In July 2025, Johnson & Johnson (JNJ) continues to demonstrate resilience with steady financial performance amidst evolving market conditions. With a recent revenue of $90.63 billion and a profit margin of 25%, the company shows strength in its operational capabilities. Recent headlines have highlighted JNJ's innovative pipeline and defensive market positioning, attributing it as a potential safe investment amid economic uncertainties. As analysts adjust their forecasts positively following upbeat earnings, JNJ's stock performance will be closely watched in the upcoming quarters. Investors are keen to understand how emerging therapies and market dynamics will inform the company's trajectory over the next three years.

Key Points as of July 2025

- Revenue: $90.63B

- Profit Margin: 25.00%

- Quarterly Revenue Growth (yoy): 5.80%

- Share Price: $167.26

- Analyst View: Positive adjustments following earnings

- Market Cap: $402.85B

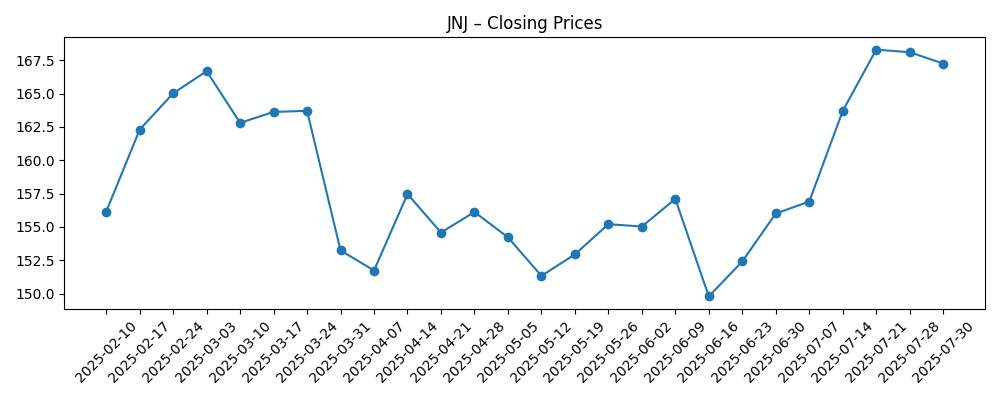

Share price evolution – last 6 months

Notable headlines

- Johnson & Johnson: Buy JNJ Stock Ahead of Its Upcoming Earnings? [Forbes]

- Johnson & Johnson (JNJ)’s Pasritamig Shows Breakthrough Promise in Prostate Cancer [Yahoo Entertainment]

- Johnson & Johnson’s (JNJ) Defensive Strength Shines Among the Dogs of the Dow [Yahoo Entertainment]

- Johnson & Johnson (JNJ): I Would “Love” If Trump Praised The Company, Says Jim Cramer [Yahoo Entertainment]

- Goldman Sachs Rates Johnson & Johnson a Buy, Citing Pipeline Strength and Policy Tailwinds [Yahoo Entertainment]

- Johnson & Johnson (JNJ) Applied to the European Medicines Agency to Expand AKEEGA Usage [Yahoo Entertainment]

- Johnson & Johnson Analysts Raise Their Forecasts After Upbeat Earnings [Biztoc.com]

- S&P 500 Gains & Losses Today: Johnson & Johnson Stock Jumps; Universal Health Services Shares Slide [Investopedia]

- J.P. Morgan Maintained Their Hold Rating on Johnson & Johnson (JNJ) [Yahoo Entertainment]

- Guggenheim Maintained a Hold Rating on Johnson & Johnson (JNJ) [Yahoo Entertainment]

Opinion

The recent fluctuations in Johnson & Johnson's stock price, which saw peaks above $168 amid positive sentiment bolstered by strong earnings, reflect the market's optimism about the company's strategic initiatives. In particular, JNJ's robust earnings report, coupled with a significant pipeline of potential breakthroughs in health care, has led several analysts to upgrade their forecasts. Notably, JNJ's focus on innovative treatments, such as those showcased for prostate cancer, positions the company well against competitors. As the healthcare sector evolves, JNJ's investments in research and development could yield substantial returns, enhancing its market reputation.

Investors should also consider the broader economic context, as market conditions remain volatile. Analysts have indicated that JNJ's defensive characteristics give it an edge in uncertain times. The company's ability to maintain a strong dividend yield and manage its debt levels efficiently plays a crucial role in attracting institutional investors. As JNJ navigates its current environment, maintaining strong performance in core segments like pharmaceuticals will be essential for sustainable growth.

Furthermore, the company’s plans to expand the usage of its AKEEGA product through regulatory approvals underscore JNJ's commitment to leveraging its innovation pipeline effectively. The path forward is fraught with challenges, but if JNJ successfully capitalizes on these opportunities, it could see significant share price appreciation in the coming years. Coupled with its defensive strength, steady cash flows, and positive earnings growth, the outlook remains favorable.

Ultimately, stakeholders should be attentive to the changes in JNJ's operational strategies and how they adapt to regulatory and market challenges. Future developments, especially in emerging therapies and strategic collaborations, will be critical indicators of the company's trajectory. Stakeholders must remain vigilant to how JNJ manages its growth while maintaining profitability and investor confidence, particularly in this competitive landscape.

What could happen in three years? (horizon July 2025+3)

| Scenario | Market Cap (estimated) | Share Price (estimated) |

|---|---|---|

| Best | $500B | $207.49 |

| Base | $450B | $186.66 |

| Worse | $350B | $145.23 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- New product approvals and pipeline developments

- Market competition and regulatory changes

- Global economic conditions impacting consumer spending

- Changes in healthcare policies and insurance reimbursements

- Investor sentiment and institutional investment levels

Conclusion

In conclusion, Johnson & Johnson's current outlook reflects a combination of positive earnings momentum and strategic positioning in the healthcare sector. With analyst upgrades following strong earnings, the company appears poised for continued growth over the next three years. The defensive nature of JNJ’s business, combined with its commitment to innovation, provides a solid foundation for resilience in challenging market conditions. However, investors must remain aware of potential risks stemming from economic volatility and competitive pressures which could impact growth trajectories. Overall, JNJ's proactive approach to managing opportunities and challenges will be integral in shaping its future performance. Stakeholders should keep a close watch on developments that could significantly influence share price movements, and be prepared to adjust strategies accordingly.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.