LVMH (MC.PA) enters late‑2025 after a reset in luxury demand. Over the last year, the stock fell 18.98% and trades near 492 (Sep 9, 2025), below its 200‑day moving average of 558.43 but close to the 50‑day at 481.76. Despite softer momentum—TTM revenue of 82.82B with quarterly revenue growth -4.50% and quarterly earnings growth -21.60%—profitability remains robust (13.26% net margin; 22.58% operating margin) and cash generation strong (TTM operating cash flow 19.52B; levered free cash flow 13.22B). Valuation sits at 22.55x trailing P/E and 20.24x forward, supported by a 2.62% forward dividend yield and 59.09% payout ratio. Recent headlines include an HSBC upgrade and signs of improving luxury sentiment, while brand initiatives such as Louis Vuitton’s high‑end beauty releases aim to deepen customer engagement for the next cycle.

Key Points as of September 2025

- Revenue scale: Revenue (ttm) 82.82B; Gross profit (ttm) 54.68B.

- Profit/margins: Profit margin 13.26%; Operating margin 22.58%; ROE 16.96%; ROA 7.83%.

- Sales trend: Quarterly revenue growth (yoy) -4.50%; Quarterly earnings growth (yoy) -21.60%.

- Share price: 492.00 on 2025‑09‑09; 52‑week change -18.98%; range 762.70–436.55; 50‑DMA 481.76; 200‑DMA 558.43.

- Valuation snapshot: Trailing P/E 22.55; Forward P/E 20.24; PEG (5yr) 3.07; EV/EBITDA 10.72; EV/Revenue 3.31; Price/Sales 2.99; Price/Book 3.77.

- Balance sheet & liquidity: Cash 12.33B; Debt 39.71B; Debt/Equity 59.37%; Current ratio 1.48; Beta 0.99.

- Cash generation: Operating cash flow (ttm) 19.52B; Levered free cash flow 13.22B.

- Market cap & income: Market cap 246.45B; Forward dividend yield 2.62% (rate 13.00; payout 59.09%); Ex‑dividend date 12/2/2025.

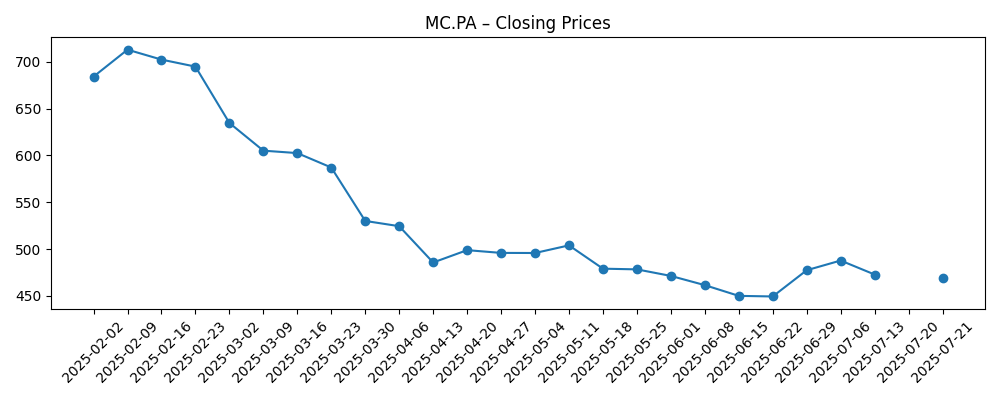

Share price evolution – last 12 months

Notable headlines

- LVMH-Moet Hennessy Louis Vuitton (OTCMKTS:LVMUY) Upgraded at HSBC Global Research

- LVMH-Moet Hennessy Louis Vuitton SA (OTCMKTS:LVMUY) Given Consensus Recommendation of “Buy” by Brokerages

- LVMH: Share transactions disclosure

- Why Louis Vuitton's $160 lipstick is a 'strategic play' in luxury beauty

- HSBC Sees Light at the End of Tunnel for Beleaguered Luxury Sector

Opinion

The past six months read like a reset. MC.PA slid from early‑year strength to a June low near 449.95 (week of Jun 15) before stabilizing and grinding higher toward 504.10 (week of Aug 24), then settling around 492 on Sep 9. That pattern aligns with slowing fundamentals—quarterly revenue down -4.50% and earnings down -21.60% year over year—meeting still‑premium expectations (PEG 3.07). The 200‑day moving average at 558.43 remains a ceiling for now, but the 50‑day at 481.76 offers a nearby reference for accumulating long‑term positions if sentiment continues to mend. With beta at 0.99, LVMH has tracked broader markets more than it typically does late in cycles, suggesting macro drivers (rates, travel, FX) are as important as brand news in setting the near‑term path.

On the positive side, HSBC’s upgrade and improving sector tone hint that the destocking and China softness that pressured luxury in early 2025 may be closer to the end than the beginning. Beauty’s appeal is notable: Louis Vuitton’s high‑end lipstick underscores a strategy to widen the client funnel and monetize brand heat through margin‑friendly categories. This complements the group’s strength in leather goods and selective retail, potentially smoothing growth across cycles. If demand normalization emerges into year‑end, investors could refocus on structural advantages—global scale, pricing power, and a balanced maisons portfolio—rather than quarter‑to‑quarter volatility.

Valuation looks reasonable against quality. A 22.55x trailing and 20.24x forward P/E for a company with 22.58% operating margin, 16.96% ROE, and 19.52B in operating cash flow remains defensible if growth stabilizes. The 2.62% forward dividend yield with a 59.09% payout provides carry while waiting for revenue re‑acceleration. The recent share‑transactions disclosure reminds that capital moves are under active stewardship, though investors should read the filing for specifics. Balance‑sheet flexibility (12.33B cash vs 39.71B debt; current ratio 1.48) limits downside risk to long‑term brand investment, a key differentiator when peers pull back on marketing or capex.

Still, the path is not linear. A PEG of 3.07 implies little tolerance for prolonged negative growth prints, and the 52‑week range of 762.70–436.55 shows how quickly sentiment can swing. If China travel, U.S. aspirational demand, or FX headwinds persist, shares may remain capped under the 200‑day average until comps ease. Conversely, sustained traction in beauty, leather goods innovation cycles, and a steadier macro could draw multiples back toward sector highs. In a three‑year view, the bull case rests on brand equity compounding and cash conversion; the bear case hinges on a deeper demand downdraft or prolonged discounting. The base case is a gradual rebuild as macro noise fades.

What could happen in three years? (horizon September 2025+3)

| Scenario | Revenue/margins direction | Valuation narrative | Share price tendency | Signals to monitor |

|---|---|---|---|---|

| Best | Luxury demand re‑accelerates; leather goods and beauty lead; operating margin sustained at a high level. | Quality premium widens as growth resumes; multiple expands versus current averages. | Trend improves with higher highs and higher lows; trades above long‑term moving averages. | Stronger China travel, robust H2 trading updates, pricing power without volume erosion. |

| Base | Growth normalizes from a soft patch; margins hold broadly steady on mix and cost control. | Multiple ranges near historical mid‑cycle as confidence slowly rebuilds. | Sideways to modestly upward, anchored by dividend support and buy‑on‑weakness flows. | Stable like‑for‑like sales, inventory discipline, steady FX, consistent marketing intensity. |

| Worse | Prolonged demand slowdown; discounting creeps in; margin pressure from operating deleverage. | De‑rating toward value territory until visibility improves. | Retests lower end of the 52‑week range; struggles below long‑term averages. | Weak China/U.S. demand, tourist flows lag, adverse FX, heightened competitive promotions. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- China and travel‑retail recovery trajectory, including visa policies and airline capacity.

- Category mix shifts (beauty and leather goods) and pricing power without volume trade‑offs.

- FX movements versus the euro and U.S. dollar, affecting reported growth and margins.

- Inventory discipline across maisons and wholesale partners, impacting sell‑through quality.

- Capital allocation (dividends, potential buybacks, M&A) and any further share‑transaction disclosures.

- Macro rates and consumer confidence, especially among aspirational buyers.

Conclusion

LVMH’s three‑year setup balances exceptional brand equity and cash generation against a near‑term growth reset. The data show a temporary soft patch—quarterly revenue and earnings contracting year over year—yet margins, returns, and liquidity remain solid. With a 22.55x trailing and 20.24x forward P/E, valuation assumes normalization rather than acceleration, leaving scope for upside if demand turns sooner or beauty deepens penetration. The dividend yield of 2.62% offers carry while waiting for clearer inflection. Headlines point to improving sentiment (HSBC upgrade) and targeted brand actions (high‑end beauty), both supportive into the next cycle. Risks center on China/U.S. demand, FX, and promotional intensity; these could cap the multiple if they linger. On balance, the base case is a gradual rebuild in confidence and earnings through better mix, pricing, and operational discipline, with the brand portfolio providing resilience across macro regimes.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.