As of August 2025, Deutsche Telekom (DTE.DE) enters the next three years with a sturdy cash engine and measured growth. The company delivers trailing‑12‑month revenue of 120.55B and EBITDA of 41.54B, with a 23.31% operating margin and 10.45% profit margin. Cash generation remains strong (operating cash flow 40.92B; levered free cash flow 14.45B), supporting a 0.90 per‑share dividend (2.87% yield) at a 35.02% payout. Balance‑sheet leverage is elevated (total debt 140.31B; debt/equity 156.36%) but liquidity is adequate (current ratio 1.12). Shares are up 21.25% over 52 weeks, recently around 31.22, within a 25.62–35.91 range; beta is 0.47. Recent headlines show a consensus “Strong Buy” tempered by a downgrade and a brief price pullback. Our outlook weighs resilient cash flows against modest revenue growth and high debt.

Key Points as of August 2025

- Revenue – TTM revenue 120.55B; recent quarterly revenue growth (YoY) 1.00%, indicating steady but modest top‑line momentum.

- Profit/Margins – Operating margin 23.31% and profit margin 10.45%; gross profit 53.9B; EBITDA 41.54B; ROE 21.32% and ROA 5.54% underscore capital efficiency.

- Sales/Backlog – Stable sales base supported by revenue per share of 24.59; quarterly earnings growth (YoY) 25.20% highlights operating leverage.

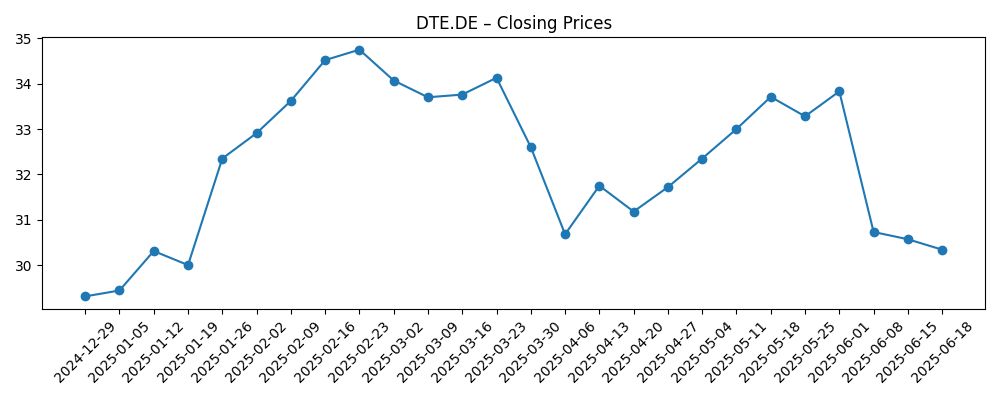

- Share price – Last weekly close near 31.22 (Aug 29, 2025); 52‑week change 21.25%; 52‑week high/low 35.91/25.62; 50‑DMA 30.96; 200‑DMA 31.68; beta 0.47.

- Analyst view – Recent reports cite a consensus “Strong Buy,” alongside a separate downgrade; sentiment remains broadly constructive but not unanimous.

- Market cap – Large‑cap European incumbent with 4.9B shares outstanding and a 4.19B float; insider ownership 28.26% and institutions 33.29%.

- Balance sheet & liquidity – Total debt 140.31B; debt/equity 156.36%; total cash 10.44B; current ratio 1.12.

- Dividend – Forward/trailing annual dividend rate 0.90 (2.87% yield); payout ratio 35.02%; last ex‑dividend date 4/10/2025.

Share price evolution – last 12 months

Notable headlines

- Deutsche Telekom AG (OTCMKTS:DTEGY) Given Consensus Recommendation of “Strong Buy” by Analysts

- Deutsche Telekom (ETR:DTE) Stock Price Down 5%

- Deutsche Telekom (OTCMKTS:DTEGY) Stock Rating Lowered by Wall Street Zen

Opinion

Deutsche Telekom’s investment case over the next three years rests on a familiar trade‑off: dependable cash generation versus elevated leverage and muted top‑line growth. The company’s 23.31% operating margin and 10.45% profit margin, alongside 40.92B in operating cash flow and 14.45B in levered free cash flow, suggest ample capacity to maintain its dividend while funding network needs. A 35.02% payout ratio and a 2.87% yield provide a cushion for income‑oriented holders. The recent “Strong Buy” consensus points to confidence in execution and balance between growth and returns. Still, quarterly revenue growth of 1.00% signals that value creation will rely more on efficiency and cash discipline than on rapid expansion. Against that backdrop, the low beta of 0.47 may keep the shares attractive to defensive investors seeking stability.

Price action corroborates a resilient but unspectacular trajectory. Over the past six months, shares rallied to a 52‑week high of 35.91 in early 2025 before retreating to the low‑30s, with the 50‑ and 200‑day moving averages clustered around 30.96 and 31.68. That technical setup often indicates consolidation and potential base‑building. A brief 5% pullback highlighted in August headlines looks more like a sentiment reset than a thesis break, particularly as the 52‑week change remains a positive 21.25%. In a low‑volatility, cash‑rich profile, investors may tolerate sideways periods provided the dividend is secure and operational KPIs hold. Sustained trading in the 30–33 range would not be surprising while the market awaits clearer catalysts.

Debt is the pivot. Total debt of 140.31B and debt/equity of 156.36% raise the portfolio’s sensitivity to interest‑rate conditions and refinancing windows, even with a current ratio of 1.12 and 10.44B in cash. For the equity story to compound, deleveraging via steady free cash flow is key. With quarterly earnings growth at 25.20% YoY and ROE at 21.32%, the business demonstrates operating muscle that can absorb investment and service debt. Yet, in a sector where pricing power can be constrained by regulation and competition, sustaining margins near 23.31% while nudging revenue forward will be the principal challenge. If management prioritizes balance‑sheet repair and incremental efficiency, the risk‑reward skews favorable despite the growth ceiling.

The analyst split in August—consensus bullishness versus an isolated downgrade—captures the subtlety of the setup. Bulls see a high‑quality cash generator with a covered dividend, low beta characteristics, and optionality if sentiment improves. Skeptics focus on slow growth and leverage. Both views can be right depending on execution and macro rates. Over a three‑year horizon, the likely path of least resistance is a gradual re‑rating if the company demonstrates consistent free cash flow, stable to improving margins, and credible steps toward deleveraging. Conversely, a surprise rise in funding costs or a bout of pricing pressure could cap multiples and force a more defensive posture. For now, the balance of evidence favors patience and compounding, not heroics.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Modest but consistent revenue growth each year, margins hold or edge higher on efficiency, free cash flow comfortably covers the dividend and supports balance‑sheet improvement. Sentiment benefits from steady delivery and stabilizing rates, with shares rewarded for reliability. |

| Base case | Top line remains broadly stable while cost discipline preserves operating margin. Dividend is maintained within the current payout framework, and leverage gradually improves through retained cash. Shares track fundamentals and trade around long‑term averages. |

| Worse case | Revenue stagnates or dips amid competitive and regulatory pressure; margin compression and higher funding costs constrain cash coverage. Management prioritizes balance‑sheet protection, with dividend growth paused and valuation settling at a discount until visibility returns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Interest‑rate moves and refinancing conditions affecting a 140.31B debt load and overall debt/equity of 156.36%.

- Regulatory decisions (pricing, access, spectrum obligations) impacting revenue growth and margin sustainability.

- Competitive intensity in core markets that could pressure ARPU and the 23.31% operating margin.

- Execution on network quality and efficiency programs, with knock‑on effects to cash flow and the 35.02% payout policy.

- Analyst and investor sentiment shifts following earnings updates, guidance, and dividend announcements.

Conclusion

Deutsche Telekom’s three‑year outlook is one of durable cash flows and disciplined execution set against modest growth and sizable leverage. With 120.55B in TTM revenue, a 23.31% operating margin, and 40.92B in operating cash flow, the company has the financial capacity to fund operations and maintain its 0.90 dividend at a 35.02% payout. The balance sheet, however, remains the swing factor: 140.31B of total debt and a 156.36% debt/equity ratio keep the equity sensitive to rates and refinancing. Share performance—up 21.25% over the past year and consolidating near long‑term averages—suggests investors already value the stability and yield. If management steadily deleverages and preserves margins while nudging growth above the 1.00% quarterly pace, a gentle re‑rating is plausible. Should funding costs rise or pricing pressure intensify, expect range‑bound trading and a defensive stance.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.