LVMH Moët Hennessy, one of the world's leading luxury goods conglomerates, continues to navigate a turbulent market. Recent financial indicators show a decline in both revenue and share price, prompting analysts to reassess the company's outlook. Despite these challenges, LVMH maintains a strong market position with innovative strategies, including new store openings and management changes. Investors are keenly watching how the company adapts to ongoing economic pressures and evolving consumer preferences in the luxury segment.

Key Points as of July 2025

- Revenue: $84.68B

- Profit/Margins: Net Income: $12.55B; Profit Margin: 14.82%

- Sales/Backlog: Quarterly Revenue Growth (yoy): -2.10%

- Share price: $468.80

- Analyst view: Cautious outlook amid market challenges

- Market cap: $234.97B

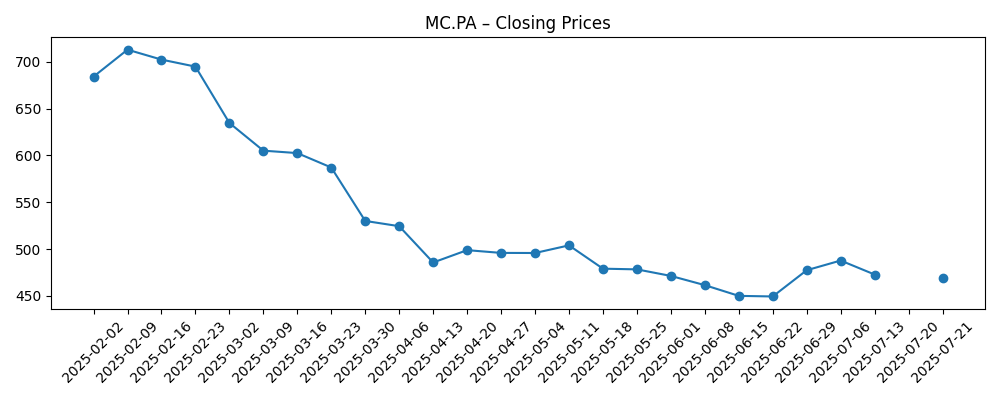

Share price evolution – last 6 months

Notable headlines

- Mercedes to LVMH Are Blunting the EU’s Fight Against Trump’s Tariffs

- Louis Vuitton Opens Cruise Ship Style Store The Louis In Shanghai

- Michael Burke to Head LVMH Americas

- LVMH Share transactions disclosure

Opinion

LVMH’s recent performance has raised several questions among investors and analysts alike. The company’s revenue hit a troubling decline of over 2% year-on-year, which reflects the broader challenges facing the luxury sector. Concerns about economic stability, shifting consumer behavior, and an uptick in competition from both traditional and emerging luxury brands have contributed to this downturn. The volatility in LVMH's share price, plummeting from a 52-week high of $762.70 to its current level, suggests that investor confidence is shaky.

In light of these dynamics, LVMH's strategy to open new flagship stores, such as the recent launch in Shanghai, could be a crucial move. These initiatives could invigorate sales and strengthen brand presence in key markets. However, the success of these ventures is contingent on their ability to attract a discerning consumer base that is increasingly influenced by sustainability and authenticity. The management transition, with Michael Burke taking the helm in the Americas, adds another layer of scrutiny to operational effectiveness moving forward.

Moreover, looming tariffs and regulatory challenges, as highlighted in the recent headlines, may further complicate LVMH's international dealings. As the luxury market evolves, LVMH must adapt to maintain its competitive edge. Investors will be closely monitoring these developments, specifically how LVMH navigates geopolitical tensions and emerging market opportunities in the coming years.

Ultimately, the outlook for LVMH is a mixed bag. While there are tangible efforts to innovate and expand, the company must also contend with external pressures that could affect its bottom line. A key focus will be whether these strategies translate into tangible performance improvements and regain lost shareholder confidence.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Revenue growth rebounds, market cap exceeds $300B, shares recover to $700+ |

| Base | Stable growth in luxury market, revenue stabilizes around $90B, shares hover around $500 |

| Worse | Continued market declines, revenue falls below $75B, shares drop to $400 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Consumer spending trends in luxury markets

- Regulatory impacts and tariff changes

- Management effectiveness and strategic direction

- New product line successes or failures

- Global economic conditions

Conclusion

In conclusion, LVMH's position in the luxury sector is being tested by both internal and external forces. While the company's brand strength and operational capabilities remain robust, the current market conditions present a significant challenge. Key strategic decisions, including the new leadership role of Michael Burke in the Americas and the opening of new luxury stores, will be pivotal in shaping LVMH's future trajectory. Investors can expect further volatility in share prices as the market reacts to ongoing economic developments and the company's ability to adapt to changing consumer preferences. Overall, while there are clear risks involved, the potential for recovery remains if the company can leverage its strengths and navigate these turbulent waters effectively.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.