NN Group (NN.AS) enters the next three years with improving market sentiment, a high yield and a still-modest valuation. The shares are up 29.13% over 12 months, closing at 57.90 on September 5, 2025, with a 52-week high of 63.58 and beta of 0.62. Fundamentals show scale and profitability: revenue of 14.45B (ttm), profit margin 9.17% and operating margin 36.83%, alongside robust quarterly revenue growth of 35.70% year on year. Valuation screens undemanding at a trailing P/E of 12.37, forward P/E of 7.04 and price-to-book of 0.71. Income remains central with a forward dividend yield of 6.11% on a 3.54 payout and a 73.50% payout ratio. Recent coverage has turned incrementally constructive, with JPMorgan lifting its price target by EUR 5 and a consensus “Hold” call reported by ETF Daily News.

Key Points as of September 2025

- Revenue: 14.45B (ttm); revenue per share 53.89; quarterly revenue growth (yoy) 35.70%.

- Profit/Margins: profit margin 9.17%; operating margin 36.83%; ROE 6.24%; ROA 1.76%.

- Sales/Momentum: gross profit 8.58B; EBITDA 5.86B; operating cash flow 249M; levered FCF 175.5M.

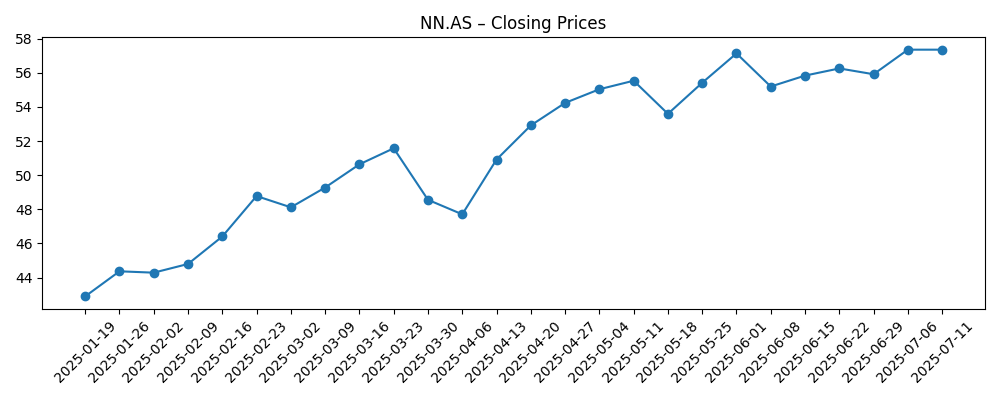

- Share price: last weekly close 57.90 (Sep 5, 2025); 52-week change 29.13%; 52-week high 63.58; low 40.44; 50-day MA 58.63; 200-day MA 51.17; beta 0.62.

- Analyst view: JPMorgan raised price target by EUR 5; Kepler Capital Markets upgraded to Hold; brokerages’ consensus “Hold” (ETF Daily News).

- Market cap and valuation: market cap 15.32B; trailing P/E 12.37; forward P/E 7.04; PEG 0.72; EV/Revenue 2.61; Price/Book 0.71; Price/Sales 1.94.

- Dividend: forward annual dividend rate 3.54 (yield 6.11%); payout ratio 73.50%; ex-dividend date 8/12/2025.

- Balance sheet/ownership: total cash 62.24B; total debt 13.31B; debt/equity 61.25%; current ratio 70.24; shares outstanding 263.91M; float 251.28M; institutions hold 61.91%.

Share price evolution – last 12 months

Notable headlines

- NN Group price target raised by EUR 5 at JPMorgan [Thefly.com]

- NN Group (OTCMKTS:NNGRY) Raised to Hold at Kepler Capital Markets [ETF Daily News]

- NN Group (OTCMKTS:NNGRY) Shares Down 2.3% [ETF Daily News]

- NN Group NV Unsponsored ADR Receives Consensus Recommendation of “Hold” from Brokerages [ETF Daily News]

Opinion

Valuation is the crux of the three-year debate. NN Group trades at a trailing P/E of 12.37 and a forward P/E of 7.04, implying that consensus expects a visible earnings rebuild. The price-to-book of 0.71 adds another cushion: investors are paying meaningfully below reported book value per share of 81.72. The key swing factor is the path of earnings quality. Quarterly revenue growth is strong at 35.70% year on year, but quarterly earnings growth is currently negative (yoy), which helps explain the still-tempered “Hold” stance across brokers. If reported profitability normalizes toward the forward multiple and margins remain near current levels (profit margin 9.17%, operating margin 36.83%), the discount to book could narrow and the shares may earn a higher multiple without stretching fundamentals.

Income investors will focus on durability. The forward annual dividend rate of 3.54 implies a 6.11% yield, but the payout ratio of 73.50% requires steady earnings and cash generation to remain comfortable. Reported operating cash flow of 249M and levered free cash flow of 175.5M show recent variability that can occur in insurance-heavy models. Offsetting that, NN Group’s balance sheet metrics appear robust on headline figures (total cash 62.24B versus total debt 13.31B; debt/equity 61.25%), providing flexibility to sustain distributions and invest for growth. Over the next three years, investors will likely reward consistent capital returns paired with disciplined underwriting and cost control, while any wobble in earnings trajectory could quickly shift the conversation back to dividend cover.

Price action has already improved. The stock’s 52-week change of 29.13% and stabilization above the 200-day moving average of 51.17 suggest sentiment repair, while the 50-day moving average at 58.63 frames near-term momentum. With a beta of 0.62 and average three-month volume near 593k shares, the name tends to move less than the market but can still trend when fundamentals align. A sustained push through prior highs would likely need confirmation from earnings, not just multiple expansion. Conversely, pullbacks toward longer-term moving averages could offer tests of investor conviction in the dividend and the forward P/E story. Over three years, a pattern of higher lows alongside improving profitability would be a constructive setup.

Street signals have turned marginally more positive. JPMorgan’s move to raise its price target by EUR 5 and Kepler Capital Markets’ upgrade to Hold nudge expectations higher without signaling exuberance. That tone matches the data: valuation is not stretched, fundamentals show improvement, and the dividend remains a central part of the equity case. The broker consensus labeled as “Hold” by ETF Daily News leaves room for upside if execution stays on track and capital returns are predictable. On this backdrop, we see three main levers for a rerating over the next three years: delivering on the implied earnings recovery embedded in the forward multiple, preserving the yield with sufficient coverage, and demonstrating steady operating momentum after a period of mixed earnings growth.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operations | Capital returns | Valuation and market tone |

|---|---|---|---|

| Best | Revenue growth remains solid; margins broadly hold near recent levels; earnings align with the forward P/E narrative. | Dividend maintained or modestly increased in line with earnings; balance sheet flexibility supports optionality. | Discount to book value narrows; sentiment improves and the stock sustains an uptrend above longer-term averages. |

| Base | Mid-cycle delivery: growth normalizes after a strong patch; profitability steady with occasional volatility. | Dividend maintained with periodic fine-tuning; capital allocation balances shareholder returns and reinvestment. | Valuation converges toward historical norms for a low-beta insurer; trading remains range-bound with constructive bias. |

| Worse | Revenue slows and earnings remain choppy; cost inflation or claims volatility pressure margins. | Dividend coverage tightens; management prioritizes balance sheet strength over distribution growth. | Discount to book persists; shares retrace toward support areas as investors wait for clearer earnings momentum. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution vs expectations: bridging trailing P/E of 12.37 to forward P/E of 7.04 requires a visible earnings recovery after negative quarterly earnings growth (yoy).

- Dividend sustainability: a 6.11% yield and 73.50% payout ratio hinge on consistent earnings and cash generation (OCF 249M; LFCF 175.5M).

- Market environment: interest-rate moves and investment market swings that affect portfolio returns and insurance claims trends.

- Regulatory and legal developments: any changes affecting capital, reserving, or distribution policies.

- Capital allocation and analyst sentiment: shifts in dividend policy, potential buybacks, or rating/target changes from major brokers.

Conclusion

NN Group’s three-year setup blends cyclical recovery potential with income resilience. The valuation case is straightforward: shares trade at a discount to book (price-to-book 0.71) and at a forward multiple that implies earnings normalization (7.04 vs 12.37 trailing). The income case is appealing at a 6.11% indicated yield, provided the 73.50% payout ratio remains supported by earnings and cash generation. Price action has improved, with a 29.13% 12‑month gain and support anchored by the 200‑day moving average, but a durable break higher likely requires steadier earnings after mixed quarterly trends. Recent analyst moves (JPMorgan’s price target increase and a Hold‑weighted stance) suggest cautious optimism. Over the next three years, consistent profitability, disciplined capital returns, and stable markets could close the valuation gap; setbacks to earnings quality or dividend cover would likely cap the rerating. On balance, the risk‑reward skews constructive but execution remains key.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.