L’Oréal enters late‑summer 2025 with a resilient but slowing growth profile and a premium valuation. Shares have recovered toward the upper end of their 52‑week range (316.30–413.20), with the latest weekly close near 397.90, yet the stock’s 1.45% 52‑week change trails the S&P 500’s 15.11%. On fundamentals, trailing‑12‑month revenue stands at 43.84B and profit margin at 13.96%, supported by a 21.09% operating margin and 20.16% ROE. Valuation remains rich (P/E 35.23; forward P/E 31.25; PEG 4.49; EV/EBITDA 20.49), offset by strong cash generation (OCF 9.02B; FCF 6.28B) and a steady dividend (1.74% yield; 61.30% payout). Balance sheet flexibility is adequate with 4.82B in cash, 8.83B in total debt, and a 1.19 current ratio. With quarterly revenue growth at 1.60% year over year and quarterly earnings growth down 7.90% year over year, execution on mix, innovation, and geographic demand will be crucial to sustain the premium.

Key Points as of August 2025

- Revenue: TTM sales of 43.84B; quarterly revenue growth of 1.60% year over year; revenue per share 82.08.

- Profit/Margins: Profit margin 13.96%; operating margin 21.09%; ROE 20.16%; ROA 10.24%.

- Sales/Backlog: No formal backlog metric; growth cooled while brand breadth supports resilience.

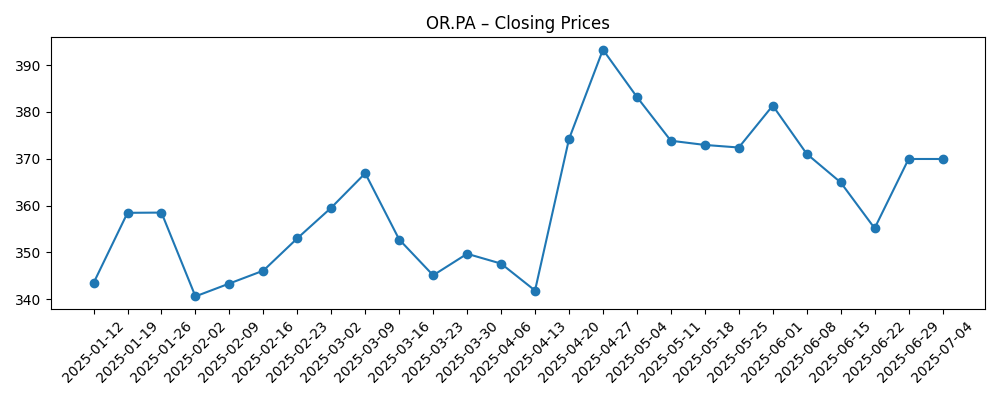

- Share price: Latest weekly close ~397.90; 52‑week range 316.30–413.20; trading above 50‑day (377.69) and 200‑day (359.78) averages; beta 0.83.

- Analyst view/valuation: P/E 35.23 and forward P/E 31.25 with PEG 4.49 and EV/EBITDA 20.49 suggest a premium multiple requiring sustained execution.

- Market cap/enterprise value: Market cap 214.53B; EV 218.54B.

- Balance sheet/liquidity: Cash 4.82B; total debt 8.83B; current ratio 1.19; total debt/equity 28.31%.

- Cash flow/dividends: Operating cash flow 9.02B; levered FCF 6.28B; dividend yield 1.74% (rate 7.00; payout 61.30%).

Share price evolution – last 12 months

Notable headlines

Opinion

L’Oréal’s premium versus broader equities (P/E 35.23; forward P/E 31.25; PEG 4.49) underscores the market’s confidence in its brand equity, pricing power, and category leadership. To justify this stance over the next three years, the company needs to translate innovation and mix into steady top‑line acceleration from today’s 1.60% quarterly revenue growth, while stabilizing earnings after the recent year‑over‑year decline. The path is feasible given portfolio depth, but the hurdle is not low: current multiples imply sustained delivery without major missteps. With EV/EBITDA at 20.49, upside likely hinges on margin expansion and a return to more robust earnings momentum rather than simple re‑rating.

Profitability remains a relative strength, with a 21.09% operating margin and 20.16% ROE supported by scale and premiumization. Over the horizon, incremental gains could come from disciplined promotions, continued trade‑up in skincare and dermocosmetics, and selective pricing. Cash generation (9.02B OCF; 6.28B FCF) provides room to invest in R&D, digital channels, and targeted geographic expansion without overstretching the balance sheet. The key is executing growth investments while keeping working capital and overheads tight so that incremental revenue drops through to profit at attractive rates, supporting the dividend and optionality for bolt‑ons.

Geographic and channel mix will likely determine the slope of the recovery in earnings growth. L’Oréal’s category diversification helps cushion volatility, but demand normalization in travel retail and any softness in discretionary spend could keep quarterly earnings growth uneven. Currency can also sway results, potentially masking underlying progress. Against this backdrop, consistent share gains in core franchises and effective product cycles would allow revenue growth to compound without sacrificing margin. Conversely, heavier promotional intensity or supply chain friction could pressure the 13.96% profit margin.

Technical context is constructive: the share price sits above both the 50‑day (377.69) and 200‑day (359.78) moving averages and is not far from the 52‑week high of 413.20. That positioning can attract momentum interest if fundamental news flow improves. Still, with the stock’s 52‑week gain at 1.45% versus the S&P 500’s 15.11%, many investors may wait for clearer evidence of re‑acceleration or for a better entry point. The dividend yield of 1.74% and strong cash generation offer a cushion, but the multiple leaves modest room for disappointment, making consistent delivery the central driver of three‑year outcomes.

What could happen in three years? (horizon August 2028)

| Scenario | Business outcome | Valuation stance | Key signposts |

|---|---|---|---|

| Best | Innovation and premiumization lift demand; margins hold or improve; earnings momentum resumes and compounds. | Multiple sustains or modestly expands as growth visibility improves; dividend grows from a healthy cash base. | Stronger like‑for‑like trends, steady pricing power, and sustained cash conversion supporting reinvestment. |

| Base | Steady but uneven growth with resilient profitability; selective investments drive gradual share gains. | Multiple largely holds near current levels; returns track fundamentals with the dividend providing carry. | Stable margins, controlled promotions, and balanced capital allocation without leverage creep. |

| Worse | Demand softens in key channels; promotional intensity rises; earnings remain pressured versus prior peaks. | De‑rating as growth disappoints; focus shifts to capital preservation and efficiency. | Weak sell‑out data, slower innovation cycles, FX or input cost headwinds overwhelming pricing. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Top‑line momentum relative to expectations, particularly the cadence of revenue growth versus recent 1.60% quarterly growth.

- Margin trajectory and discipline around promotions and mix, given a 21.09% operating margin baseline.

- Cash generation and capital allocation, including sustainability of a 1.74% dividend yield and payout at 61.30%.

- Currency movements and macro sensitivity in beauty demand across key regions and travel retail.

- Competitive dynamics and innovation cycle strength across core franchises and channels.

Conclusion

L’Oréal combines scale, brand depth, and cash generation with a valuation that presumes consistent execution. Today’s metrics show durable economics (21.09% operating margin, 20.16% ROE, strong OCF and FCF) but also slower momentum (1.60% quarterly revenue growth; earnings growth down year over year). Over the next three years, the stock’s path likely mirrors the balance between innovation‑led demand and promotion‑driven share defense. If mix and pricing support steady improvement while cash continues to fund growth and dividends without straining a modestly levered balance sheet, the premium multiple can be maintained. Should demand or margins falter, a de‑rating is plausible from P/E and EV/EBITDA levels already implying confidence. With shares near the top of their 52‑week range and above key moving averages, near‑term sentiment leans constructive, but the burden of proof remains on re‑accelerating earnings.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.