CATL’s shares have rebounded into October after a volatile first half, as investors reassess growth and profitability in the battery cycle. The immediate change is faster profit momentum versus steadier sales: quarterly earnings growth rose 33.20% year over year while revenue growth was 8.30%, suggesting mix and cost control are doing more work than pure volume. Sentiment also improved alongside signs of recovering electric‑vehicle demand in Europe and steady energy‑storage orders, even as price competition remains intense. At the same time, China’s tighter export regime for certain critical materials has refocused attention on supply‑chain security and localization strategies, themes that matter directly for a global cell supplier. For investors across the EV supply chain, the question now is whether margins can be defended as industry capacity built in 2021–2023 continues to chase demand, and whether overseas expansion offsets any domestic softness. The sector is transitioning from hypergrowth to scale economics, where utilization, chemistry choice and integration with energy storage will drive returns.

Key Points as of October 2025

- Revenue: trailing‑twelve‑month (TTM) revenue is 374.13B; quarterly revenue growth (yoy) 8.30% indicates steady top‑line expansion.

- Profit/margins: profit margin 15.59% and operating margin 10.25%; quarterly earnings growth (yoy) 33.20% points to mix and cost efficiency.

- Balance sheet and cash: total cash 367.9B vs total debt 141.73B; current ratio 1.69; operating cash flow 110.97B; levered free cash flow 41.74B.

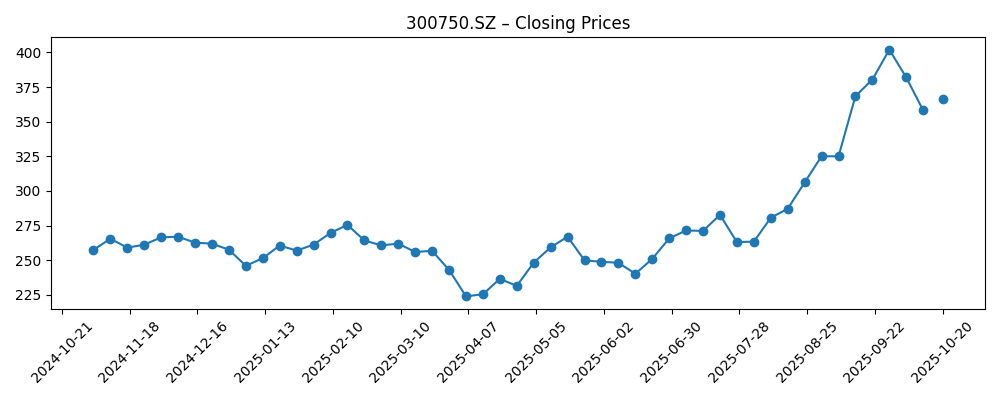

- Share price and momentum: last close 366.5 (Oct 20, 2025); 52‑week range 209.11–424.36; 50‑day MA 338.13 vs 200‑day MA 275.71; 52‑week change 41.36%.

- Dividend: forward annual dividend rate 5.56 and yield 1.55%; payout ratio 34.23%; ex‑dividend date 8/20/2025.

- Sales/backlog: backlog data not disclosed; near‑term sales visibility tied to EV and energy‑storage orders amid ongoing pricing pressure.

- Analyst view: formal Street ratings not provided here; debate centers on the pace of margin normalization and overseas mix.

- Market cap: not disclosed in the provided data.

- Qualitative: scale leadership in mainstream chemistries (e.g., LFP – lithium iron phosphate) underpins cost position; export rules on critical materials and FX exposure shape sourcing and localization strategies.

Share price evolution – last 12 months

Notable headlines

- Electric vehicle sales surge across EU as overall car market stalls (Euronews)

- China tightens export rules for crucial rare earths (BBC News)

- How China wields rare earths as a strategic weapon (Deutsche Welle)

Opinion

CATL’s latest trendline shows a company leaning on operating discipline and product mix to grow earnings faster than revenue. With profit margin at 15.59% and operating margin at 10.25%, the distance between gross, operating and net profitability implies that cost control, learning‑curve effects and scale are offsetting pricing pressure. The 33.20% year‑over‑year earnings growth alongside 8.30% revenue growth suggests improved utilization and a richer mix from energy‑storage systems, where integration and long‑cycle contracts can stabilize spreads. The share price recovery into October, above the 200‑day moving average, signals the market is tentatively pricing a margin floor after a bruising price war. That backdrop reduces downside tail risk but demands evidence that cash conversion remains robust through seasonally weaker quarters.

Sustainability is the crux. Battery average selling prices remain contested as incumbents and challengers compete for auto and utility awards. While earlier raw‑material deflation helped, input costs can swing, and China’s tighter export regime for certain critical materials heightens the need for diversified sourcing. Against that, CATL’s cash reserves (367.9B) and consistent operating cash flow (110.97B) provide flexibility to localize supply, invest in new chemistries and fund customer support. The dividend yield of 1.55% and a 34.23% payout ratio signal balance between returns and reinvestment. The company’s ability to maintain free cash flow (41.74B TTM) while defending share should determine whether the recent earnings beat cadence is repeatable into 2026.

Industry dynamics are mixed but improving at the margin. European EV demand shows signs of re‑acceleration, a helpful offset to uneven consumer sentiment elsewhere and a maturing China market. Utility‑scale energy storage remains a second engine of growth, often with different buying cycles and contract structures than automotive. In this setting, chemistry choice (for example, LFP for cost and durability vs higher‑nickel variants for energy density), production yields, and project execution in overseas facilities will influence pricing power. If CATL can marry scale with localized manufacturing and long‑term supply agreements, the company can sustain above‑peer utilization and soften ASP pressure without sacrificing share.

These operating choices will shape the valuation narrative. Return on equity of 22.58% and a beta of 1.00 argue for a quality‑growth profile if margins hold and cash generation remains consistent. Conversely, geopolitics and trade policy add a risk premium that could cap multiples in periods of policy noise. Investors will parse the bridge from gross profit (91.3B TTM) to operating and net income to gauge how much of the recent strength is structural versus cyclical. A coherent capital allocation mix—steady dividend, selective capex, and potential partnerships—could keep the story anchored to cash returns, even if unit pricing remains volatile.

What could happen in three years? (horizon October 2025+3)

| Case | Narrative |

|---|---|

| Best | EV adoption re‑accelerates globally while utility‑scale storage booms. CATL deepens localization in key export markets, secures long‑dated contracts, and improves manufacturing yields. Pricing pressure eases as capacity rationalizes, sustaining healthy margins and compounding free cash flow that supports incremental shareholder returns and technology investment. |

| Base | EV growth is moderate and price competition persists, but overseas expansion and storage offset domestic volatility. Margins normalize gradually from current levels, with cash generation funding disciplined capex and a stable dividend. The stock tracks execution milestones and sector demand rather than rerating materially. |

| Worse | Trade barriers and export controls disrupt materials flow and access to end markets. Persistent price wars depress utilization and margins, delaying project ramps. Free cash flow tightens as working capital and capex needs rise, and the equity narrative shifts to balance‑sheet defense until supply/demand rebalances. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Battery pricing vs input costs: trajectory of average selling prices relative to materials and manufacturing costs.

- Policy and trade: export rules for critical materials, localization requirements, and market‑access barriers.

- Execution on overseas capacity: timing, yields, and customer qualification of plants serving Europe and other export markets.

- Demand inflection: order flow from auto OEMs and utility‑scale energy storage integrators.

- Capital allocation and cash conversion: sustaining operating cash flow and free cash flow while investing in growth and dividends.

- Competitive intensity: actions by global cell makers and new entrants affecting share and margins.

Conclusion

CATL exits 2025 with improving sentiment as earnings outpace sales growth and the stock trades well above longer‑term averages. The financial profile—TTM revenue of 374.13B, profit margin of 15.59%, solid cash and free cash flow—supports a narrative of scale and resilience amid a still‑competitive market. Sector conditions are shifting from hypergrowth to a focus on utilization, localization and product‑mix advantages, with European EV demand and energy storage providing incremental support. The valuation debate will hinge on how quickly operating margin normalizes and how effectively CATL converts contract wins into cash. Watch next 1–2 quarters: pricing discipline vs share retention; gross‑to‑operating margin bridge; overseas plant ramp milestones; policy developments on critical‑materials exports; cash conversion and dividend cadence. Evidence of sustained cash generation with stable margins could keep the recovery intact, while slippage on execution or policy shocks would quickly filter through to multiples.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.