Amazon enters Q4 2025 with momentum in profitability and cash generation after a year of tighter operations and faster growth in higher‑margin lines like cloud, advertising, and third‑party services. Trailing revenue is 670.04B, but the more important shift is mix: the company’s profit margin at 10.54% reflects leaner fulfillment, improved ad yield, and disciplined capital allocation in logistics and data centers. Shares have been choppy in recent months as investors weigh AI spending needs against evidence of margin durability, yet the narrative is coalescing around steady operating leverage. The near‑term setup is retail seasonality, Prime events, and holiday demand, while the three‑year lens hinges on AWS’s AI workloads and the pace of automation across the network. In large‑cap tech, the sector backdrop is defined by heavy AI infrastructure investment, intensifying competition for retail share, and regulators probing platform power. Because mix is moving toward higher‑return businesses and costs are better contained, the next phase for Amazon will likely be judged on execution, not ambition.

Key Points as of October 2025

- Revenue: Trailing twelve‑month revenue stands at 670.04B with quarterly revenue growth of 13.30% year over year.

- Profit/Margins: Profit margin is 10.54% and operating margin is 11.43%; diluted EPS (ttm) is 6.57, indicating improved operating leverage.

- Sales/Backlog: Backlog is not disclosed; retail demand remains seasonal with Prime events and holiday quarter as key volume drivers; logistics initiatives aim to shorten delivery times.

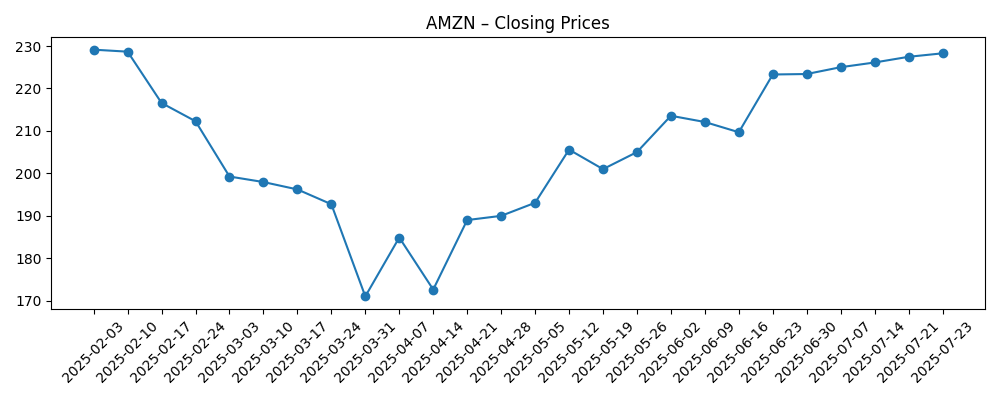

- Share price: Recent weekly close was 224.21 (2025‑10‑24); 52‑week range is 161.38–242.52; 50‑day and 200‑day moving averages are 225.14 and 214.19; beta is 1.28; 52‑week change is 19.01%.

- Cash & leverage: Operating cash flow is 121.14B; levered free cash flow is 31.02B; cash is 93.18B versus total debt of 159.57B; current ratio at 1.02.

- Market cap: Not specified in the snapshot; with 10.66B shares outstanding and broad index inclusion, Amazon remains a mega‑cap.

- Ownership & liquidity: Institutions hold 66.36%; insiders 9.21%; short interest equals 0.77% of float (short ratio 1.56), indicating modest bearish positioning.

- Qualitative setup: Competitive push in low‑price grocery, marketplace expansion, and warehouse/last‑mile automation may improve unit costs but could face regulatory and labor scrutiny.

- Analyst focus: Street debates AI infrastructure spend versus margin durability; key watch items are AWS growth trajectory, ad monetization, and retail productivity.

Share price evolution – last 12 months

Notable headlines

- Amazon Prime Big Deal Days 2025: 50 best deals to shop before sale ends at midnight - AOL.co.uk

- Amazon wants to buy ‘thousands’ of Rivian’s pedal-assist cargo bikes - The Verge

- Leaked Amazon Plans Say Robots Will Help It Avoid Hiring 600,000 Workers - Gizmodo

- Amazon really wants to win Walmart and Aldi shoppers — and it's offering a $5 line of groceries - Business Insider

Opinion

Amazon’s recent trajectory reflects disciplined execution rather than a cyclical lift. Revenue growth of 13.30% year over year, paired with 34.70% earnings growth, signals a healthier mix and cost structure. Profit margin at 10.54% and operating margin at 11.43% imply that logistics densification, advertising yield, and cloud utilization are translating into sustainable operating leverage. The quality of results looks higher because cash generation backs it up: 121.14B in operating cash flow with positive levered free cash flow suggests growth is increasingly self‑funded despite ongoing investment in AI infrastructure and fulfillment.

Sustainability rests on two levers: mix and efficiency. On mix, advertising and marketplace services tend to expand gross margin without adding heavy fixed costs; on efficiency, network automation and shorter‑distance shipping reduce variable costs and delivery times. The risk is that AI and data center capital intensity can rise faster than monetization, pressuring free cash flow. Yet the balance sheet shows ample flexibility with 93.18B in cash versus 159.57B debt and a manageable current ratio of 1.02. If AWS demand for AI training and inference continues to scale, utilization and software attach could offset higher capex.

Industry dynamics cut both ways. Retail peers are adopting generative AI for shopping and customer service, raising the bar for discovery and conversion. Meanwhile, grocery is a battleground on price and convenience; Amazon’s push into low‑price private labels and faster delivery is designed to defend share but may cap near‑term margins. In cloud, hyperscaler competition remains intense as customers weigh multi‑cloud strategies and cost optimization. Amazon’s edge is breadth—commerce, media, logistics, and cloud—creating cross‑sell and data advantages, but regulatory oversight can slow product rollouts and add compliance cost.

These forces shape how the market values the stock. If investors gain confidence that margin gains are durable—via ad growth, AWS AI workloads, and automation—multiples can hold even if top‑line growth moderates. Conversely, an uptick in capex without visible monetization or a consumer slowdown could compress valuation. The narrative over the next three years likely centers on execution proof points: AI services adoption in AWS, ad relevance and measurement, grocery and last‑mile unit economics, and steady free cash flow. Clear evidence on these fronts can reduce volatility and anchor expectations.

What could happen in three years? (horizon October 2028)

| Scenario | Narrative |

|---|---|

| Best | AWS monetizes AI training and inference at scale, ad services deepen across retail and streaming, and automation trims fulfillment and last‑mile costs. Retail share holds in key categories, regulatory friction is manageable, and free cash flow expands, supporting ongoing reinvestment and balance‑sheet strength. |

| Base | Steady mid‑teens revenue growth in cloud and ads offsets slower discretionary retail. Efficiency gains continue but at a measured pace as capex remains elevated for AI infrastructure. Profitability inches higher with stable conversion of operating cash flow to free cash flow, keeping valuation ranges intact. |

| Worse | Macroeconomic softness hits discretionary demand; cloud optimization persists longer while AI monetization lags. Elevated capex and regulation compress margins; logistics and labor pressures resurface. Free cash flow tightens, forcing prioritization of projects and a more conservative growth posture. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution in AI and cloud workloads (utilization, software attach, and pricing versus rising data‑center capex).

- Retail unit economics (delivery speed, returns, and automation) and the impact of low‑price grocery strategy on margins.

- Advertising growth and measurement quality amid privacy, brand‑safety, and regulatory scrutiny.

- Regulatory and legal outcomes affecting marketplace practices, labor, and potential remedies in key geographies.

- Consumer demand trends and FX volatility impacting international e‑commerce performance.

- Competitive dynamics across hyperscalers and big‑box retailers adopting generative AI in shopping and customer service.

Conclusion

Amazon’s investment case into 2028 hinges on whether mix and efficiency continue to outrun the capital intensity of AI and logistics. The numbers point to a sturdier engine: revenue growth outpacing expense growth, double‑digit margins, and strong operating cash flow that cushions elevated investment cycles. The sector backdrop—AI infrastructure build‑out, omnichannel competition, and heightened regulation—raises the execution bar but also rewards platforms that translate scale into better service and lower unit costs. For now, the market appears to be pricing steady operating leverage with room for AI upside if adoption proves durable. Watch next 1–2 quarters: AWS AI workload demand and monetization; retail holiday conversion and returns; ad growth resilience; automation milestones in fulfillment and last‑mile; and the cash‑flow impact of ongoing capex. Clear progress on these vectors could stabilize the narrative and reduce volatility, while slippage would keep the debate centered on timing and payback of new investments.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.