MercadoLibre, Inc. (MELI) has demonstrated robust growth in recent quarters, with a revenue (ttm) of $22.38 billion, reflecting a year-on-year quarterly revenue growth of 37%. The company's strong profit margin of 9.21% and operating margin of 13.06% underpin its operational efficiency. A significant focus on expanding financial services, combined with strategic collaborations such as the partnership with Oxxo to enhance financial access in Mexico, suggests a commitment to capturing market share in the rapidly evolving fintech landscape. Analyst expectations remain high, as reflected by multiple buy ratings and raised price targets from firms like UBS and Scotiabank, indicating strong market confidence.

Key Points as of August 2025

- Revenue: $22.38B

- Profit Margin: 9.21%

- Quarterly Revenue Growth (YoY): 37.00%

- Share Price: $2,375.92

- Analyst View: Mostly Buy ratings

- Market Cap: $120.0B

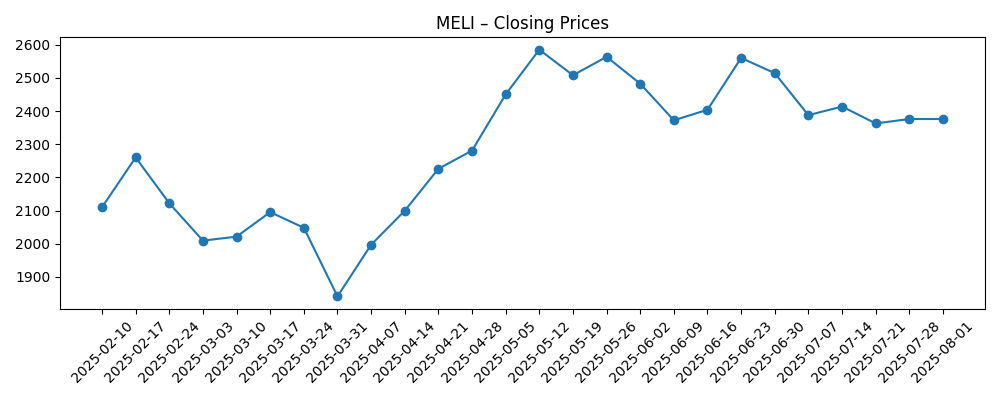

Share price evolution – last 6 months

Notable headlines

- UBS Raises MercadoLibre (MELI) Price Target, Keeps Buy Rating

- Scotiabank Initiated MercadoLibre, Inc (MELI) With a Buy Rating

- Bank of America Securities Maintained a Buy rating on MercadoLibre (MELI)

- MercadoLibre (MELI) Teams with Oxxo to Expand Financial Access Across Mexico

- Sustained Momentum Boosted MercadoLibre (MELI) in Q2

Opinion

The recent price increase and upward analyst ratings position MELI as a strong contender in the Latin American e-commerce market. With strategic moves like partnerships and technology investments, MELI aims to capitalize on the growing digital economy in the region. Its emphasis on financial services not only diversifies revenue streams but also enhances customer engagement, creating a sustainable competitive advantage.

However, investors should be cognizant of market volatility and macroeconomic factors that could impact growth. The recent decline in share price following peaks earlier in the year could indicate a volatile trading environment influenced by investor sentiment and external economic pressures.

In the coming years, MELI's ability to innovate and expand its customer base will be crucial. Enhanced logistics, improved user experience on its platforms, and strategic pricing could further solidify its market position. The balance between expansion and maintaining profitability will be essential to navigate future challenges.

Overall, MercadoLibre's strategic focus on growth and innovation, combined with a favorable analyst outlook, presents a compelling case for potential investors looking at the Latin American market.

What could happen in three years? (horizon August 2025+3)

| Scenario | Projected Revenue | Share Price |

|---|---|---|

| Best Case | $35.0B | $4,000 |

| Base Case | $30.0B | $3,200 |

| Worst Case | $25.0B | $2,000 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory changes in e-commerce and fintech sectors

- Competitive landscape changes and new entrants

- Macroeconomic stability in Latin America

- Technological advancements in logistics and customer experience

Conclusion

In conclusion, MercadoLibre stands at a pivotal moment in its journey as a leader in e-commerce and fintech within Latin America. The company's solid financials, coupled with a favorable analyst outlook, suggest a bright future, provided it navigates the complexities of the market effectively. Continuous investment in its technology and infrastructure will be vital to capture the growing digital consumer base in the region. While there are inherent risks, the strategic direction and recent partnerships illustrate a commitment to sustaining growth and profitability, making MELI an interesting prospect for investors looking to capitalize on Latin American opportunities.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.