Berkshire Hathaway’s Class B shares enter the next three years from a position of unusual financial strength but mixed sentiment. As of August 2025, the conglomerate posts $370.15B in trailing revenue with a 22.43% operating margin and 17.00% profit margin, supported by $62.92B in net income. Liquidity is ample with $344.09B of cash versus $127.02B of debt (current ratio 3.00). The stock recently changed hands near $495.72—above its 50‑ and 200‑day moving averages of $479.14 and $487.18—yet its 52‑week gain of 5.84% trails the S&P 500’s 15.91%. Recent headlines point to softer near‑term earnings and slower buybacks, offset by portfolio repositioning and media calls to “buy more.” This note outlines what could drive BRK‑B over the next three years, the key risks, and scenarios investors should monitor.

Key Points as of August 2025

- Revenue: Trailing 12‑month revenue is $370.15B; quarterly revenue growth (yoy) is -1.20%.

- Profit/Margins: Operating margin 22.43% and profit margin 17.00%; net income (ttm) $62.92B; EBITDA $98.2B; ROE 9.91% and ROA 4.68%.

- Sales/Backlog: No backlog disclosed here; cash generation remains solid with operating cash flow $27.41B and levered free cash flow $28.27B (ttm).

- Share price: Recent level ~$495.72 (Aug 27, 2025); 52‑week range 437.90–542.07; 50‑ and 200‑day moving averages at 479.14 and 487.18; beta 0.80; 3‑month average volume 4.77M.

- Analyst view: Media noted a post‑earnings dip on slower buybacks and declining earnings; other voices (e.g., Cramer) urged “Buy More.” Quarterly earnings growth (yoy) is -59.20%.

- Market cap/ownership: No market cap shown here; shares outstanding 1.38B; institutions hold 64.95%. Short interest remains modest at 0.61% of shares outstanding (short ratio 2.75).

- Balance sheet: Total cash $344.09B vs total debt $127.02B; current ratio 3.00; total debt/equity 18.95%.

- Capital returns: No dividend (payout ratio 0.00%); buybacks remain the primary lever but were lighter recently, disappointing some investors.

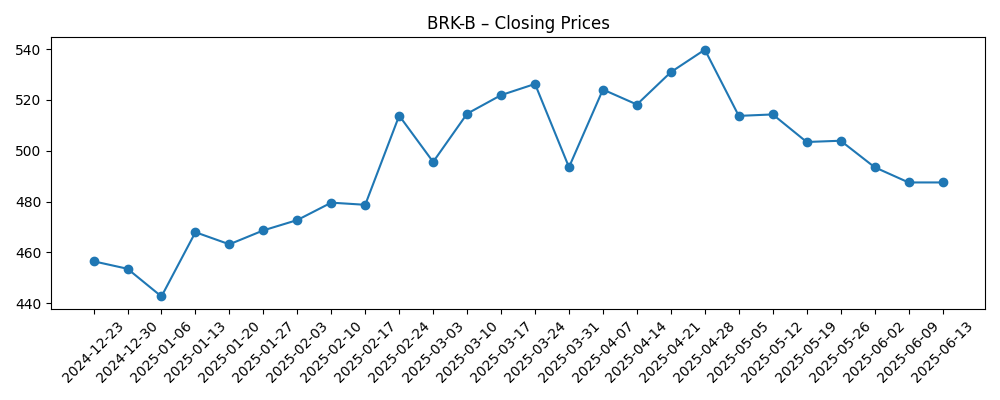

Share price evolution – last 12 months

Notable headlines

- Berkshire shares dip after earnings decline, lack of buybacks disappoint investors (CNBC)

- Berkshire Hathaway’s Second Quarter 2025 Portfolio Moves (Forbes)

- Jim Cramer on Berkshire Hathaway Stock: “Buy More” (Yahoo Entertainment)

- Warren Buffett's 'Mystery Stock' Revealed in New Filing (Newsweek)

- Buffett's Berkshire Hit With $3.8 Billion Kraft Heinz Charge (NDTV Profit)

- Billionaire Family Offices Join Berkshire in UnitedHealth Bet (Livemint)

Opinion

The early‑August selloff following a reported earnings decline and lighter buybacks underscores a recurring Berkshire tension: the market often equates buyback cadence with management’s view on intrinsic value. Berkshire’s discretionary repurchases are valuation‑sensitive by design and can slow when cash opportunities elsewhere look superior or when management deems the shares near fully valued. With the stock around $495.72—above its 50‑ and 200‑day moving averages but below the 52‑week high—investors seem to be reassessing near‑term catalysts. The quarterly earnings growth figure of -59.20% (yoy) and revenue softness (-1.20% yoy) likely reflect both market volatility in the investment portfolio and uneven operating trends, rather than structural weakness. Over a three‑year horizon, the slope of book value compounding and the timing of large capital deployments will matter far more than any single quarter’s buyback tally.

Portfolio disclosures grabbed attention, including coverage of a “mystery stock” and repositioning cited in Q2 2025. Historically, incremental shifts in the listed portfolio—combined with bolt‑on deals—have refined risk/return without changing the conglomerate’s core. Headlines linking Berkshire and health care exposure, alongside the $3.8B Kraft Heinz charge, highlight why GAAP results can swing despite steady underlying cash generation. Berkshire’s unusually large cash balance of $344.09B and relatively modest debt give it a wide menu of future options: opportunistic equity stakes, negotiated private deals, or accelerated buybacks if the discount to intrinsic value widens. The path chosen will color sentiment; transparent rationale around capital allocation could help narrow any valuation gap if investors worry that cash is a drag in a rising‑market tape.

Operationally, the mosaic remains anchored by insurance, energy, rail and manufacturing/services/retail businesses. Insurance results and catastrophe experience can dominate year‑to‑year variability, but the low beta (0.80) and conglomerate breadth often dampen shocks at the portfolio level. With operating cash flow at $27.41B (ttm) and levered free cash flow at $28.27B, Berkshire has internal funding to pursue growth without leaning on debt markets. That said, the measured revenue contraction (‑1.20% yoy) and the earnings step‑down (‑59.20% yoy in the latest quarter) remind investors that cyclical end‑markets and equity mark‑to‑market can both weigh on reported numbers. Three years from now, the quality of underwriting, energy transition execution, and rail efficiency could be as important to returns as equity picks.

Positioning the stock, Berkshire’s lack of a dividend and episodic buybacks mean shareholder returns hinge on compounding intrinsic value and the timing of repurchases. Short interest is low (0.61% of shares outstanding), and ownership is institutionally anchored (64.95%), which can keep volatility contained but also temper momentum when catalysts are scarce. Technically, the shares are mid‑range within the 52‑week band of 437.90–542.07 and modestly above the 50‑ and 200‑day moving averages—supportive, but not decisive. If capital deployment reaccelerates, especially via sizable buybacks or a needle‑moving acquisition, sentiment could improve. Conversely, prolonged caution on deploying $344.09B of cash may invite scrutiny about opportunity cost. In our view, patience and process discipline remain the distinguishing features—and the near‑term pendulum of headlines should not obscure them.

What could happen in three years? (horizon August 2025+3)

| Scenario | Strategic actions | Financial drivers | Implications for BRK‑B |

|---|---|---|---|

| Best | Active yet disciplined deployment of cash into accretive deals and opportunistic buybacks when valuations are favorable. | Stable to improving underwriting, resilient rail/energy profits, and constructive equity markets. | Intrinsic value compounds steadily; sentiment turns more favorable as the cash drag fades and capital efficiency improves. |

| Base | Selective portfolio rotations, ongoing bolt‑ons, and episodic buybacks aligned with intrinsic value. | Mixed macro with modest growth; investment gains/loses net out over time; margins remain healthy. | Shares track book value growth with periods of consolidation; volatility stays below market given beta of 0.80. |

| Worse | Prolonged capital deployment pause and adverse insurance events; equity markets remain choppy. | Lower reported earnings from mark‑to‑market swings and charges (e.g., investee setbacks); slower cash generation. | Multiple compresses; stock drifts toward the lower end of its recent trading ranges until visibility improves. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Underwriting results and catastrophe losses in insurance lines, which can shift reported earnings materially.

- Capital allocation pace—size/timing of buybacks and acquisitions relative to the $344.09B cash position.

- Equity portfolio volatility and investee‑specific events (e.g., charges like the Kraft Heinz item) affecting GAAP results.

- Macro cycle for rail, energy and industrial units, influencing revenue growth (currently -1.20% yoy) and margins.

- Interest‑rate environment impacting investment income, valuation multiples, and deal economics.

- Investor sentiment and liquidity—media views, average volume (4.77M), and low beta (0.80) shaping trading dynamics.

Conclusion

Berkshire Hathaway enters the next three years with uncommon flexibility: $344.09B of cash, durable margins (22.43% operating; 17.00% profit), and a broad operating base to buffer shocks. Yet the shares reflect the push‑pull of near‑term optics versus long‑term discipline. Earnings volatility (‑59.20% yoy in the latest quarter) and a lighter buyback pace sparked disappointment and a short‑lived pullback, while the stock now sits above key moving averages and mid‑range within its 52‑week band of 437.90–542.07. In our base case, returns track steady intrinsic value growth, punctuated by opportunistic repurchases and selective deals. The upside case requires visible capital deployment and stable underwriting; the downside case features prolonged caution and adverse loss events. For long‑horizon investors, patience with process—rather than reacting to any single headline—remains the central thesis.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.