Fomento Económico Mexicano (FMX) enters late 2025 with improving top-line momentum but pressured earnings, setting up a three-year arc defined by margin repair and currency dynamics. The stock has lagged broader U.S. equities, with a 52‑week change of -3.33% versus the S&P 500’s 19.74%, as investors weigh a high cash payout against volatile net income. The change stems from resilient consumer demand in Mexico and Latin America that lifts sales, while cost inflation, mix, and one-off items compress profitability. It matters because FMX’s appeal now centers on a rich dividend and a defensive beta, so the valuation narrative hinges on whether margins normalize without sacrificing growth. For consumer staples and retail operators, the sector backdrop is mixed: demand is steady, but pricing power is moderating as inflation cools and FX (foreign exchange) swings can overwhelm local gains. Over the next three years, credible cost control, disciplined capital allocation, and steadier currencies could re-rate the shares; the opposite would keep the equity range‑bound despite healthy cash generation.

Key Points as of November 2025

- Revenue: trailing twelve months (ttm) of 829.57B, supported by quarterly revenue growth (yoy) of 9.10%.

- Profit/Margins: profit margin 1.96% and operating margin 8.20%; returns modest (ROE 7.77%, ROA 4.89%).

- Sales/Backlog: backlog not a core metric for consumer retail; growth driven by traffic and ticket size, with quarterly revenue growth (yoy) of 9.10%.

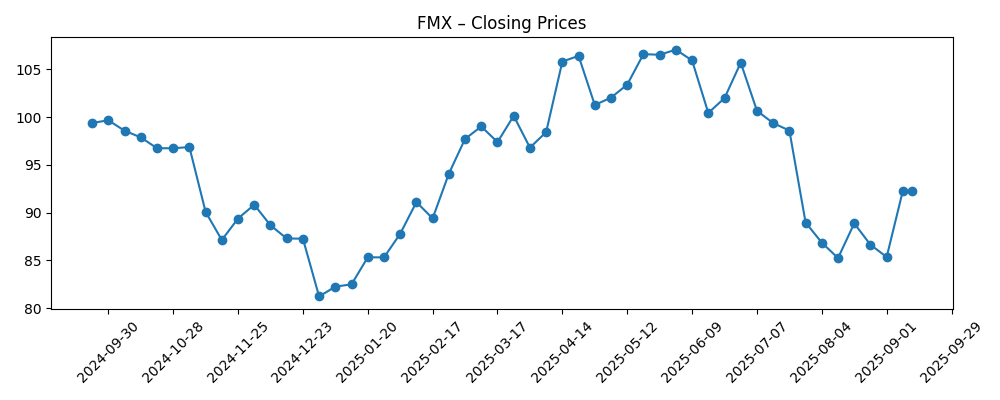

- Share price: last weekly close 94.36 (10/31/2025); 52‑week high 108.74, low 81.08; 50‑day MA 92.96 vs 200‑day 96.04; 52‑week change -3.33%.

- Dividend: forward annual dividend rate 5.45 (forward yield 5.77%); payout ratio 271.50%; last dividend date 10/27/2025 (ex‑date 10/16/2025).

- Balance sheet: cash 123.63B vs total debt 257.52B; current ratio 1.34; debt/equity 78.65%.

- Market cap/liquidity: market capitalization not disclosed in the provided data; liquidity moderate (avg 3‑month volume 802.42k; 10‑day 457k).

- Short interest/Analyst view: short interest low (0.40% of shares outstanding; short ratio 2.07); no consolidated analyst guidance in dataset.

- Qualitative: low beta (0.38) suggests a defensive profile; performance sensitive to FX (USD/MXN) and consumer spending trends in Mexico and Latin America.

Share price evolution – last 12 months

Notable headlines

Opinion

FMX’s recent mix of solid revenue growth with sharp earnings pressure points to a quality gap between sales momentum and profitability. The figures imply that operating execution is broadly intact—an 8.20% operating margin and strong gross profit base—but net income is absorbing cost inflation, mix shifts, and possibly non-recurring items, resulting in a 1.96% profit margin and weak year‑over‑year earnings growth. Cash flow helps bridge this gap: operating cash flow of 77.63B and levered free cash flow of 40.91B support generous dividends despite thin GAAP earnings. That said, a payout ratio above 200% highlights reliance on cash generation and balance sheet flexibility rather than earnings alone, making dividend signaling a central variable for the equity story.

The market’s message is cautious but not outright bearish. A low beta of 0.38 underscores defensive characteristics, while the share price sitting between its 50‑ and 200‑day moving averages and below the 52‑week high suggests investors want proof of margin repair before paying a fuller multiple. Debt of 257.52B against 123.63B cash and a 1.34 current ratio appear manageable, yet refinancing costs and currency swings can quickly reshape free cash coverage. In short, the multiple over the next year is likely to follow evidence of operating leverage and cost discipline more than sales growth per se.

Within consumer staples and convenience retail, the cycle is shifting from price‑led to volume‑mix normalization. For FMX, that means the ability to hold traffic while easing price increases, improve in‑store productivity, and keep supply chain costs contained will matter more than headline expansion. FX (foreign exchange) remains a swing factor: a strong USD can dilute reported results even when local performance is sound, while a stable or firmer MXN can unlock operating leverage visibility. Regulatory and competitive dynamics—like rules on alcohol retailing and intensified local competition—can nudge margins and capex timing.

Looking out to 2028, the narrative bifurcates. If management converts revenue growth into higher incremental margins, the dividend’s credibility could compress the risk premium and re‑anchor valuation around cash returns and defensiveness. If earnings remain volatile, investor focus may pivot to deleveraging, selective portfolio moves, and tighter capital allocation. Either way, with a notable yield and modest volatility profile, the stock’s path should be set less by top‑line beats and more by the cadence of cost control, mix optimization, and FX translation.

What could happen in three years? (horizon November 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Operating discipline lifts margins as input inflation cools; FX stays broadly supportive; cash flow comfortably covers dividends while funding selective growth in convenience and beverages. The equity narrative pivots to dependable cash returns and lower perceived risk. |

| Base case | Sales growth moderates but remains positive; margins improve gradually with ongoing cost actions; FX is mixed. Dividend remains a key pillar, covered by cash flow with tight capex. Valuation tracks steady, if unspectacular, earnings normalization. |

| Worse case | FX turns adverse and wage/logistics costs rise, stalling margin repair. Earnings stay volatile, forcing tougher capital allocation and slower expansion. The market focuses on balance sheet resilience and sustainability of the dividend policy. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- FX (USD/MXN) direction and volatility affecting reported sales and margins.

- Execution on cost control and margin recovery relative to a 1.96% profit margin and 8.20% operating margin.

- Dividend sustainability versus cash flow (40.91B levered free cash flow) and a high payout ratio.

- Consumer demand trends in Mexico and Latin America impacting traffic and pricing power.

- Balance sheet and refinancing conditions given 257.52B total debt and 123.63B cash.

- Competitive/regulatory developments in convenience retail and beverages that shape mix and store productivity.

Conclusion

FMX’s three‑year setup is a tug‑of‑war between steady sales growth and the pace of margin repair. The company’s low beta and sizable dividend create a defensive profile, but the valuation argument will only broaden if earnings volatility eases and cash coverage of distributions remains clear. Debt looks manageable and liquidity is adequate, yet FX and operating costs can quickly change free cash math. Sector‑wise, staples and convenience retail are shifting toward volume‑led growth, putting a spotlight on mix, store productivity, and disciplined pricing. If cost initiatives stick and currency headwinds subside, the equity could transition from income‑anchored to quality‑cash‑flow‑anchored. Watch next 1–2 quarters: margin trajectory versus operating costs; FX translation effects; dividend coverage from free cash flow; pricing discipline and traffic trends; debt refinancing cadence.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.