Exxon Mobil Corporation (XOM) demonstrates resilience despite market fluctuations and evolving energy demands. With recent fluctuations in share price and ongoing strategic partnerships, Exxon is positioning itself for future growth. The company's latest financial results indicate both challenges and opportunities in its quest to maintain shareholder value and support its dividend strategy. As of July 2025, Exxon seeks to navigate through geopolitical tensions and market competition, providing a compelling prospect for investors balancing risk and reward in their portfolios.

Key Points as of July 2025

- Revenue: $341.09B

- Profit Margin: 9.73%

- Quarterly Revenue Growth (yoy): 0.60%

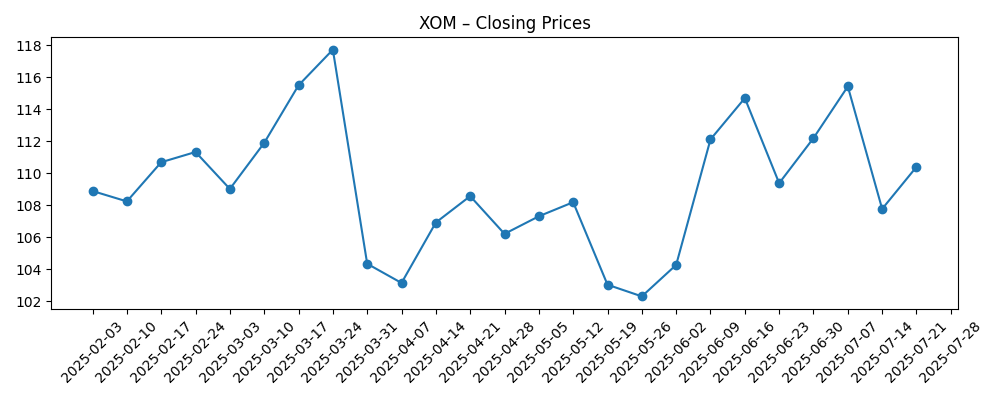

- Share price fluctuated between $102.30 – $117.73

- Analyst view remains cautiously optimistic

- Market cap: Approximately $330B

Share price evolution – last 6 months

Notable headlines

- Chevron and Exxon Lead $34B US-Indonesia Energy and Trade Pact

- Is Exxon Mobil Corporation (XOM) Offering a Compelling Opportunity?

- Here is Why Exxon Mobil (XOM) is an Absolute Favorite Among Billionaire Investors

Opinion

The recent agreement between Chevron and Exxon Mobil for a substantial $34 billion energy pact highlights the strategic partnerships that major oil players are pursuing in an environment of shifting energy demands and tighter regulations. This move may not only bolster their market positions but also emphasize the importance of collaboration in navigating complex geopolitical landscapes. While these partnerships might provide immediate benefits, the long-term sustainability of such alliances remains uncertain, depending on global energy policies and market conditions.

Furthermore, Exxon's current profit margin of 9.73% reflects the necessity for continued operational efficiency amidst fluctuating oil prices. The company's ability to maintain or improve margins will largely hinge on its operational flexibility and cost management strategies. However, with a revenue growth rate of 0.60% year over year, it suggests a pressing need for Exxon to explore additional revenue streams or innovations, particularly in renewable energy, to diversify its portfolio amidst declining fossil fuel demands.

The volatility of Exxon's share price in recent months, fluctuating in a range from $102.30 to $117.73, emphasizes the market's reaction to both internal and external pressures. Investors' sentiment appears cautious, with analysts maintaining a cautiously optimistic outlook driven by Exxon's dividend strategy, which remains attractive in an otherwise volatile market. Maintaining investor confidence is crucial for Exxon as it seeks to uphold its reputation as a reliable dividend payer while also strategizing for future growth.

As Exxon navigates these challenges, its focus on shareholder returns amidst evolving market conditions will be key. Investors may find comfort in Exxon's long-standing commitment to dividends—an aspect that continues to attract interest even during periods of uncertainty. However, the company must also address potential criticisms regarding environmental sustainability and increasing calls for greener operational practices, which could significantly impact its future market value.

What could happen in three years? (horizon July 2025+3)

| Scenario | Outlook |

|---|---|

| Best | Revenue growth accelerates, advancing towards $400B with renewed investments in renewables. |

| Base | Stable revenue around $350B, maintaining current dividend levels while exploring new markets. |

| Worse | Revenue declines to $300B due to regulatory pressures and falling oil prices. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global oil price fluctuations

- Regulatory changes in energy policies

- Performance of strategic partnerships

- Innovations in renewable energy

- Investor sentiment towards dividends

Conclusion

In conclusion, Exxon Mobil Corporation stands at a crossroads of opportunity and challenge. While current market conditions suggest a stable but cautious outlook, the company's ability to adapt and innovate amidst evolving energy demands will define its trajectory over the next few years. Strategic partnerships and a strong dividend policy are pivotal in maintaining investor confidence and providing some cushion against market volatility. However, Exxon's future success will depend on its responsiveness to regulatory pressures and public concerns over sustainability. With careful navigation, Exxon can continue to leverage its strengths while preparing for the road ahead, positioning itself favorably for investors seeking stability in a fluctuating market.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.