MercadoLibre enters the next three years with momentum in both commerce and fintech: trailing‑12‑month revenue stands at 26.19B and the most recent quarter showed 39.5% year‑over‑year revenue growth. The mix has tilted toward higher‑margin services such as payments, advertising and credit, while logistics density supports faster delivery and higher conversion. Yet earnings have lagged revenue as the company continues to invest and to manage funding costs and credit provisioning, and free cash flow has been pressured by scale‑up needs. The share price rallied mid‑year and then cooled as investors reassessed the balance between growth and profitability. In Latin America, e‑commerce and digital payments penetration still have room to rise, but the macro backdrop is volatile and foreign exchange (FX) swings can quickly move results. Because MercadoLibre straddles two secular growth curves—online retail and fintech—the next stage depends on disciplined underwriting, cost control, and steady monetization gains rather than raw volume alone. That is why the quality of growth will likely set the narrative.

Key Points as of November 2025

- Revenue: ttm revenue 26.19B; quarterly revenue growth (yoy) 39.5% underscores continued scale in commerce and fintech.

- Profit/Margins: profit margin 7.93% and operating margin 9.77% reflect reinvestment and credit/funding costs alongside operating leverage.

- Sales/Backlog: GMV/backlog details not disclosed; demand appears supported by payments adoption and logistics improvements.

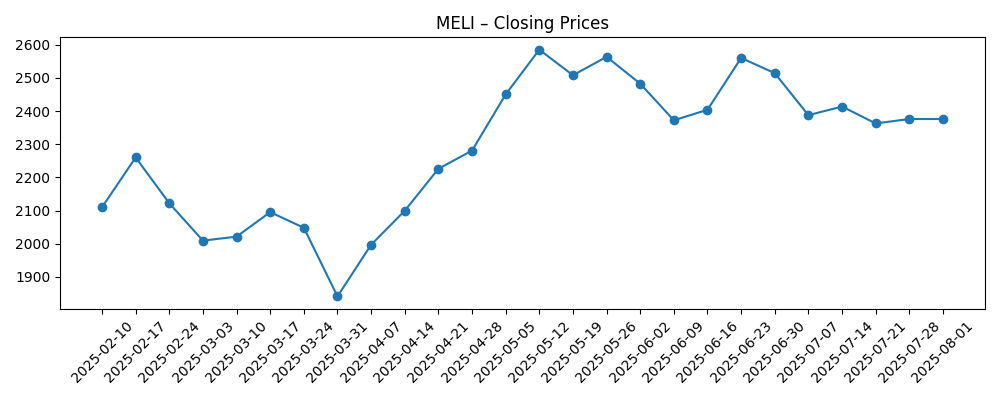

- Share price: 52‑week high 2,645.22; low 1,646.00; last weekly close provided 2,327.26 (10/31). Up 12.77% over 52 weeks vs S&P 500 at 19.74%. 50‑day MA 2,309.70; 200‑day MA 2,258.51.

- Analyst view: ratings not provided; debate likely centers on sustaining growth while improving free cash flow and credit performance.

- Market cap: not disclosed in provided data; shares outstanding 50.7M.

- Balance sheet: total cash 6.3B vs total debt 9.88B; current ratio 1.17 highlights the need for disciplined funding.

- Cash flow: operating cash flow 9.83B; levered free cash flow −1.84B indicates growth investment and financing costs.

- Qualitative: competitive position benefits from network effects across marketplace, payments and logistics; FX mix and regulation remain material variables.

Share price evolution – last 12 months

Notable headlines

Opinion

Top‑line growth remains the headline. With 26.19B in trailing revenue and 39.5% year‑over‑year quarterly growth, MercadoLibre is executing on two reinforcing flywheels: marketplace density and a broadening fintech stack. The quality of revenue appears to be improving as services scale, but the income statement still shows the cost of building and funding credit, densifying logistics, and expanding seller services. The result is a profit margin in the high single digits and operating margin below 10%, which investors tend to tolerate when the growth curve is steep. The key question is not demand—Latin American digitization continues—but the sustainability of growth at attractive returns without over‑reliance on credit expansion.

Earnings growth trailing revenue growth suggests mix and funding dynamics at work. A 7.93% profit margin alongside robust operating cash generation but negative levered free cash flow points to heavy investment and interest/financing outflows. The return on equity of 40.65% is eye‑catching; leverage contributes, so the durability of that ROE hinges on credit quality and the cost of capital. If underwriting remains disciplined and take rates hold, incremental margins can expand as logistics and technology costs spread over a larger base. Conversely, if credit losses or funding costs rise, operating gains could be absorbed by provisions and interest expense.

Within the sector, MercadoLibre’s integrated model still offers advantages: first‑party logistics can defend delivery speed; payments acceptance deepens buyer/seller attachment; and advertising can lift margin without increasing fulfillment intensity. Competitive pressure—from global e‑commerce platforms, local retailers scaling omnichannel, and banks/fintechs—limits pricing power in core commerce but supports monetization via value‑added services. Regulation around payments, consumer credit and data privacy is tightening, which can raise compliance costs but also erects barriers to entry, potentially favoring scaled incumbents.

Valuation will likely track the narrative shift from “grow at all costs” to “grow with cash discipline.” Should revenue growth remain high while levered free cash flow turns positive, the market could reward MELI with a resilient premium multiple despite macro volatility. If credit costs spike or FX turns sharply adverse, investors may refocus on balance‑sheet risk and compress the multiple. The stock’s 1.46 beta implies swings around macro headlines; clear progress on underwriting, funding mix, and operating leverage would help dampen that volatility and support a steadier re‑rating path.

What could happen in three years? (horizon November 2028)

| Scenario | Narrative |

|---|---|

| Best | Commerce, payments, and ads compound with disciplined credit underwriting. Funding costs ease with a stronger balance sheet and improved funding mix. Operating leverage from logistics/tech lowers unit costs, and free cash flow turns sustainably positive. MELI is viewed as a durable platform with multiple high‑margin levers. |

| Base | Growth moderates but remains above sector averages. Credit performance is managed through tighter scorecards and pricing, offsetting funding costs. Margins inch higher as services scale, while FX and regulatory changes create periodic noise. The equity narrative centers on steady execution, not step‑changes. |

| Worse | Macro and FX shocks hit consumer demand and credit quality. Provisioning and funding costs rise faster than take‑rate and ad gains. Regulatory shifts cap some fintech economics. Investment needs keep levered free cash flow negative, and the multiple compresses toward a risk‑aware stance. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Credit cycle and underwriting outcomes in consumer/merchant lending (loss rates vs. take‑rate and funding costs).

- FX volatility across core markets and its translation effect on reported growth and margins.

- Execution in logistics density, seller services and ads, driving operating leverage.

- Competitive intensity from global platforms, local retailers, and banks/fintechs, affecting pricing power.

- Regulatory developments in payments, lending, and data privacy across key countries.

- Access to and cost of capital, including refinancing terms relative to growth investment needs.

Conclusion

MercadoLibre’s setup into the next three years is a classic growth‑at‑scale trade‑off: strong top‑line expansion supported by integrated commerce and fintech, offset by the need to fund credit and logistics while navigating FX and regulation. The numbers point to a business with high returns on equity and solid operating cash generation, yet with levered free cash flow still constrained by financing and investment needs. In a sector where penetration remains structurally underdeveloped, execution on underwriting discipline and monetization can pivot the story from “volume” to “quality of growth.” Watch next 1–2 quarters: credit losses vs. pricing; take‑rate and advertising traction; operating leverage in fulfillment; FX translation effects; funding‑mix and interest expense. If MELI can maintain growth while steadily lifting free cash flow and margins, the equity narrative can shift toward durability despite macro noise; if not, valuation sensitivity to credit and FX will remain elevated.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.