The Coca‑Cola Company (NYSE: KO) is a global non‑alcoholic beverage leader, selling sparkling soft drinks, juices, waters, sports and energy drinks in virtually every major market. Its portfolio—anchored by Coca‑Cola, Diet Coke/Coke Zero Sugar, Sprite and Fanta—competes with PepsiCo, Keurig Dr Pepper, Nestlé’s water brands, and local private labels. The company operates an asset‑light concentrate model alongside an extensive independent bottling system.

As of <today>, KO reports trailing‑twelve‑month revenue of $47.06B and net income of $12.18B (profit margin 25.89%), with an operating margin of 34.66% and EBITDA of $15.79B. Quarterly revenue growth is 1.40% year over year, while quarterly earnings growth is 58.00% year over year. Balance sheet and liquidity metrics include total cash of $14.3B, total debt of $50.21B, a current ratio of 1.21 and total debt‑to‑equity of 166.37%. The stock’s beta is 0.43. The forward annual dividend rate is $2.04 (forward yield 3.09%; payout ratio 70.57%), with the next dividend date on 10/1/2025 and recent ex‑dividend date on 9/15/2025. Over the last 52 weeks the shares are down 8.09% versus the S&P 500 up 15.10%.

Key Points as of September 2025

- Revenue and growth: Trailing‑twelve‑month revenue is $47.06B; most recent quarterly revenue growth is 1.40% year over year.

- Profitability: Operating margin 34.66% and profit margin 25.89%; EBITDA $15.79B; net income attributable to common $12.18B.

- Cash, liquidity and leverage: Total cash $14.3B, total debt $50.21B, current ratio 1.21, total debt/equity 166.37%.

- Cash flow: Operating cash flow (ttm) $1.3B and levered free cash flow (ttm) $1.71B.

- Dividend: Forward annual dividend rate $2.04 (forward yield 3.09%); payout ratio 70.57%; dividend date 10/1/2025; ex‑dividend date 9/15/2025.

- Share price and trend: Last weekly close (2025‑09‑26) $65.67; 52‑week range 60.62–74.38; 52‑week change −8.09% vs S&P 500 +15.10%; below 50‑day ($68.69) and 200‑day ($68.48) moving averages.

- Market cap: Implied market value equals share price ($65.67) multiplied by ~4.3B shares outstanding (float 3.87B).

- Trading and ownership: Beta 0.43; short interest 0.92% of float (short ratio 2.32); average volume 16.06M (3‑month) and 17.7M (10‑day); insider ownership 9.88%, institutions 65.60%.

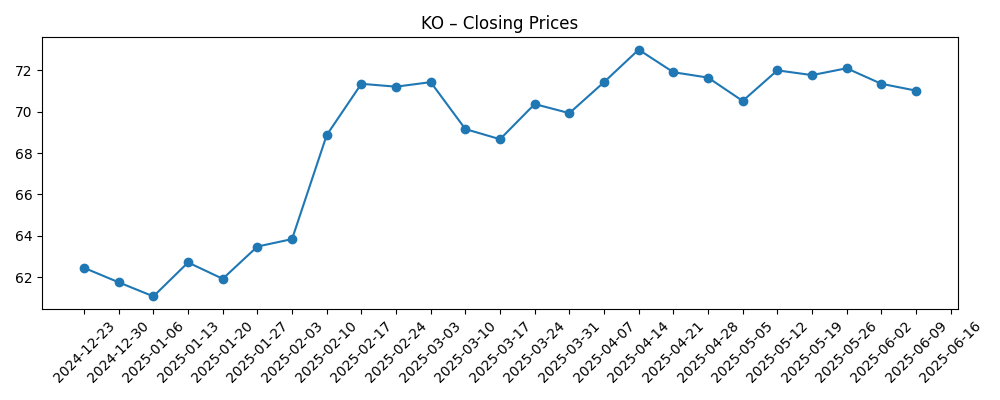

Share price evolution – last 12 months

Notable headlines

Opinion

KO’s share price action over the last year underscores a defensive but not immune profile. After bottoming near the 52‑week low of 60.62, the stock rallied into the spring, closing as high as roughly $73.00 in mid‑April 2025 before fading through the summer. By the week of 2025‑09‑26, shares were $65.67 and trading below both the 50‑day ($68.69) and 200‑day ($68.48) moving averages. That setup generally reflects modest growth expectations (1.40% quarterly revenue growth year over year) offset by very strong profitability (34.66% operating margin, 25.89% profit margin) and a dependable dividend. For income‑oriented investors, the 3.09% forward yield and long track record of payments provide ballast while sentiment is subdued.

The bigger debate for the next three years is cash conversion and leverage. Trailing operating cash flow of $1.3B versus net income of $12.18B and total debt of $50.21B raises the bar for free cash flow improvement. If working‑capital timing or other transitory items are depressing cash generation, normalization could be a powerful catalyst. If not, the 70.57% payout ratio would limit dividend growth and constrain optionality for buybacks or acquisitions. The current ratio of 1.21 suggests liquidity is adequate, but investors will watch cash flow closely.

KO’s defensive attributes are intact: a low beta of 0.43, vast brand equity and global distribution, and low short interest (0.92% of float) all argue for relatively contained downside absent a shock. In a slow‑growth environment, pricing, mix, and marketing effectiveness become crucial to sustain margins without sacrificing volume. With the S&P 500 up 15.10% over the last year while KO fell 8.09%, relative valuation support can emerge if earnings resilience continues and cash conversion improves. Conversely, if top‑line momentum stays near recent trends and cash flow lags, the stock may remain range‑bound.

Over a three‑year horizon, the most plausible base case is steady but unspectacular growth, robust margins, and a dividend that remains the core of total return. Upside would come from sustained price/mix benefits, improved working‑capital efficiency, and cost discipline that converts accounting profits into cash. Risks cluster around input costs, currency, and regulation. With approximately 4.3B shares outstanding and broad institutional ownership (65.60%), catalysts will likely need to be company‑specific—cash flow traction, balance‑sheet de‑risking, or consistent above‑peer organic growth—to unlock multiple expansion. Until then, KO looks positioned as a quality income compounder rather than a high‑beta growth vehicle.

What could happen in three years? (horizon September 2028)

| Scenario | Narrative to 2028 | Signals to watch | Likely stock reaction |

|---|---|---|---|

| Best | Marketing effectiveness, price/mix discipline and steady volume in key categories sustain strong margins. Operating cash flow normalizes well above recent trends, supporting dividend growth while gradually reducing leverage. FX is benign and input costs remain manageable. | Sequential improvement in operating cash flow versus net income; stable to rising operating margin; consistent quarterly earnings growth; declining total debt or debt/equity. | Re‑rating toward a premium defensive multiple, with total return led by dividends plus moderate capital appreciation. |

| Base | Modest revenue growth with stable margins. Cash flow improves from current levels but remains closely managed; leverage metrics are broadly steady. Dividend growth tracks underlying earnings, and valuation stays near historical defensive ranges. | Quarterly revenue growth hovering around recent levels; payout ratio maintained near current levels; moving averages flatten and price trades within the 52‑week range. | Range‑bound performance with dividends comprising a meaningful share of total return. |

| Worse | Input‑cost inflation, currency headwinds and tighter sugar‑related regulation pressure volumes and margins. Cash conversion remains weak, limiting flexibility; leverage becomes a focus. Dividend growth slows or pauses to preserve balance‑sheet strength. | Persistently low operating cash flow relative to earnings; rising debt/equity; margin compression; elevated volatility versus the stock’s recent beta. | De‑rating to a lower defensive multiple, with downside cushioned but not eliminated by the dividend. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Cash conversion versus earnings: trajectory of operating cash flow (ttm $1.3B) relative to net income ($12.18B) and effects on dividend sustainability (payout ratio 70.57%).

- Pricing power and demand elasticity: ability to sustain revenue growth (recent quarterly +1.40% yoy) without eroding volumes.

- Costs, currency and regulation: commodities/packaging inflation, FX moves versus key currencies, and sugar‑related policy shifts in major markets.

- Balance sheet and capital allocation: progress on leverage (total debt $50.21B; debt/equity 166.37%), pace of dividend increases (forward yield 3.09%) and any buyback cadence.

- Competitive intensity: responses from PepsiCo, Keurig Dr Pepper and local brands across core categories and channels.

- Investor risk appetite: staples sector rotation, with KO’s low beta (0.43) potentially attracting flows during market volatility.

Conclusion

Coca‑Cola enters the next three years with enviable brand strength, sector‑leading margins and a dividend that anchors returns. The near‑term setup blends modest top‑line growth (+1.40% yoy in the most recent quarter) and strong profitability with questions about cash conversion (ttm operating cash flow $1.3B versus $12.18B of net income) and balance‑sheet leverage ($50.21B debt, 166.37% debt/equity). The stock’s 3.09% forward yield, low beta and relatively low short interest can cushion volatility, but sustained outperformance likely requires visible improvement in free cash flow, steady margins and disciplined capital allocation. If those elements align, KO can compound as a high‑quality income holding with selective upside; if not, shares may remain range‑bound around moving averages as investors favor faster growers. On balance, a base‑case path of steady earnings, gradual cash‑flow normalization and continued dividends appears most probable over this horizon.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.