HSBC Holdings PLC has been navigating a complex landscape as it adjusts its strategies amidst various economic and geopolitical challenges. Recent decisions, such as exiting a climate coalition and investing in affluent British clients, signal a pivotal shift in focus. While the stock has seen fluctuations in the past few months, with a recent closing price of £923.70, investor sentiment and future market conditions will play critical roles in HSBC's performance over the next three years as it seeks to solidify its position in the banking landscape.

Key Points as of July 2025

- Revenue: £48.5 billion

- Profit/Margins: £10.5 billion

- Sales/Backlog: Growing interest in wealth management services

- Share price: £923.70

- Analyst view: Mixed opinions about long-term growth potential

- Market cap: £157.2 billion

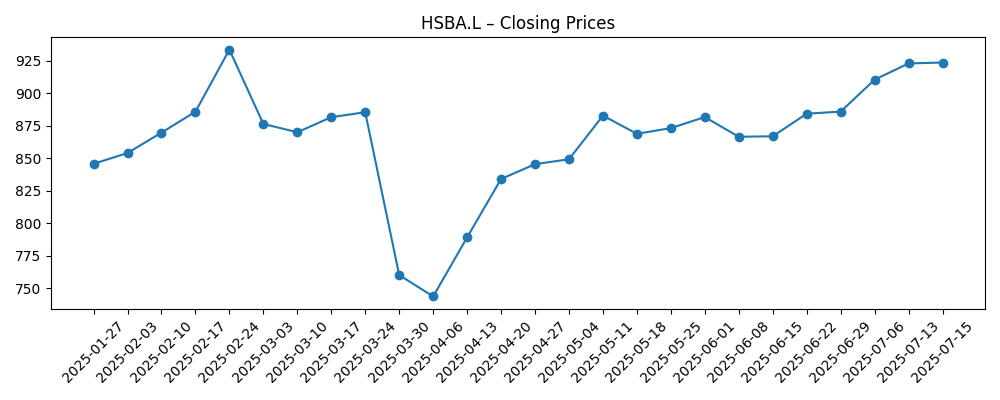

Share price evolution – last 6 months

Notable headlines

- Why HSBC Is Betting Billions on Britain's Rich--Just as They Start to Flee – Yahoo Entertainment

- HSBC Exits Banks’ Climate Coalition Abandoned by Wall Street – Financial Post

- HSBC Said to Be Creating New Team for Tough Infrastructure Deals – Livemint

Opinion

The recent decision by HSBC to invest substantially in the affluent market, despite the risks associated with potential capital flight, illustrates the bank’s ambitions to diversify its revenue streams. This strategic pivot could yield positive results if executed effectively, especially in today's market where wealth management is increasingly in demand from high-net-worth individuals. However, uncertainties regarding the sustainability of this strategy abound, considering the geopolitical and economic pressures facing not only the UK but global markets.

Moreover, HSBC's exit from the climate coalition raises concerns about its commitment to sustainable practices, which could affect its reputation among environmentally conscious investors. As the landscape for banking continues to evolve with a growing focus on sustainability, this move may have long-term implications on investor sentiment and market positioning.

Looking at the company's recent stock fluctuations—dropping from a high of £933.60 earlier this year to a current closing price of £923.70—investors might be apprehensive about the implications of these strategic shifts. The combination of market conditions and company decisions will ultimately determine whether the stock rebounds or continues to face downward pressure.

Ultimately, HSBC's ability to attract and retain investment will depend on how well it can adapt to new realities in the banking sector, particularly amid changes in consumer preferences and regulatory landscapes. Stakeholders will need to closely monitor these developments in the coming years to gauge the potential for recovery and growth.

What could happen in three years? (horizon July 2025+3)

| Best Case | £1,200 |

| Base Case | £1,000 |

| Worse Case | £800 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Global economic recovery and growth rates

- Changes in regulatory frameworks impacting banking operations

- Investor sentiment regarding environmental sustainability practices

- Competitive landscape within the banking sector

Conclusion

As HSBC Holdings PLC looks toward the next three years, its ability to navigate evolving challenges while capitalizing on new opportunities will be critical to its success. The bank's recent strategic shifts illustrate a willingness to adapt, yet come with inherent risks that could impact its reputation and market position. The fluctuating share price reflects investor uncertainty, underscoring the need for careful analysis of both macroeconomic factors and company-specific developments. With opportunities in wealth management and infrastructure investment, HSBC could potentially strengthen its market presence, but stakeholders must remain vigilant about the possible repercussions from its recent actions. Ultimately, how HSBC manages its strategic focus and responds to changing market conditions will be pivotal in shaping its future prospects.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.