EssilorLuxottica enters August 2025 with a premium valuation and new momentum from smart eyewear, while its core optical retail and lens businesses continue to grow at a measured pace. The shares closed at 252.30 on 2025-08-08 after a volatile first half, up 20.96% over 12 months yet below the 52–week high of 298.00, with a beta of 0.74. Fundamentals remain resilient: revenue is 27.24B (ttm) with 5.50% quarterly revenue growth and 8.74% profit margin, supported by 5.63B in EBITDA and 4.91B in operating cash flow. Management is extending vertical integration via targeted acquisitions and leaning into the Ray–Ban Meta partnership as smart‑glasses sales accelerate. A 1.57% forward dividend yield and 76.70% payout ratio underscore income appeal but limit flexibility. This note outlines a balanced three‑year outlook on EL.PA.

Key Points as of August 2025

- Revenue: 27.24B (ttm); quarterly revenue growth (yoy) 5.50%.

- Profit/Margins: Profit margin 8.74%; operating margin 14.25%; EBITDA 5.63B; quarterly earnings growth (yoy) 1.60%.

- Sales/Backlog: Retail demand supported by Sunglass Hut traffic gains; smart‑glasses sales have accelerated; no formal backlog disclosed.

- Share price: 252.30 (2025-08-08); 52–week high/low 298.00/202.10; 50‑DMA 244.78 vs 200‑DMA 249.16; beta 0.74.

- Valuation/Analyst view proxy: Trailing P/E 48.97; forward P/E 33.56; PEG 2.66, indicating a growth premium embedded in the shares.

- Market cap & value: Market cap 116.30B; EV 127.19B; EV/Revenue 4.67; EV/EBITDA 18.97; Price/Sales 4.27; Price/Book 3.07.

- Balance sheet: Total debt 14.05B; cash 2.79B; current ratio 0.97; ROE 6.44%; ROA 3.58%.

- Dividend: Forward dividend 3.95 (yield 1.57%); payout ratio 76.70%; ex‑dividend date 5/7/2025.

- Ownership: Insiders hold 36.89%; institutions 29.69%; float 293.63M shares.

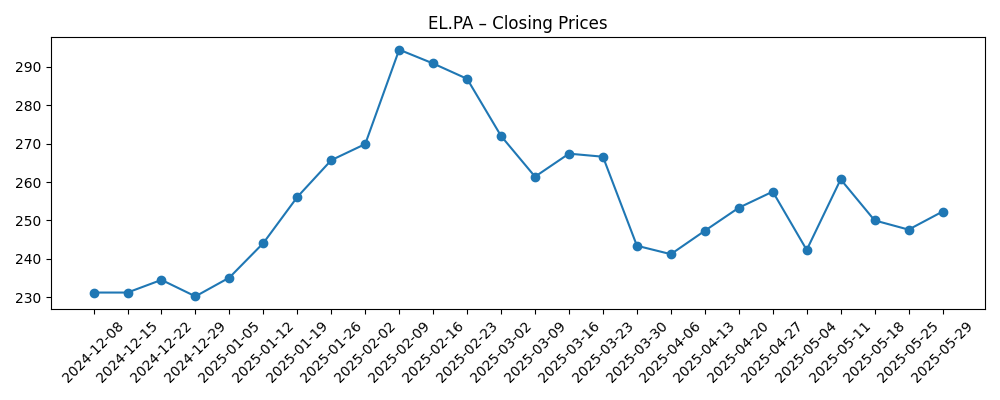

Share price evolution – last 6 months

Notable headlines

- Ray-Ban Meta smart glasses sales triple as EssilorLuxottica doubles down on wearables [9to5Mac]

- Ray-Ban Meta Smart Glasses Revenue Triples Year-over-Year, Fueling Meta’s $3.5 Billion Bet on EssilorLuxottica [Road to VR]

- AI Ray-Ban Meta glasses help EssilorLuxottica boost sales [Yahoo Entertainment]

- EssilorLuxottica Acquires Optical Lens Quality Control Player Automation & Robotics [WWD]

- EssilorLuxottica Acquires Lens Component Division of South Korean Company PUcore [Yahoo Entertainment]

- Sunglass Hut sees a lift in store traffic after running CTV ads [Digiday]

- Ray-Ban Meta Smart Glasses (Gen 3): Everything we know so far [Android Central]

- Oakley Meta HSTN fixes the biggest problem with Ray-Ban Meta Smart Glasses, and I couldn't be happier about it [Android Central]

Opinion

Wearables have moved from optional to strategic for EssilorLuxottica. Multiple reports indicate Ray‑Ban Meta smart‑glasses revenue has tripled year over year, spotlighting a category that historically sat at the periphery of the eyewear P&L. While the absolute contribution to group revenue is not disclosed, the partnership binds brand equity (Ray‑Ban, Oakley) with a large platform partner’s software and AI roadmap. That mixture can be margin‑accretive as scale improves and as cross‑sell into prescription lenses and accessories materializes. The company’s low beta of 0.74 and global retail reach provide ballast while the category matures. The key investment question is sustainability: does enthusiasm convert to repeat purchases and broader demographics, or is this a single‑product spike? Upcoming product cycles, including a Gen‑3 iteration and feature improvements, will be early litmus tests for staying power over a three‑year horizon.

Retail execution remains the flywheel. A traffic lift at Sunglass Hut following CTV campaigns suggests marketing efficiency gains can still influence like‑for‑like sales even in a mixed consumer environment. With 5.50% quarterly revenue growth and an 8.74% profit margin, the core machine is resilient but not immune to macro slowdowns. Vertical integration moves – acquiring Automation & Robotics in lens quality control and the lens component division of PUcore – point to a steady push for cost, quality, and supply‑chain control. Such steps can reduce defect rates and lead times, buttressing gross profit of 16.89B and the 14.25% operating margin. The near‑term watchpoint is working capital: a 0.97 current ratio requires disciplined inventory management as seasonal collections roll and wearables demand is forecasted.

Valuation sets a high bar. A trailing P/E of 48.97 and forward P/E of 33.56, alongside a PEG of 2.66, imply investors are underwriting multi‑year earnings compounding powered by mix upgrades and operational excellence. EV/EBITDA at 18.97 and EV/Revenue at 4.67 reinforce the growth‑quality narrative but compress margin for error if execution slips. Cash generation is a strength – 4.91B in operating cash flow and 3.07B in levered free cash flow support capex and bolt‑ons – yet capital allocation is bounded by a 76.70% payout ratio on a 1.57% forward dividend yield. Debt of 14.05B is manageable, but balance‑sheet flexibility must be preserved to fund innovation and store refurbishments without straining returns on equity, which stand at 6.44%.

The share price picture is constructive but not euphoric. After sliding through March and finding support in late June, the stock reclaimed the 50‑ and 200‑day moving averages (244.78 and 249.16), closing at 252.30 on 2025-08-08. That technical stabilization, coupled with a 52–week range of 202.10–298.00, frames a three‑year setup with asymmetric outcomes driven by category adoption curves. In a favorable path, smart‑glasses become a normalized accessory sold across the company’s retail banners, boosting traffic and ASPs. In a middling path, wearables remain a halo that aids brand heat but contributes modestly. In a tougher path, consumer electronics cycles fade and discretionary spend softens, leaving valuation multiples to compress toward peers. Given beta of 0.74, drawdowns may be shallower than high‑beta discretionary names, but multiple sensitivity remains real.

What could happen in three years? (horizon August 2025+3)

| Scenario | Outcome by 2028 |

|---|---|

| Best | Wearables adoption scales across Ray‑Ban and Oakley with regular refresh cycles; retail traffic benefits from omnichannel marketing and in‑store services; recent lens automation and component acquisitions lower unit costs and defect rates, lifting operating efficiency. Brand power sustains pricing, and dividend growth resumes alongside disciplined M&A. |

| Base | Smart‑glasses remain a niche but durable adjunct; core lenses and retail deliver mid–single‑digit growth; incremental efficiencies keep margins broadly stable. Capital allocation balances maintenance capex, selective store openings, and a steady dividend policy without stretching the balance sheet. |

| Worse | Category fatigue in consumer electronics collides with slower retail traffic; integration synergies from acquisitions lag; promotional intensity rises, squeezing gross margin. Multiple compresses as growth expectations reset; management prioritizes cash preservation and working‑capital discipline. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Wearables trajectory and product cadence for Ray‑Ban/Oakley smart‑glasses, including feature upgrades and geographic rollouts.

- Retail health and marketing ROI across banners (e.g., Sunglass Hut), affecting like‑for‑like sales and mix.

- Margin execution from supply‑chain moves (Automation & Robotics, PUcore) versus input‑cost and promotional pressures.

- Valuation sensitivity to growth delivery: P/E 48.97 (ttm) and 33.56 (forward) with PEG 2.66 increase downside if growth slows.

- Balance‑sheet flexibility and capital returns amid 14.05B total debt, 2.79B cash, 0.97 current ratio, and a 76.70% payout ratio.

- Macro factors impacting discretionary spend and prescription cycles, plus competitive responses from tech and luxury peers.

Conclusion

EssilorLuxottica blends durable core franchises with a credible growth option in smart eyewear. The partnership model allows the company to leverage brand, retail, and lens know‑how while a platform partner advances AI and software – a capital‑efficient route to innovation. Fundamentals are solid (27.24B revenue, 16.89B gross profit, 14.25% operating margin), cash generation is healthy, and beta is low, but the equity already prices in execution with a premium multiple set. Over the next three years, the base case is steady mid–single‑digit expansion in the core, with wearables adding optionality and vertical‑integration benefits cushioning costs. The bull case requires sustained adoption and repeat purchases; the bear case hinges on consumer softness and category fatigue forcing multiple compression. For now, monitoring product cadence, retail traffic trends, and integration milestones will be the best indicators of whether the current valuation is justified.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.