KPN (KPN.AS) enters September 2025 with defensive telecom traits and improving momentum. Trailing 12-month revenue is 5.73B with gross profit of 3.08B and EBITDA of 2.28B; profit margin stands at 14.42% and operating margin at 23.83%. Free cash flow of 662M and operating cash flow of 2.16B underpin a forward dividend of 0.18 per share (4.38% yield; payout ratio 89.47%), though leverage remains elevated with total debt of 7.15B, debt/equity of 207.96%, and a current ratio of 0.72. The share last closed near 4.164 on September 4, close to its 52-week high of 4.2050, up 6.59% year-on-year versus the S&P 500’s 17.17%. Low beta (0.25) and a rising 50-day (4.0400) above the 200-day (3.8566) suggest steady sentiment into the next three years.

Key Points as of September 2025

- Revenue (ttm): 5.73B; quarterly revenue growth (yoy): 5.90%.

- Profitability: profit margin 14.42%; operating margin 23.83%; EBITDA 2.28B; net income 0.776B; diluted EPS 0.1900.

- Sales/Backlog: no backlog disclosed here; demand appears steady given 5.90% revenue growth.

- Share price and momentum: recent close 4.164 (Sep 4); 52‑week range 3.446–4.205; 50‑day MA 4.0400 vs 200‑day 3.8566; 52‑week change 6.59%.

- Dividends: forward annual dividend 0.18 (yield 4.38%); payout ratio 89.47%; ex‑dividend date 7/25/2025.

- Balance sheet: total debt 7.15B; debt/equity 207.96%; current ratio 0.72; total cash 374M.

- Cash generation: operating cash flow 2.16B; levered free cash flow 662M.

- Analyst/investor tone: no new consensus cited here; beta 0.25; institutions hold 67.22% of shares.

- Market cap/float: market cap not provided in this snapshot; float 4.04B; average 3‑month volume 8.95M.

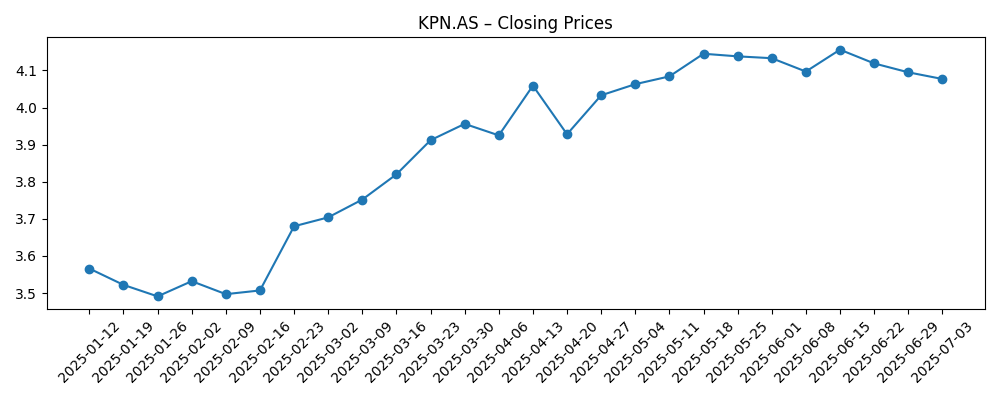

Share price evolution – last 12 months

Notable headlines

Opinion

KPN’s share price has trended higher through 2025, with technicals supportive. After late‑2024 softness near 3.51–3.53, the stock built a base and advanced above 3.90 in March, then pushed through 4.00 in April–May, reaching 4.16 in early September and approaching the 4.2050 52‑week high. The 50‑day average (4.0400) sits above the 200‑day (3.8566), a classic marker of positive momentum, and the low 0.25 beta underscores relatively contained volatility. This profile fits a defensive, income‑oriented name benefiting from steady cash generation and limited cyclicality. With a 6.59% 52‑week gain that lags the S&P 500’s 17.17%, the shares have delivered lower‑beta returns consistent with their risk posture. The next three years will likely hinge on whether stable operations and dividends can continue to attract capital as income investors seek visibility, even if growth remains measured.

Income remains the centerpiece. A forward dividend of 0.18 at a 4.38% yield is underpinned by 2.16B operating cash flow and 662M levered free cash flow, but the 89.47% payout ratio limits flexibility if earnings softness persists. Diluted EPS of 0.1900 and profit margins of 14.42% (operating margin 23.83%) suggest a comfortable, though not expansive, coverage. Elevated leverage (7.15B of total debt; debt/equity 207.96%) and a 0.72 current ratio highlight the importance of disciplined capital allocation and refinancing execution. In a benign environment, steady cash should fund the dividend and network investments; in tougher conditions, management may need to prioritize balance‑sheet resilience over payout growth. That trade‑off will be central to total returns through 2028.

Operationally, the combination of 5.90% year‑on‑year revenue growth and consistent profitability (gross profit 3.08B; EBITDA 2.28B) frames KPN as a cash‑generative utility‑like telecom. Returns metrics (ROE 23.35%; ROA 6.85%) point to efficient asset use, aided by stable margins. Sustaining this profile will likely require continued focus on customer retention, pricing discipline, and cost control, while keeping investment intensity aligned with cash generation. With limited headline volatility provided here, the baseline narrative is one of incremental improvement rather than step‑change acceleration. If execution maintains mid‑single‑digit top‑line momentum without margin erosion, the company can gradually deleverage and defend the dividend, improving equity defensiveness without relying on aggressive growth assumptions.

From a market‑structure angle, the 67.22% institutional ownership and a 4.04B float provide depth and liquidity, while the average 3‑month volume of 8.95M supports efficient price discovery. These characteristics, together with low beta, can cushion drawdowns but also temper upside during risk‑on phases. Relative underperformance versus a broad benchmark over the past year is consistent with that trade‑off. Looking to 2028, the investment case skews toward a carry‑and‑compounding profile: dividends plus modest appreciation if operations stay on track. Upside optionality could come from further cost efficiencies or improving pricing, whereas downside stems from competition, regulatory pressure, or funding costs interacting with leverage. In sum, KPN’s equity story appears to center on stability and cash returns rather than rapid expansion.

What could happen in three years? (horizon September 2025+3)

| Scenario | Strategy and operations | Financials | Implication for shares |

|---|---|---|---|

| Best | Consistent execution sustains customer retention and pricing discipline; efficiency programs reduce costs without harming service quality. | Revenue growth stays positive; margins hold or expand; cash flow comfortably funds capex and a progressive dividend; gradual deleveraging. | Shares consolidate above prior highs with a higher floor, supported by visibility of cash returns and improved balance‑sheet resilience. |

| Base | Stable operations with selective investment; focus on cash conversion and service quality. | Margins broadly stable; dividend maintained; leverage steady to slightly lower as cash generation funds both investment and payouts. | Total return driven by dividends and modest price appreciation, tracking operational delivery and broader market risk appetite. |

| Worse | Competitive intensity or cost inflation pressures pricing and opex; execution setbacks raise churn risk. | Margin compression and weaker free cash flow constrain capex; refinancing risk increases; dividend growth paused or payout recalibrated. | Shares revert toward prior trading lows as investors seek balance‑sheet clarity and await a reset in expectations. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Pricing power and competitive dynamics in core consumer and enterprise connectivity.

- Cost discipline and cash conversion affecting dividend capacity and deleveraging.

- Regulatory outcomes and spectrum‑related obligations that affect margins and investment needs.

- Refinancing conditions given elevated debt and the company’s current ratio.

- Investor demand for income versus growth, reflected in risk appetite and sector rotations.

Conclusion

KPN’s equity case into 2028 looks grounded in visibility: steady operations, robust cash generation, and a sizable dividend, balanced against elevated leverage and a high payout ratio. Fundamentals show a cash‑rich but capital‑intensive profile, with 5.73B in revenue, healthy margins, and 2.16B operating cash flow supporting distributions. The stock’s low beta and improving technicals suggest investors view it as a defensive income vehicle, which can outperform in choppier markets but may lag in risk‑on phases. The path to better total returns likely relies on incremental gains—cost efficiency, disciplined pricing, and measured investment—enabling gradual deleveraging and sustained payouts. Conversely, competitive pressure or tighter financing conditions could compress margins and test dividend flexibility. On balance, absent major surprises, a carry‑led return profile with modest capital appreciation appears the most probable outcome over the next three years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.