Chevron heads into late 2025 with steadier shares but softer growth, as top‑line and earnings momentum cooled from the prior cycle’s highs. Revenue stands at 189.27B on a trailing basis, with year‑over‑year declines reflecting normalized commodity prices and narrower refining margins. Strategy is tilting toward longer‑cycle gas and LNG, highlighted by a bid for Greek offshore blocks, while recent executive changes point to continued capital discipline and portfolio pruning. The drivers are largely macro—more balanced oil supply, moderating global growth, maintenance timing, and tightening downstream crack spreads—offset by resilient LNG demand and selective exploration. Why it matters: the equity story hinges on durable cash returns and execution on a focused project slate; the forward dividend yield of 4.51% helps anchor valuation, but elevated payout metrics raise the bar for flawless delivery if prices weaken. Sector‑wide, integrated energy sits in a later‑cycle phase where OPEC+ policy, the pace of the energy transition, and capital scarcity shape returns, putting a premium on balance‑sheet strength and advantaged LNG exposure.

Key Points as of October 2025

- Revenue – Trailing 12‑month revenue is 189.27B; quarterly revenue growth (yoy) is -10.70%.

- Profit/Margins – Profit margin 7.25%; operating margin 9.44%; diluted EPS (ttm) 7.78; quarterly earnings growth (yoy) -43.80%.

- Sales/Backlog – No formal backlog metric disclosed; growth visibility tied to LNG and exploration (including a Greek offshore bid) and project phasing.

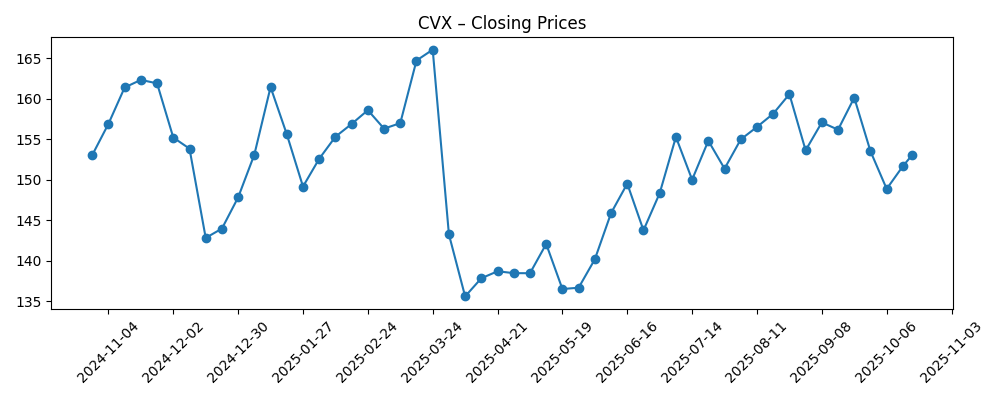

- Share price – Last weekly close 153.0800018310547 (10/17/2025); 52‑week range 132.04–168.96; 50‑day MA 155.91; 200‑day MA 150.83; beta 0.81; short interest ~0.80% of float.

- Analyst view – UBS reaffirmed a Buy rating; other commentary flags a Hold stance, signaling mixed sentiment.

- Market cap – Large‑cap integrated energy; exact market capitalization not disclosed in this snapshot; shares outstanding 2.01B; float 1.61B; institutions hold 59.08%.

- Dividend/Capital returns – Forward dividend rate 6.84; forward yield 4.51%; payout ratio 85.97%; last ex‑dividend date 8/19/2025.

- Balance sheet/Liquidity – Total debt 29.47B; debt/equity 20.01%; current ratio 1.00; cash 4.07B; operating cash flow 32.13B; levered FCF 14.43B.

- Qualitative – Executive changes announced; expanding Mediterranean/LNG optionality; exposed to emissions policy, permitting outcomes, and refining standards.

Share price evolution – last 12 months

Notable headlines

- Chevron Corp. Announces Executive Changes - MarketScreener

- Chevron Corporation (CVX) Expands Eastern Mediterranean Reach with Greek Offshore Gas Bid

- Chevron (CVX) submits bid to explore natural gas in four offshore blocks in Greece

- UBS reaffirms Buy rating on Chevron (CVX)

- Why Chevron Corporation (CVX) is a Good Option to Invest in LNG

- Chevron (CVX): A reliable energy giant for dividend investors

- Jim Cramer on Chevron: It’s just a Hold

- Chevron’s distributional probability curve offers a bullish options setup

Opinion

On the latest figures, the story is one of normalization rather than deterioration. Year‑over‑year revenue and earnings slowed as crude prices and refining crack spreads eased from the prior upcycle, compressing margins, yet the company still produced meaningful operating cash flow. That combination—lower realized prices but solid cash generation—suggests operating leverage is contained and cost control is broadly effective. The mix shift toward gas and LNG, plus selective exploration (e.g., Greek offshore), helps diversify away from the most price‑sensitive barrels, potentially smoothing future cash flows.

Quality of earnings looks adequate for the cycle. With operating cash flow of 32.13B and levered free cash flow of 14.43B, the company appears positioned to fund sustaining capex and dividends, though the payout ratio at 85.97% is a reminder that distribution flexibility narrows if the macro weakens. Balance‑sheet metrics—debt/equity of 20.01% and a current ratio of 1.00—imply manageable leverage and liquidity, while low short interest and a 0.81 beta underscore relatively muted equity volatility versus peers.

Within the industry, integrated scale remains a competitive buffer. Downstream exposure can offset upstream swings when cracks are favorable, and LNG expansion offers multi‑year offtake visibility if long‑term contracts are secured. Regulatory momentum on emissions and permitting keeps execution risk elevated, but advantaged assets and integration typically preserve cost positions. The management refresh, coupled with exploration in the Eastern Mediterranean, signals a willingness to refine the portfolio and pursue gas‑weighted opportunities aligned with demand trends.

How this shapes the multiple over the next three years: a steady dividend and disciplined capex can support a defensive, cash‑flow narrative in a late‑cycle energy tape. If LNG projects advance on time and downstream margins stabilize, investors may reward the durability of cash returns with a firmer valuation anchor. Conversely, if oil prices drift lower and turnarounds or delays sap volumes, the elevated payout ratio could cap re‑rating potential. The equity likely trades as a macro‑sensitive compounder with downside cushioned by yield and upside linked to project delivery and policy clarity.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Oil stabilizes at supportive levels while LNG demand outperforms. Key projects execute on time, Mediterranean exploration adds resources, and downstream margins normalize. Cash flow comfortably funds dividends and selective growth, reducing leverage and improving the quality of earnings, leading to a stronger, more durable valuation narrative. |

| Base case | Commodity prices trade in a mid‑cycle band; upstream volumes grow modestly as project phasing offsets declines. LNG contributes steady cash flows; downstream oscillates within historical ranges. Capital returns remain a priority, with incremental efficiency gains offsetting inflation. Valuation drifts with the macro but stays anchored by yield. |

| Worse case | Global growth slows and oil/gas prices weaken. Project timing slips and downstream crack spreads contract, pressuring margins. The high payout ratio constrains flexibility, forcing tougher capital allocation choices. Regulatory headwinds or delays in permitting add friction, and the equity underperforms cyclicals as the narrative shifts to preservation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Oil and natural gas price trajectory, including OPEC+ policy and global demand/supply shifts.

- Execution on LNG and exploration milestones (e.g., Eastern Mediterranean) and on‑time project delivery.

- Downstream refining margins and turnaround schedules affecting utilization and cash generation.

- Capital allocation discipline amid an elevated payout ratio and the balance between dividends, buybacks, and growth capex.

- Regulatory and environmental policy affecting permitting, emissions compliance, and tax regimes.

- Geopolitical stability in key operating regions and supply chain/logistics reliability.

Conclusion

Chevron’s setup into 2026–2028 is a balance of normalized but still healthy cash generation against tighter margin and policy backdrops. The company’s integrated model and LNG tilt provide diversification, while operating cash flow of 32.13B and levered FCF of 14.43B suggest capacity to sustain capital returns despite softer year‑over‑year growth. Valuation remains anchored by a 4.51% forward yield and relatively low beta, but the elevated payout ratio heightens sensitivity to execution and the commodity strip. Sector‑wise, late‑cycle conditions and energy‑transition policy mean investors will likely reward capital discipline, advantaged gas exposures, and credible delivery on projects. Watch next 1–2 quarters: progress on LNG and Mediterranean exploration milestones; downstream margin trends post‑turnaround; updates to dividend/buyback cadence; capex phasing and cost control; any implications from executive changes for portfolio priorities.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.