37%.

- Balance sheet: Total debt 768.52B; total cash 99.64B; current ratio 0.75; debt/equity 172.75%.

- Ownership: Shares outstanding 3.02B; institutions hold 6.13%; insiders 0.00%; short % of float 0.42%.

Share price evolution – last 12 months

Notable headlines

- LPL Financial LLC Purchases 11,220 Shares of America Movil, S.A.B. de C.V. Unsponsored ADR (AMX)

- Compound Planning Inc. Has $234,000 Stock Holdings in America Movil, S.A.B. de C.V. Unsponsored ADR (AMX)

- Northern Trust Corp Boosts Stake in America Movil, S.A.B. de C.V. Unsponsored ADR (AMX)

- Wellington Management Group LLP Has $18.31 Million Position in America Movil, S.A.B. de C.V. Unsponsored ADR (AMX)

- Analysts Set America Movil, S.A.B. de C.V. Unsponsored ADR (NYSE: AMX) Price Target at $18.12

Opinion

America Movil’s share price recovery through 2025—climbing from the mid‑teens early in the year to 20.34 near a 52‑week high—suggests investors are rewarding operational momentum and steady cash generation. The company’s 20.25% operating margin and 259.66B in operating cash flow provide room to fund network upgrades while maintaining a 2.72% forward dividend yield. Yet the latest listed average target of 18.12 sits below the current quote, implying the market may be pricing in continued earnings growth or optionality beyond consensus. The divergence between momentum and target prices often resolves with either stronger‑than‑expected execution (validating the rally) or a pause while estimates catch up. With beta at 0.34, AMX has historically offered lower volatility exposure; this could keep the stock in demand among defensively minded investors if macro conditions remain choppy.

Institutional headlines indicate incremental accumulation—from Wellington Management to Northern Trust—which can support liquidity and signal confidence in fundamentals. While these position updates are modest in size, they align with improving revenue trends (13.80% YoY for the most recent quarter) and solid EBITDA of 312.26B. The company’s scale in Latin America and continued monetization of data and fixed broadband remain core drivers. Over the next three years, value creation will likely hinge on balancing capex for 5G and fiber with shareholder returns. The 58.37% payout ratio appears reasonable against current free cash flow (114.65B levered FCF), though any uptick in competitive intensity or currency pressure could test dividend growth cadence. If management can translate operating leverage into higher net margins, the equity story broadens beyond yield and stability.

Leverage is the main counterweight. Total debt of 768.52B and a 172.75% debt‑to‑equity ratio, combined with a 0.75 current ratio, suggest limited room for error if funding costs rise or if local currencies weaken against the U.S. dollar. That said, the firm’s operating cash flow provides a buffer, and its beta profile indicates the equity may be less sensitive to broad risk‑off swings than peers. In a constructive scenario, debt can be refinanced on acceptable terms while EBITDA growth drives gradual deleveraging. Conversely, tighter credit and FX volatility could compress margins via higher interest expense and imported equipment costs. Over a three‑year window, disciplined capital allocation and liability management may matter as much as topline growth in sustaining valuation.

Valuation signals are mixed. The move above the 50‑day and 200‑day moving averages (18.71 and 16.22, respectively) supports a bullish technical backdrop, but the proximity to the 52‑week high of 20.47 invites profit‑taking unless fundamentals keep surprising to the upside. With short interest relatively low (0.22% of shares outstanding; short ratio 3.42), there is limited fuel for a squeeze, so further gains likely require estimate revisions or capital return surprises. Dividend reliability at a 2.72% forward yield can anchor total return, yet investors should watch for management commentary on capex, pricing, and currency exposure. Net‑net, AMX enters the next three years with solid operations and defensible cash flow, but success will depend on maintaining growth while steadily improving balance‑sheet flexibility.

What could happen in three years? (horizon September 2025+3)

| Scenario | Implications |

|---|---|

| Best | Revenue growth remains robust, operating margin holds near current levels or improves, and steady operating cash flow supports both network investment and rising dividends. Debt is refinanced on favorable terms, leverage trends down, and the stock sustains a premium to recent analyst targets as confidence in execution builds. |

| Base | Growth moderates as competition and FX fluctuations persist. Margins are broadly stable, with dividend maintained and modestly increased in line with cash flow. Leverage remains manageable but elevated, with refinancing clearing near‑term maturities. Share price tracks fundamentals and trades around consensus valuation ranges. |

| Worse | FX headwinds, higher funding costs, or regulatory actions pressure revenue and net margin. Capex needs force tighter payout decisions, limiting dividend growth. Leverage rises or deleveraging stalls, and investor sentiment weakens, pushing the stock below moving averages until visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Currency movements across key Latin American markets affecting revenue translation and equipment costs.

- Competitive dynamics in mobile data and fixed broadband, including pricing and churn.

- Regulatory decisions and spectrum policies that impact capex plans and market structure.

- Interest rates and credit market conditions influencing refinancing costs and leverage trajectory.

- Execution on 5G/fiber rollouts and monetization of higher‑value services.

- Capital allocation between dividends, potential buybacks, and balance‑sheet strengthening.

Conclusion

America Movil’s investment case into 2028 rests on a straightforward trade‑off: strong, cash‑generative operations and a dependable dividend versus a leveraged balance sheet and macro‑FX exposure. Today’s setup shows momentum—revenue growth of 13.80% YoY, solid operating margin at 20.25%, and improving technicals with the stock above its 50‑ and 200‑day moving averages. Dividend support (2.72% forward yield, 58.37% payout ratio) provides ballast to total return, while low beta offers relative defensiveness. The bear case centers on funding costs and currency headwinds that could compress net margins and slow deleveraging, potentially capping multiple expansion. The bull case envisions steady execution, resilient cash flow, and disciplined capital allocation that maintains investment and shareholder returns in tandem. On balance, AMX appears positioned for moderate, cash‑backed compounding, with upside most likely if management can incrementally improve balance‑sheet flexibility without sacrificing growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.