Koninklijke BAM Groep (BAMNB.AS) enters the next three years on stronger footing, backed by solid top‑line growth and a cleaner balance sheet. Over the past year the stock has surged 121.81%, recently closing around €8.17 (15 Sep 2025), near its 52‑week high of €8.44. The group generates €6.69B in trailing revenue, with quarterly revenue up 7.30% year on year. Profitability remains thin for a contractor—operating margin 2.87% and profit margin 1.93%—but cash of €500.6M exceeds debt of €347.4M. Valuation has reset: the forward P/E of 9.49 sits well below the trailing 19.67, while EV/EBITDA is 7.30. A 3.10% forward dividend yield (payout ratio 60.98%) adds support. This note outlines key drivers, scenarios, and risks that could shape BAM’s share price through September 2028.

Key Points as of September 2025

- Revenue: Trailing twelve‑month revenue is 6.69B; quarterly revenue growth (yoy) is 7.30%; revenue per share is 25.53.

- Profit/Margins: Operating margin (ttm) 2.87%; profit margin 1.93%; ROE 11.88%; ROA 2.99%.

- Sales/Backlog: Sales momentum positive with quarterly earnings growth (yoy) at 84.90%; operating cash flow 287.19M and levered free cash flow 138.54M support disciplined bidding.

- Share price: Last close €8.17 (15 Sep 2025); 52‑week change 121.81%; 52‑week high 8.44 and low 3.60; 50‑day MA 7.69 vs 200‑day MA 6.00; beta 1.37.

- Analyst view (valuation): Forward P/E 9.49 vs trailing 19.67; EV/EBITDA 7.30; EV/Revenue 0.29; Price/Sales 0.32; Price/Book 2.36.

- Market cap: 2.09B with enterprise value of 1.94B; float 259.42M; institutions hold 37.48%.

- Balance sheet/liquidity: Total cash 500.6M vs total debt 347.4M; current ratio 0.97; total debt/equity 39.21%.

- Dividend: Forward dividend 0.25 per share and yield 3.10%; payout ratio 60.98%; ex‑dividend date 12 May 2025.

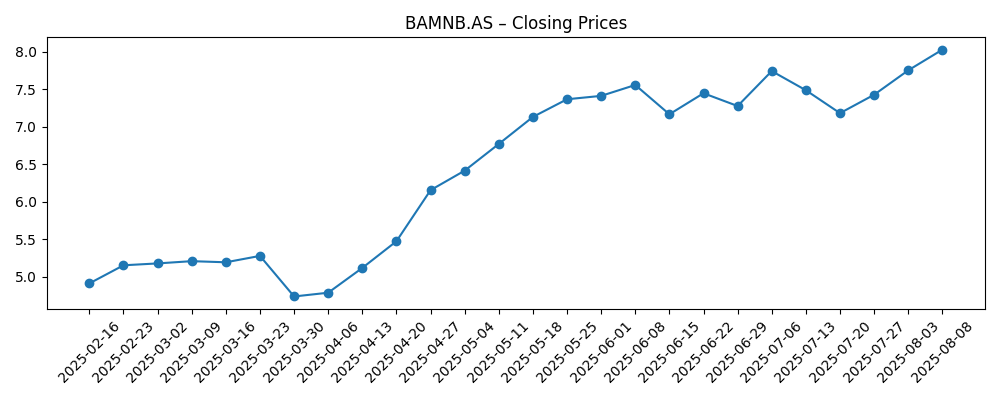

Share price evolution – last 12 months

Notable headlines

Opinion

BAM’s re‑rating over the past year reflects improving execution and expectations for higher earnings, rather than a surge in absolute profitability today. The valuation setup is notable: a forward P/E of 9.49 compared with a trailing 19.67 suggests the market anticipates material earnings growth. Momentum adds support, with the shares trading above both the 50‑day (7.69) and 200‑day (6.00) moving averages, and a 52‑week change of 121.81%. To sustain this, delivery needs to match expectations—particularly on bid discipline, cost control, and project risk management. In short, the rally is justified only if margin expansion and steadier cash conversion continue. Without that follow‑through, the multiple could compress despite healthy revenue trends.

Profitability is still modest for a contractor—operating margin of 2.87% and profit margin of 1.93%—but the direction of travel matters more than the absolute level. Quarterly revenue growth of 7.30% and quarterly earnings growth of 84.90% (yoy) point to improving operating leverage. EV/EBITDA at 7.30 indicates investors are paying a reasonable, not cheap, price for those gains. What keeps the equity case intact is evidence that risk pricing on new work is holding, and that legacy project volatility is fading. If BAM can preserve pricing, manage subcontractor exposure, and capture efficiency savings, even incremental margin improvements can translate into meaningful earnings growth given the low absolute base.

The balance sheet provides flexibility. Cash of 500.6M exceeds debt of 347.4M, which is a helpful buffer if market conditions soften. That said, a current ratio of 0.97 highlights tight working capital and the need for continued discipline in cash conversion. Operating cash flow of 287.19M and levered free cash flow of 138.54M indicate headroom for a mix of selective investment and shareholder returns. The key watchpoint is that thin margins leave little room for execution errors. Any spike in input costs or delays can quickly erode profitability; maintaining rigorous project controls and supply‑chain management will be central to delivering on the equity story.

Capital returns are a meaningful part of the thesis. A forward dividend yield of 3.10% and payout ratio of 60.98% are appealing if earnings grow as implied by the forward P/E. The dividend also helps anchor valuation through cycles, but it narrows flexibility if performance stalls. In the next three years, we expect BAM to balance capital returns with targeted investment in productivity and risk systems. If execution remains solid, the current valuation could prove supportive; if not, the shares may de‑rate from EV/EBITDA of 7.30 and Price/Book of 2.36. The path of margins and cash conversion will likely determine which way the pendulum swings.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operating momentum | Financial position | Valuation stance | Share price narrative |

|---|---|---|---|---|

| Best | Steady revenue growth with continued improvement in bid discipline and execution; earnings quality strengthens. | Cash remains comfortably above debt; working capital discipline improves from current tight levels. | Multiple holds or expands as delivery meets expectations; dividend maintained with room for incremental returns. | Positive rerating persists as confidence builds in sustainable margins and cash conversion. |

| Base | Moderate growth; margins edge up but remain sensitive to project mix; occasional project variability. | Net cash preserved; liquidity adequate despite cyclical swings in receivables and payables. | Valuation broadly stable; dividend maintained within existing payout parameters. | Range‑bound trading with periodic swings around results and order intake updates. |

| Worse | Project overruns and cost inflation pressure margins; revenue momentum softens. | Working capital strains reappear; balance sheet flexibility narrows. | Multiple compresses; dividend policy becomes more conservative to protect cash. | De‑rating as investors pivot to balance sheet protection and risk containment. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Project execution and risk control: Variance on fixed‑price contracts can quickly swing margins given the 1.93% profit margin base.

- Cost inflation and supply chain: Input cost spikes or subcontractor constraints could erode the 2.87% operating margin.

- Order intake and pricing: Sustaining 7.30% revenue growth (yoy) depends on disciplined bidding and mix, not just volume.

- Cash conversion and working capital: With a current ratio of 0.97, collections and milestone timing are critical to maintain flexibility.

- Capital allocation: The 3.10% dividend yield and 60.98% payout need earnings support; shifts here can signal confidence or caution.

Conclusion

BAM’s investment case into 2028 rests on turning solid revenue growth into steadier, higher‑quality earnings while protecting cash. The stock’s strong 52‑week performance and the gap between trailing and forward P/E indicate expectations are already elevated. That does not make the shares expensive if execution remains on track—EV/EBITDA of 7.30 and Price/Sales of 0.32 are grounded by a balanced capital structure, with cash of 500.6M versus debt of 347.4M. The dividend yield of 3.10% provides carry, but it also raises the bar for consistent delivery given a 60.98% payout. Watch margins (2.87% operating; 1.93% profit), cash conversion (current ratio 0.97), and the cadence of new work. If BAM sustains pricing discipline and continues to improve project outcomes, the current valuation could be maintained or better. If not, a de‑rating is likely as investors refocus on balance sheet protection.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.