Nestlé (NESN.SW) enters August 2025 with defensive fundamentals but mixed momentum. Over the past year, the shares fell 17.71%, closing the latest week at 75.56, versus a 52‑week range of 69.90–91.72. The group generated 90.9B in trailing 12‑month revenue with an 11.34% profit margin and 16.07% operating margin; EBITDA stands at 17.56B and net income at 10.31B. Cash generation remains solid (14.58B operating cash flow; levered free cash flow 5.76B), supporting a 3.05 dividend per share (4.07% forward yield) despite a 76.25% payout ratio. Leverage and liquidity are watch‑points (65.6B total debt, 225.85% debt‑to‑equity, 0.71 current ratio). With a trailing P/E of 18.73 and forward P/E of 17.27, the market prices modest growth and stability (beta 0.40). This three‑year outlook explores how margins, regulation, and capital allocation could shape returns.

Key Points as of August 2025

- Revenue (ttm): 90.9B; quarterly revenue growth (yoy): -1.80%.

- Profitability: Profit margin 11.34%; operating margin 16.07%; EBITDA 17.56B; ROE 33.76%.

- Cash flow and dividends: Operating cash flow 14.58B; levered FCF 5.76B; forward dividend 3.05 (yield 4.07%); payout ratio 76.25%.

- Balance sheet and valuation: Total debt 65.6B; D/E 225.85%; current ratio 0.71; EV 252.79B; EV/EBITDA 14.00.

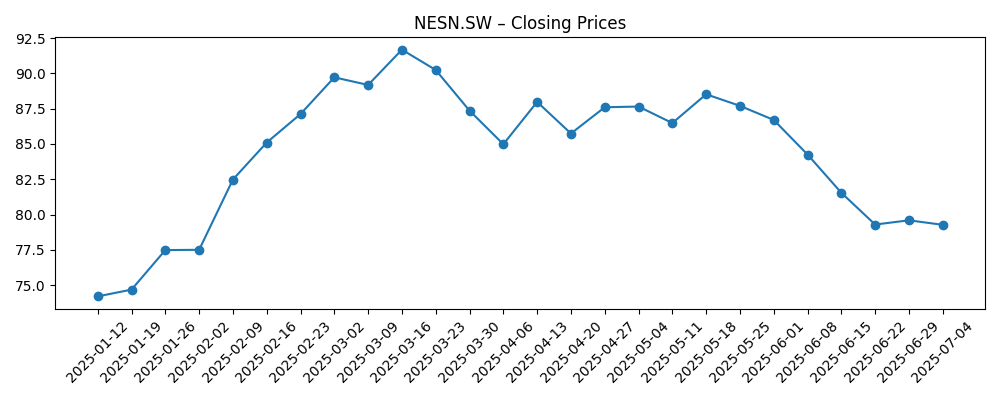

- Share price and volatility: Last weekly close 75.56 (Aug 29, 2025); 52‑week range 69.90–91.72; 52‑week change -17.71%; beta 0.40.

- Multiples: Trailing P/E 18.73; forward P/E 17.27; PEG (5yr) 4.61; Price/Sales 2.13; Price/Book 6.68.

- Market profile: Market cap 192.70B; shares outstanding 2.57B; float 2.57B; institutions hold 41.57%.

- Sales/earnings trend: Quarterly earnings growth (yoy) -10.30%; revenue per share 35.26; gross profit (ttm) 42.41B.

- Technical tone: 50‑day MA 75.65; 200‑day MA 80.74; recent weekly trough 71.10 (week of 2025‑07‑27) and rebound to 75.56.

Share price evolution – last 12 months

Notable headlines

Opinion

The stock’s trajectory in 2025 has been choppy: from weekly closes near the 52‑week high in mid‑March to a trough around late July, then a modest rebound into late August. That pattern mirrors soft near‑term fundamentals, with revenue down year over year and earnings growth negative on the latest quarterly comparison. Against a rising broader market over the past 12 months, the underperformance highlights investors’ preference for visible growth catalysts. At 4.07%, the forward dividend yield cushions sentiment, but a relatively high payout ratio limits flexibility if earnings remain pressured. The valuation—high‑teens on trailing earnings and mid‑teens on forward—suggests the market still ascribes a quality premium. To sustain it over the next three years, Nestlé likely needs to stabilize volumes, protect mix, and demonstrate that cost discipline can offset reformulation and compliance spend.

Margins are the hinge. With an operating margin of 16.07% and profit margin of 11.34%, incremental improvements in product mix and pricing power can translate meaningfully into cash flow. Over a three‑year horizon, the most credible route to better profitability is a tighter focus on categories and geographies where brand equity supports pricing, while pruning slower‑turning SKUs. Efficiency programs and selective procurement savings could help, but they must be balanced against quality and innovation investments. If management can hold gross profit broadly steady while simplifying the portfolio, operating leverage could rebuild. Conversely, if top‑line softness persists, marketing and trade‑spend inflation may compress margins, leaving the company reliant on cost cuts that carry execution risk.

Regulatory and consumer trends also shape the outlook. Heightened scrutiny of ultra‑processed foods, additives, and packaging sustainability is pushing global food majors toward cleaner labels and different materials. For Nestlé, the consequence over the next three years is likely a mix of short‑term expense—reformulation, testing, and packaging changes—followed by medium‑term brand benefits if reformulated products land well. The path is uneven: ingredient substitution can pressure taste profiles and supply chains, while compliance timelines differ across markets. Still, a proactive stance could protect shelf space and pricing, particularly in developed markets. If consumer acceptance is strong, the company may convert regulatory spend into stickier demand; if not, the risk is share loss to smaller challengers with faster innovation cycles.

Capital allocation will influence the share’s rerating. Deleveraging from a sizable debt load and enhancing liquidity would improve resilience and optionality for portfolio moves. With EV/EBITDA at 14.00 and a dividend consuming a material share of cash, management’s trade‑offs are clear: prioritize balance sheet strength and targeted investment over broad‑based expansion. Over three years, steady cash conversion can support both the dividend and selective reinvestment, but execution discipline is essential. Clear disclosures around returns on innovation, cost‑savings milestones, and any divestments or bolt‑ons could help restore confidence after a year of relative underperformance. If earnings visibility improves, the current valuation leaves room for a measured rerating; if not, the shares may remain range‑bound, anchored by income appeal rather than growth.

What could happen in three years? (horizon August 2025+3)

| Scenario | What it looks like | Potential implications |

|---|---|---|

| Best | Successful reformulations and mix improvements support steady volume, while cost discipline lifts margins. Cash conversion remains robust and the balance sheet improves. | Quality premium sustained; dividend viewed as secure; scope for a modest rerating as growth credibility returns. |

| Base | Volumes stabilize unevenly across regions; pricing offsets input costs; regulatory spend is absorbed without major disruption. | Valuation holds near current multiples; total return driven mainly by the dividend with incremental capital appreciation. |

| Worse | Consumer pushback on product changes and ongoing category scrutiny weigh on sales; cost inflation persists; deleveraging stalls. | Multiple compresses; management pivots to deeper cost actions; dividend policy faces scrutiny if earnings pressure endures. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on reformulation and packaging changes amid evolving nutrition and sustainability rules.

- Input‑cost and logistics volatility affecting gross margin and promotional intensity.

- Foreign‑exchange swings across key markets impacting reported growth and margins.

- Capital allocation discipline, including deleveraging progress and any portfolio pruning or bolt‑on deals.

- Demand resilience for core brands versus private label and niche challengers.

Conclusion

Nestlé’s three‑year investment case balances dependable cash generation and brand strength against moderate growth and execution challenges. The starting point is mixed: revenue dipped year over year, earnings momentum is soft, and leverage and liquidity metrics argue for prudence. Yet the company retains key supports—solid operating cash flow, a meaningful dividend yield, and a valuation that implies confidence in durability rather than acceleration. Looking ahead, the bull path hinges on protecting mix, demonstrating pricing power without eroding volumes, and converting regulatory spend into brand equity. The bear path centers on prolonged volume pressure, rising compliance and input costs, and slower‑than‑hoped balance sheet progress. Our base view sees stability with selective improvement as management narrows focus, maintains cost discipline, and prioritizes cash generation. In that setup, income drives most of the return, while sustained execution could gradually rebuild investor trust.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.