Lucid Group (LCID) enters the next three years under intense scrutiny. The EV maker reverse‑split its stock 1:10 on September 2, 2025 to maintain Nasdaq compliance amid a volatile tape; the shares last closed around 22.53, well below the 52‑week high of 37.30 and down 34.97% over the year. Fundamentally, scale remains the hurdle: trailing‑twelve‑month revenue stands at about 0.93B, while margins are deeply negative (profit margin −247.07%, operating margin −309.54%). Liquidity is meaningful with 2.83B in cash against 2.74B of debt and a 2.58 current ratio, but operating cash flow of −2.25B underscores the path to self‑funding is not yet secure. Headlines point to a pivot toward affordability (a confirmed new $50,000 EV and cheaper trims, including Gravity) and ongoing debate around short‑squeeze potential. Our outlook weighs execution, capital needs, and competition.

Key Points as of September 2025

- Revenue: TTM revenue ~0.93B; quarterly revenue growth (yoy) 29.30%.

- Profit/Margins: Profit margin −247.07%; operating margin −309.54%; gross profit −0.92B; EBITDA −2.63B; net income −3.06B; diluted EPS −11.30.

- Liquidity/Leverage: Total cash 2.83B; total debt 2.74B; current ratio 2.58; total debt/equity 64.16%.

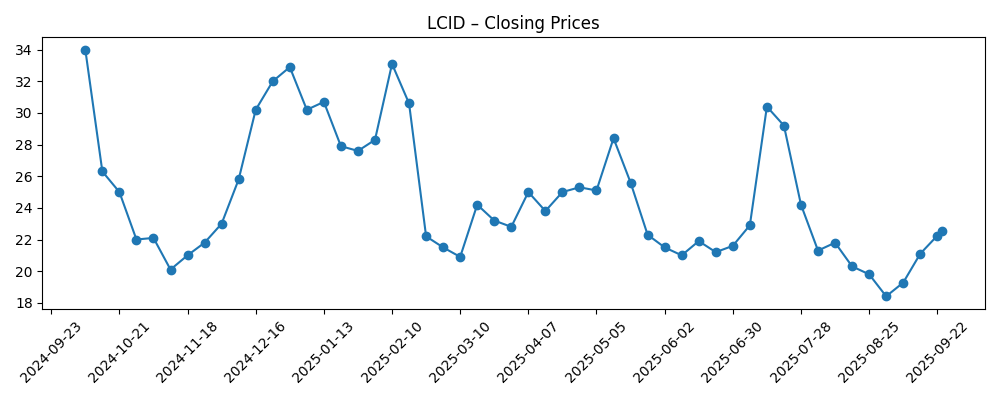

- Share price: Last weekly close 22.53 (9/24/2025); 52‑week range 15.25–37.30; 52‑week change −34.97% vs S&P 500 +16.33%; 50‑day MA 22.60; 200‑day MA 24.66; beta 0.79.

- Sales/Backlog: No disclosed backlog; revenue per share 3.30; product roadmap emphasizes affordability (Gravity, and a confirmed new ~$50,000 model).

- Analyst view: Stifel lowered LCID price target to $2.10 and reiterated Hold; commentary also highlights elevated short‑squeeze speculation.

- Market cap/ownership: Shares outstanding 307.3M; float 125.36M; institutions hold 74.51%; insiders hold 1.52%.

- Short interest: 38.41M shares short (8/29/2025); short ratio 4.56; short % of float 45.89%; short % of shares outstanding 12.50%.

Share price evolution – last 12 months

Notable headlines

- Touted As The Tesla-Killer, Lucid Scrambles to Stay On The NASDAQ (Gizmodo)

- Uber Investment and Reverse Split Drive Lucid’s Price Target Upward (Yahoo Entertainment)

- Lucid confirms a new $50,000 EV is coming (Electrek)

- Lucid’s EVs are about to get more affordable, starting with the Gravity SUV (Electrek)

- Lucid is bringing a new $50,000 EV overseas (Electrek)

- Lucid gets past its reverse split selloff: Can LCID still go higher? (Barchart)

- Why LCID speculators are sounding the short‑squeeze alarm (Barchart)

- Stifel lowers LCID price target to $2.10, reiterates Hold (Biztoc)

Opinion

Lucid’s reverse split was a pragmatic move to preserve Nasdaq listing and buy time. Splits do not change intrinsic value, but they can alter trading dynamics by reducing the share count per price tier and, in this case, keeping the quote above compliance levels. With the stock down 34.97% over 12 months and the 50‑day average now near the last close, the technical setup can swing on headlines and positioning. Short interest is elevated (45.89% of float as of 8/29/2025), which means rallies can overshoot as shorts cover, while disappointments can accelerate declines. In our view, sentiment will hinge less on the split and more on tangible signs of operating leverage. The market will look for consistent deliveries, stable order intake, and credible unit‑cost reductions that begin to pull gross profit toward breakeven.

The bigger strategic signal is affordability. Electrek reports confirm a new ~$50,000 model and lower‑priced trims, including the Gravity SUV, with commentary about taking the concept overseas. That approach broadens the addressable market and could improve factory utilization—key for a company with negative gross profit and EBITDA. The trade‑off is near‑term margin pressure if price cuts outpace cost reductions. To navigate this, Lucid must execute a disciplined cost‑down roadmap (materials, manufacturing, and warranty), while maintaining the brand’s premium technology narrative. If the new model brings in incremental buyers without cannibalizing higher‑margin variants, mix could support margin recovery over time. Conversely, if affordability tactics devolve into discounting without scale, the financials may remain stressed.

Capital remains a swing factor. With 2.83B in cash and 2.74B in debt, plus a current ratio of 2.58, liquidity looks adequate for near‑term operations, but operating cash flow at −2.25B (ttm) shows why external funding or significant loss reduction may still be needed within the investment horizon. Headlines referencing potential strategic interest—from rideshare to distribution—could become catalysts if they come with capital or guaranteed volumes. Even absent a marquee partner, incremental steps like supplier re‑pricing, platform reuse, and a tighter options list can improve cash burn. Investors should watch the cadence of product launches, factory throughput, and service network expansion; each can move working capital and confidence. Any equity raise, convert issuance, or asset‑backed facility would likely be read as either a stabilizer or dilution risk, depending on terms.

Over a 2025–2028 window, the path bifurcates. A constructive case pairs the affordability push with steady demand, credible cost downs, and maturing production quality, allowing gross margins to climb toward positive territory and cash burn to narrow. That narrative would likely pull the share price toward the 200‑day trend and beyond, especially if high short interest fuels momentum. The downside case is a competitive squeeze—from entrenched luxury brands and aggressive pricing by mass‑market EVs—that blunts volumes and forces recurring capital raises. In that scenario, valuation would remain tethered to cash and optionality, and volatility could persist. Our base view: execution progress is plausible, but proof points must arrive sequentially—product launch, cost curve, and service scale—before the market assigns a more durable multiple.

What could happen in three years? (horizon September 2025+3)

| Scenario | Operations | Profitability | Capital | Stock implications |

|---|---|---|---|---|

| Best | Affordability lineup launches on time; overseas rollout gains traction; production yields and service quality improve. | Gross margin turns positive; operating losses narrow materially as scale and cost‑downs take hold. | Access to capital improves via strategic investment or favorable debt; reduced need for dilution. | Multiple expands as confidence builds; high short interest amplifies upside on positive catalysts. |

| Base | Staged launches with occasional delays; steady but uneven demand; incremental manufacturing improvements. | Gross margin trends upward but remains mixed; operating losses persist yet decline year over year. | Periodic funding as needed, balanced between equity and credit; manageable terms. | Range‑bound with bursts of volatility around newsflow; tracks execution milestones and broader EV sentiment. |

| Worse | Launch slips and competitive pricing undercut volumes; quality issues slow scale‑up. | Margins remain negative; cash burn elevated; restructuring risks rise. | Costly or dilutive capital raises; tighter liquidity conditions. | Prolonged weakness and high volatility; downside supported mainly by cash on hand and option value. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on the affordability roadmap (new ~$50,000 model and Gravity trims) and its impact on demand and mix.

- Progress toward positive gross margin and reduced operating losses from cost‑down initiatives and scale.

- Capital access and terms for any equity, convertible, or debt financing; potential strategic partnerships.

- Competitive pricing and product launches from luxury and mass‑market EV rivals in core geographies.

- Short‑interest dynamics and technicals (50‑/200‑day averages) that can amplify moves on news.

Conclusion

Lucid is trying to thread a narrow path: preserve brand equity while making vehicles meaningfully more attainable. The financial snapshot shows both the opportunity and the strain—revenue is growing, yet margins and cash flow remain deeply negative. The reverse split keeps LCID compliant and tradable, but the equity story ultimately rests on execution: delivering the promised lower‑priced EV, improving Gravity’s economics, and driving factory utilization high enough to bend unit costs down. With 2.83B in cash and visible access to capital markets, management has room to operate, though not indefinitely. Over the next three years, we think the base case is a gradual improvement in unit economics and a volatile, news‑driven stock. Upside requires on‑time launches and credible cost reductions; downside stems from competitive price pressure and funding risks. Investors should track delivery cadence, gross margin trajectory, and any strategic capital developments.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.