BYD’s setup has shifted from pure volume momentum to a more nuanced balance between growth and profitability. Revenue is still expanding (quarterly growth of 14.00%) as the company scales exports and pushes deeper into Europe and other overseas markets, while domestic competition keeps pricing tight. The profit line is the swing factor: a slim 4.97% profit margin underscores how price cuts, model refresh cycles, and international ramp costs are weighing on earnings quality. What changed is not demand for electrified transport per se, but where growth is coming from and what it costs to win it: more overseas localization, higher go‑to‑market spend, and disciplined battery investment. This matters because the global electric‑vehicle sector is transitioning from early adoption to mass‑market share gains, where cost leadership, distribution, and regulatory navigation determine who converts scale into cash flow. BYD’s vertical integration in batteries and its localization moves could rebuild pricing power—if execution and policy conditions cooperate.

Key Points as of October 2025

- Revenue: trailing 12‑month revenue at 847.26B with quarterly revenue growth (yoy) of 14.00%.

- Profit/Margins: profit margin 4.97% and operating margin 2.00%; quarterly earnings growth (yoy) at -29.90% highlights pressure from pricing and mix.

- Cash flow & liquidity: operating cash flow 151.11B; levered free cash flow -2.95B; total cash 147.43B vs total debt 50.19B; current ratio 0.76.

- Sales/backlog: backlog not disclosed; headlines point to China leadership, rapid UK/EU traction, a global sedan launch, and an India e‑bus win.

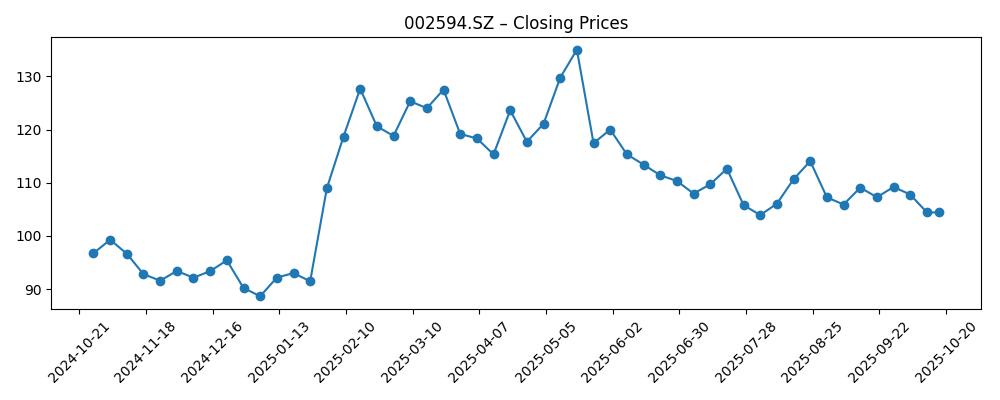

- Share price: recent weekly close 104.43; 52‑week range 87.40–138.70; 50‑day MA 108.02 vs 200‑day MA 112.69; beta 0.48; 52‑week change 6.85%.

- Shareholder base & liquidity: shares outstanding 5.43B; insiders hold 58.63%, institutions 9.13%; average 3‑month volume 58.49M.

- Dividends & actions: forward dividend yield 1.27% with payout ratio 13.74%; 3:1 split and ex‑dividend on 7/29/2025.

- Market cap: not disclosed in the provided snapshot; investors focus on margin recovery and cash conversion as valuation anchors.

- Strategy & positioning: EU localization via Hungary plant, battery tech partnership in Japan, and stronger European distribution underpin export growth.

Share price evolution – last 12 months

Notable headlines

- Chinese EV giant BYD sees UK sales soar by 880% [BBC News]

- Electric vehicle sales surge across EU as overall car market stalls [Business | Euronews RSS]

- BYD Company reports significant revenue Q2 2025 [Reuters]

- BYD's EV sales surge, secures leadership in China [Bloomberg]

- BYD partners with Japanese firm for battery development [Financial Times]

- BYD targets European market with new plant opening in Hungary [Wall Street Journal]

- BYD Company Limited's 2025 Annual General Meeting [BYD Company Limited]

- BYD secures contract with Indian state for electric buses [Economic Times]

- BYD launches new electric sedan in global markets [Business Insider]

- BYD stock surges on record Q1 2025 results [Reuters]

Opinion

BYD’s recent prints show a classic scale‑vs‑margin trade‑off. Revenue growth remains healthy, helped by continued leadership in China and faster export ramps, but the earnings line is constrained by a low operating margin profile. The combination of a slim profit margin and negative levered free cash flow suggests heavy spend—likely capex and international build‑out—absorbing operating cash. That is not inherently negative if it translates into cost‑down and localized production that reduce tariff and logistics headwinds. The quality of beats or misses will be judged less on headline unit growth and more on evidence that each incremental vehicle adds to gross profit without relying solely on discounting.

The balance sheet provides optionality: substantial cash and modest debt give room to execute, even as the current ratio signals tight working capital management. The dividend is small and flexible, indicating capital allocation remains growth‑first. Insider ownership is high, which can align decisions with long‑term manufacturing and technology bets. However, quarterly earnings volatility—amid price adjustments and product cycles—keeps the near‑term narrative sensitive to mix (premium vs value models), export logistics, and battery input costs.

Strategically, localization in Europe via Hungary plus a battery partnership in Japan point to a de‑risking path: manufacture closer to customers, secure technology, and reduce exposure to cross‑border frictions. Headlines of UK and wider EU momentum are encouraging, but distribution depth, brand building, and aftersales coverage remain execution hurdles. Winning outside China could lift average selling prices and stabilize margins if BYD can tailor trims and software to local preferences while maintaining its cost advantage through vertical integration.

Within the EV industry’s shift to mass adoption, pricing power is thin and incumbents are cutting prices to defend share. BYD’s scale, battery know‑how, and bus/commercial entries provide diversification that many peers lack. If the company proves that export‑led growth can coexist with improving margins and positive free cash flow, the narrative may migrate from “volume winner” to “cash generator,” supporting a sturdier multiple. Conversely, a prolonged price war or adverse trade policy could keep margins capped and anchor the stock to a range bound by cash conversion concerns.

What could happen in three years? (horizon October 2028)

| Case | Narrative |

|---|---|

| Best | European localization ramps smoothly, mitigating tariffs and logistics costs; brand gains share with a balanced mix of value and premium trims. Battery partnership accelerates chemistry and pack cost improvements, lifting margins and turning free cash flow sustainably positive. Overseas revenue mix reduces reliance on China, and the dividend grows prudently. |

| Base | Exports steadily expand and the Hungary plant reaches stable utilization, offsetting continued domestic price pressure. Margins improve gradually via cost‑downs and scale, while cash generation is episodic as the company funds capacity and product refreshes. The stock narrative centers on consistent growth with disciplined capital spending. |

| Worse | Global price wars intensify and new trade barriers emerge, forcing continued discounting. Overseas ramp underdelivers, inventory rises, and working capital tightens; free cash flow remains weak despite solid operating cash. Investor focus shifts to balance‑sheet defense and slower expansion. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution at European localization (Hungary plant start‑up, supply chain localization, dealer network build‑out).

- Margin trajectory versus domestic price competition and model mix (value vs premium trims, software features).

- Trade and regulatory developments affecting Chinese EVs in Europe and other export markets.

- Battery technology progress and input costs, including partnerships and vertical integration benefits.

- Free cash flow inflection relative to capex and working capital management.

- Demand momentum in key overseas markets (UK/EU, India public transport) and associated brand perception.

Conclusion

BYD enters the next three years with clear strengths—scale, battery integration, and growing overseas traction—but the investment debate hinges on converting that into durable margins and cash. The data show solid revenue expansion amid margin compression and negative levered free cash flow, consistent with a company investing through a price war while it localizes supply chains and broadens distribution. If European production and partnerships lower unit costs and ease policy risk, the narrative can tilt toward profitable growth and better cash conversion; if discounting persists or policy turns adverse, returns may stay constrained. Watch next 1–2 quarters: margin progression versus pricing, export mix and localization milestones in Europe, free cash flow inflection, and evidence that new model launches lift average selling prices without sacrificing volume.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.