As of August 2025, Intel Corporation (INTC) finds itself in a crucial phase of transformation following a challenging financial period. The company's restructuring plan and new leadership are garnering attention amid fluctuating share prices and ongoing operational challenges. With recent earnings reports showing signs of potential recovery, investors are closely monitoring Intel's ability to navigate competition and capitalize on emerging technologies in the semiconductor market. The outlook remains cautious, yet hopeful as the company works towards regaining its footing.

Key Points as of August 2025

- Revenue: $53.07B

- Profit Margin: -38.64%

- Sales Backlog: Quarterly Revenue Growth (YoY): 0.20%

- Share Price: $19.31

- Analyst View: Mixed reviews following recent restructuring

- Market Cap: Approximately $84.44B

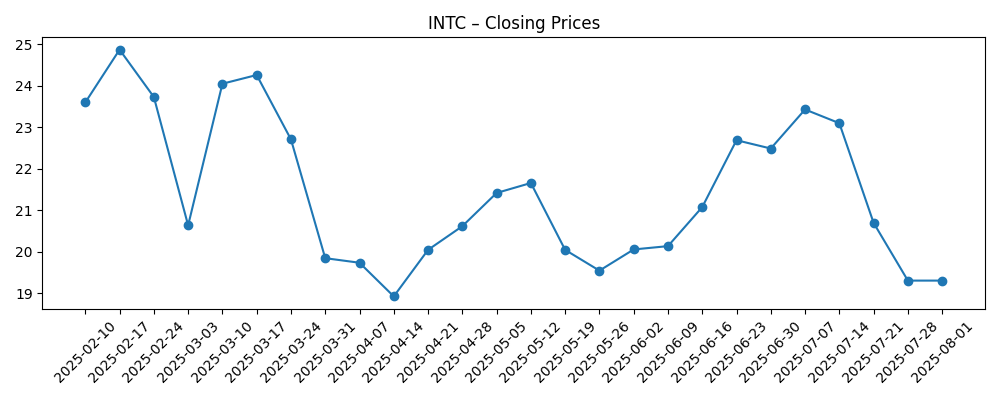

Share price evolution – last 6 months

Notable headlines

- Intel Q2 beat: Company's turnaround still a 'longer-term story'

- Intel Corp. (INTC) Surges 7.23% as Investors Cheer Restructuring Plan

- Intel Corporation (INTC): New CEO’s “Terrific,” Says Jim Cramer

- Intel Corporation (INTC) Releases Q2 Financial Results; Beats Revenue Expectations

- Is Intel Stock A Buy Now?

Opinion

Intel's recent quarterly earnings beat expectations, signifying a potential turning point for the company amidst ongoing challenges. As the semiconductor industry continues to evolve, Intel must adapt its strategies to maintain its competitive edge. The restructuring plan, which includes significant operational cost savings, is a critical step in regaining investor confidence. However, analysts remain cautious, noting that while initial improvements are promising, they may not be sufficient to offset the company's substantial losses over the past year.

Investor sentiment has seen slight recovery following the announcement of a new CEO, whose vision for the company is perceived as a fresh start. Nonetheless, the road to recovery is fraught with risks, particularly from competitors who are aggressively investing in AI and next-generation semiconductor technologies. Intel's ability to innovate and maintain relevance in this rapidly changing landscape will be pivotal for its long-term success.

Amid these developments, Intel's stock has fluctuated significantly, reflecting broader market sentiments and company-specific news. The recent decline in stock price, coupled with a high short interest ratio, raises questions about market confidence and the potential for continued volatility. Investors are advised to closely monitor upcoming quarters for signs of sustained improvement or further setbacks in Intel's operational performance.

In summary, while the restructuring and leadership changes indicate a proactive approach by Intel, the company must execute effectively to turn around its fortunes. Stakeholders are advised to remain vigilant as Intel navigates a complex path forward in the semiconductor domain.

What could happen in three years? (horizon August 2025+3)

| Scenario | Prospects |

|---|---|

| Best | Intel successfully revitalizes its product lineup, achieving significant market share and profitability. |

| Base | Continued growth, with gradual recovery of revenues and profitability, but competitive pressure remains high. |

| Worse | Failure to adapt leads to further declines in market position and financial performance. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Success of restructuring efforts

- Market demand for semiconductor products

- Competitive landscape and technological advancements

- Global economic conditions

Conclusion

Intel Corporation stands at a critical juncture as its management seeks to navigate a shifting technology landscape marked by fierce competition and rapid innovation. The recent changes in leadership and strategic restructuring are aimed at revitalizing the company's prospects, yet significant challenges remain. As Intel strives to regain its foothold in the semiconductor market, investors should be prepared for a potentially volatile ride, driven by both operational performance and external market factors. While signs of recovery are evident, sustained improvements will be essential for restoring confidence among shareholders and moving the company back to profitability.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.