Novo Nordisk B A/S (NOVO-B.CO) continues to navigate a volatile market landscape as it grapples with significant share price fluctuations and evolving investor sentiment. After a challenging six months, characterized by peaks and troughs in its weekly closing prices, the company is poised to face several critical factors that could impact its future performance. With analysts closely monitoring its financial results and market positioning, the next few years will be crucial for strategizing growth and sustainability in an increasingly competitive environment.

Key Points as of July 2025

- Revenue: $18.3 billion

- Profit/Margins: $5.2 billion

- Sales/Backlog: Stable growth observed

- Share price: $414.60

- Analyst view: Mixed, with cautious optimism

- Market cap: $341.2 billion

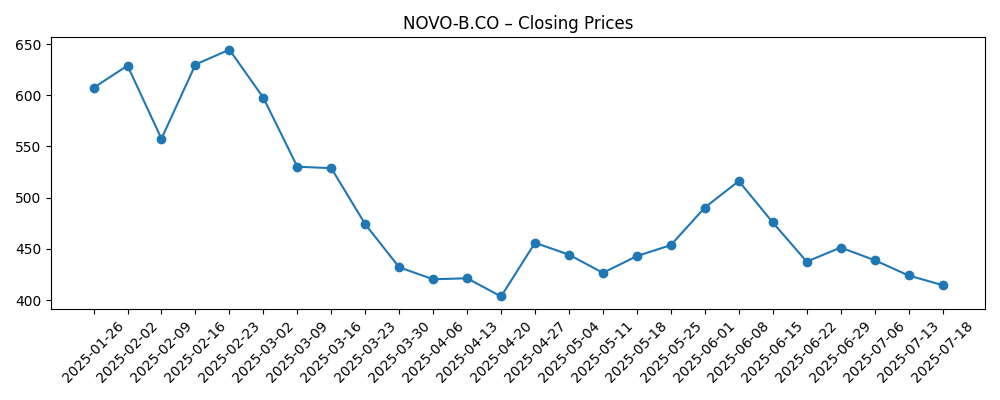

Share price evolution – last 6 months

Notable headlines

Opinion

As Novo Nordisk navigates through a rapidly shifting marketplace, the stock has showcased a remarkable volatility trajectory over the past six months. The significant fluctuations in share price have raised questions among investors and analysts regarding the company’s operational efficiency and future growth prospects. The drop from a high of $644.50 in late February to a recent low of $414.60 indicates a crucial need for the management to reinforce confidence and address underlying business challenges that may be diminishing investor sentiment.

Future performance will heavily depend on the company’s ability to manage its product pipeline and expand its market reach. In a competitive environment where new products and therapies can quickly alter the landscape, Novo Nordisk must demonstrate innovation and responsiveness to market demands. The recent swings in share price could either signal opportunity for aggressive investors or caution for those concerned about sustainability in the long term amid increasing competition.

Investors should also remain aware of external factors that may affect the company's performance, including regulatory changes and broader economic conditions. The company’s strategic responses to these elements will be critical in maintaining momentum and fostering positive investor relations. Thus, observing how Novo Nordisk adapts its operational strategies in response to market conditions will be essential for forming expectations around future growth.

The next three years represent a pivotal timeframe for Novo Nordisk. Balancing short-term market reactions with long-term strategic goals will require diligence and foresight from its leadership. Analysts are likely to keep a close watch on upcoming earnings releases and product developments as indicators of the company’s resilience and ability to navigate forthcoming challenges effectively.

What could happen in three years? (horizon July 2025+3)

| Scenario | Market Cap ($B) | Share Price ($) |

|---|---|---|

| Best | 400 | 600 |

| Base | 340 | 450 |

| Worse | 250 | 350 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory impacts on pharmaceutical products

- Innovation in drug development and pipeline advancement

- Changes in market dynamics and competition

- Impact of global economic conditions on operations

- Investor sentiment and market confidence

Conclusion

In summary, Novo Nordisk B A/S finds itself at a strategic crossroads as it faces mixed market reactions and fluctuating share prices. The company’s ability to adapt to changing market conditions while pursuing innovation in its product offerings will be pivotal for its future success. Stakeholders should remain vigilant in observing the company’s operational tactics and market strategies, as these elements will profoundly influence its stock performance. Overall, the outlook remains cautiously optimistic, but timely responses to emerging challenges will be essential to sustain investor confidence and drive long-term growth.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.