Bank of America enters the next phase of the cycle with healthier top‑line momentum and improving investor sentiment. Revenue growth accelerated year over year to 12.60%, and the share price has recovered strongly from last spring’s trough, aided by a calmer rate backdrop and early signs of capital‑markets thawing. The setup reflects a familiar banking equation: net interest income benefits from rates staying relatively elevated, while fee lines like investment banking and wealth rebound as activity returns. Expense discipline and technology modernization help hold the line on costs, while credit normalization remains the swing factor. The stock’s year‑on‑year advance of 26.99% raises the bar for execution but also signals confidence in earnings durability. For the sector, large U.S. banks are navigating regulatory capital proposals and intense deposit competition even as they lean into digital operating models. Over a multi‑year horizon, the debate will turn on margins, losses, and capital return—three levers that can either compound value or cap the multiple depending on how the macro evolves.

Key Points as of October 2025

- Revenue: trailing‑twelve‑month revenue of 101.45B with quarterly revenue growth (y/y) at 12.60%.

- Profit/Margins: profit margin 29.22%; operating margin 35.29%; return on equity 9.87% indicates room to improve vs. large‑bank peers over time.

- Earnings: net income attributable to common of 28.25B; diluted EPS 3.66 on a trailing basis.

- Sales/Backlog: banks do not report backlog; capital‑markets activity is improving across peers, but BAC‑specific pipeline figures were not disclosed.

- Share price: last reported weekly close at 53.03 (2025‑10‑30); 52‑week range 33.07–53.44; 50‑day/200‑day averages at 50.92/45.83; beta 1.33; 52‑week change 26.99%.

- Dividend/Capital: forward annual dividend rate 1.12 (2.13% yield); payout ratio 28.96%; next ex‑dividend date 12/5/2025; dividend date 12/26/2025.

- Market cap: not disclosed in the provided data.

- Ownership/Short interest: institutions hold 68.01% of shares; short interest 1.46% of float; short ratio 3.22.

- Qualitative: scale consumer and corporate franchises, diversified fee mix, and technology investment could support operating leverage; sensitivity to rate path and regulation remains high.

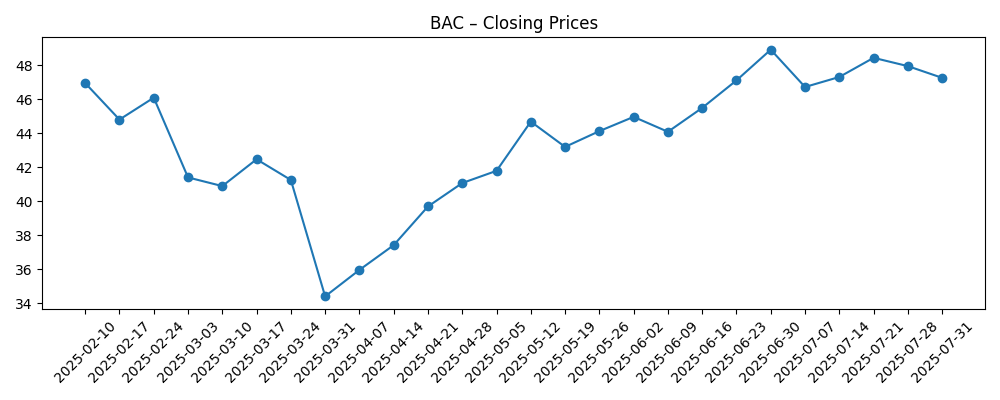

Share price evolution – last 12 months

Notable headlines

- Affordable Dividend Stocks to Watch: Bank of America Corporation’s (BAC) Income Potential

- Phillip Securities Raises the PT on Bank of America Corporation (BAC), Keeps a Buy

- Bank of America Gains Jim Cramer’s Backing Amid Fintech Funding and Strong Institutional Support

Opinion

The latest run of figures suggests BAC is exiting a period of market skepticism with improving fundamentals. Revenue growth of 12.60% year over year and earnings growth of 22.80% indicate both topline and operating leverage are moving in the right direction. Profitability is solid, with a 29.22% profit margin and 35.29% operating margin on a trailing basis, implying good cost control alongside resilient spreads. The share price recovery into the low‑50s mirrors that improvement and tightens the feedback loop: higher confidence reduces the equity cost of capital, which in turn makes organic growth initiatives and technology spend easier to defend. The quality of the beat appears broad‑based—rate support for net interest income, paired with the early rebuilding of fee lines. The caveat is that banks can look best at the turn: investors will want to see these gains persist as deposit costs reprice and credit losses normalize.

Sustainability hinges on the pace of deposit mix shifts and the path of rates. If funding costs stabilize and asset yields hold, net interest income should remain a tailwind; if the curve compresses, spread income could fade. The reported ROE of 9.87% leaves headroom to lift returns through a mix of operating efficiency and a richer fee mix. The payout ratio at 28.96% also leaves capacity for buybacks when conditions allow, though capital rules and stress‑test outcomes will set the ceiling. Management’s ability to balance growth with underwriting discipline will be decisive: slower loan growth can still be accretive if pricing holds and fees accelerate, but aggressive growth into a softening economy would be risky.

Within the industry, a tentative reopening of deal markets would help BAC’s investment banking and wealth platforms regain momentum. Large banks are competing on deposits, payments, and digital engagement; scale helps, but nimble fintechs keep pricing pressure elevated in certain segments. Technology modernization can protect the cost‑to‑serve and improve cross‑sell, supporting margins even if volumes are choppy. Regulation remains an active overhang, with capital and liquidity standards influencing the speed of buybacks and balance‑sheet mix. In this context, BAC’s diversified franchise is an asset: consumer banking anchors low‑cost funding, while corporate and markets businesses provide cyclical upside when activity improves.

Valuation narratives over the next few years will likely track the earnings mix. If fee income rises as a share of revenue and credit stays benign, the market could reward BAC with a sturdier multiple for perceived quality and lower volatility of earnings. Conversely, if spreads narrow and losses lift, investors may revert to book‑value‑anchored frameworks and demand a larger discount for uncertainty. The path that wins is the one that shows durable ROE above the cost of equity, consistent tangible book growth, and visible capacity for capital return. That combination would underpin a more confident equity story even without macro heroics. In short, execution on spreads, fees, costs, and credit will shape the multiple at least as much as the macro tape.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Soft‑landing economy with a modestly steeper yield curve sustains net interest income; fee businesses benefit from a multi‑year recovery in dealmaking and markets; credit losses normalize but remain manageable; regulatory clarity enables steady buybacks and a rising dividend; returns and sentiment improve. |

| Base | Growth slows but remains positive; rate cuts are gradual and deposit costs stabilize; investment banking recovers in fits and starts; expenses are contained through automation; credit normalizes without a sharp spike; capital return is consistent but measured. |

| Worse | Recession and a flatter curve pressure spreads; credit costs rise meaningfully in consumer and commercial books; regulation tightens capital buffers, constraining buybacks; investors rotate to book‑value anchors until earnings visibility returns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Federal Reserve rate path and yield‑curve shape, which drive net interest income and margins.

- Credit quality trends in consumer and commercial portfolios, including charge‑offs and reserve builds.

- Regulatory outcomes on capital and liquidity requirements that affect buybacks and balance‑sheet mix.

- Capital‑markets activity levels across underwriting, advisory, and trading, impacting fee revenue.

- Deposit competition and mix shifts, influencing funding costs and franchise stability.

- Execution on technology and expense discipline to sustain operating leverage.

Conclusion

Bank of America’s setup for the next few years is balanced: healthier revenue growth, improving fee prospects, and disciplined costs on one side; interest‑rate sensitivity, regulation, and credit normalization on the other. The recent improvement in profitability shows the operating model can compound when spreads and activity cooperate, and a moderate payout leaves room for future capital return if rules and stress tests permit. The equity narrative will firm up if the bank can lift returns while preserving underwriting standards and funding stability. Watch next 1–2 quarters: net interest income trajectory; deposit mix and pricing; investment‑banking fee recovery; credit normalization in cards and commercial; operating‑expense trend; capital and buyback signaling post‑regulatory milestones. These are the levers most likely to shape earnings quality and, by extension, the multiple investors are willing to pay in this phase of the cycle.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.