As Apple Inc. (AAPL) enters the second half of 2025, the company confronts a mix of challenges and opportunities in the technology sector. With a reported revenue of $400.37 billion and a profit margin of 24.30%, Apple continues to be a dominant player. However, increasing pressure is arising from market competition, especially in the AI domain, as seen with Nvidia's rise to a $4 trillion valuation. Analysts are suggesting a need for renewed focus on innovative product development amidst concerns over management and strategic direction. Investors are cautious, reflected in the stock’s fluctuating performance, yet maintaining a long-term outlook remains crucial as Apple adapts to evolving market dynamics.

Key Points as of July 2025

- Revenue: $400.37B

- Profit Margin: 24.30%

- Quarterly Revenue Growth: 5.10%

- Share price: $211.18

- Analyst view: Cautious with recent upgrades

- Market cap: Approximately $3.15T

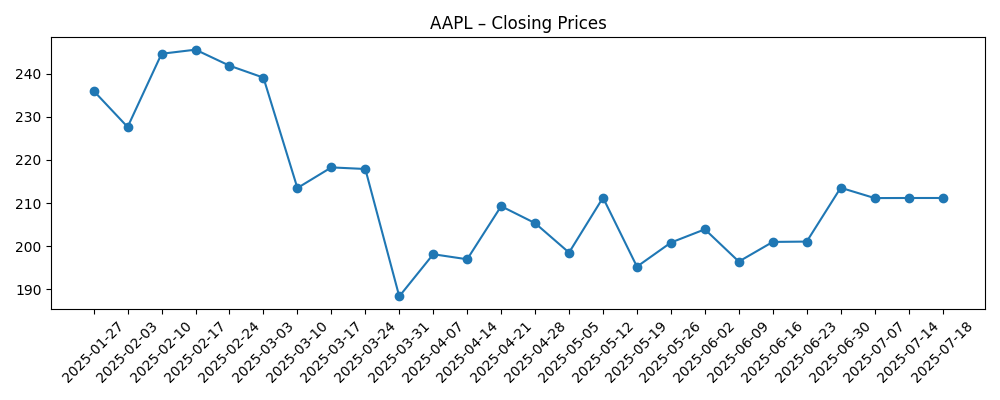

Share price evolution – last 6 months

Notable headlines

- Apple Needs 'Product-Focused CEO,' Say Analysts As Tim Cook Faces Heat Over AI Failures And Innovation Slump

- Apple Inc. (AAPL): People Are Tired Of The Stock Buybacks, Says Jim Cramer

- Apple (AAPL) Hit With ‘Sell’ Rating Ahead of Earnings Report

- Apple fires back at court’s ‘punitive’ App Store order in Epic Games case

- Apple (AAPL) Stock Upgraded to ‘Hold’ by Jefferies — But Analysts Still Cautious on AI

Opinion

The recent headlines illustrate a significant crossroads for Apple as it navigates competitive pressures and internal challenges. The call for a 'product-focused CEO' reflects a broader concern that the company may be falling behind in innovation, especially in light of competitors like Nvidia that are leveraging advancements in AI. This sentiment has been echoed by analysts and investors alike, leading to a cautious stance regarding future growth prospects. Tim Cook's leadership is under scrutiny, pushing for a reassessment of the company's strategic direction. Investors will be watching closely to see if Apple can pivot effectively to maintain its competitive edge.

Additionally, the discussion around stock buybacks continues to surface, signaling a potential disconnect between management strategies and shareholder expectations. As Apple transitions to focusing more on services and software, it must strike a balance between rewarding shareholders and investing in future growth initiatives. This delicate balancing act is crucial as Apple aims to retain investor confidence amidst changing market dynamics.

In the short term, fluctuations in the stock price may continue as the market reacts to news and earnings reports. With a recent share price hovering around $211.18, the outlook remains cautiously optimistic, but the stock needs to demonstrate sustained performance to reassure investors. Strong quarterly results could serve as positive catalysts, but inconsistent performance may lead to further volatility.

Ultimately, the future of Apple’s stock will depend on its ability to innovate and adapt to challenges in its core business areas, particularly as it faces increasing competition. As the company prepares for its upcoming earnings report, all eyes will be on how it positions itself within the rapidly evolving tech landscape.

What could happen in three years? (horizon July 2025+3)

| Scenario | Market Capitalization | Share Price |

|---|---|---|

| Best | $4.5T | $300 |

| Base | $3.5T | $240 |

| Worst | $2.5T | $180 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Innovation in product lines and services

- Market competition, especially in AI and tech

- Overall economic conditions and consumer spending

- Changes in leadership and corporate strategy

Conclusion

As we look ahead, Apple Inc. stands at a pivotal moment with numerous factors shaping its trajectory. The company must navigate competitive pressures while maintaining innovation in its product offerings. The urgency for a renewed focus on product development is underscored by analysts and market perceptions. The upcoming earnings report is crucial for gauging investor sentiment and providing an insight into Apple’s strategic plans moving forward. A successful pass through this critical period could bolster investor confidence and support a stronger market position. Conversely, missteps in strategy or continued performance pressures could lead to a re-evaluation of Apple’s standing in the tech industry. Investors should keep an eye on these developments as they unfold in the coming quarters.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.