Mitsubishi UFJ Financial Group (8306.T) enters the next three years with a stronger share price, robust balance sheet, and a cautious earnings tone. As of August 2025, the stock trades near its 52‑week high after a 52.89% gain, supported by a forward dividend of ¥70 (3.06% yield) and a low 0.24 beta. The June quarter showed a 1.8% year‑on‑year profit decline, yet management maintained a record full‑year forecast, underscoring confidence in core momentum. Debate on Bank of Japan rate normalization – including MUFG’s call for an earlier hike – could lift margins while raising mark‑to‑market risks. Internationally, MUFG is exploring a $22B financing for a Texas AI‑driven data hub, highlighting selective growth beyond Japan. This note outlines key facts, scenarios, and catalysts shaping MUFG’s 2025–2028 outlook.

Key Points as of August 2025

- Revenue and earnings: Revenue (ttm) ¥5.44T; Net income (ttm) ¥1.26T; Profit margin 23.10%; Operating margin 38.26%.

- Balance sheet and liquidity: Total cash (mrq) ¥151.08T vs total debt ¥105.84T; book value per share ¥1,752.92.

- Sales/Backlog proxy: Exploring a $22B financing for a Texas AI‑driven data hub alongside JPMorgan, indicating a healthy project finance pipeline.

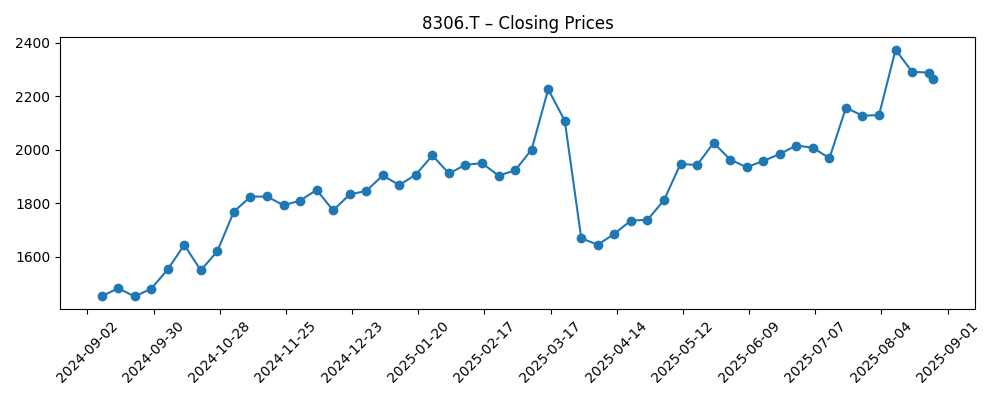

- Share price: Last close ¥2,265.5; 52‑week change +52.89%; 52‑week high ¥2,374.50; 50‑day MA ¥2,060.38; 200‑day MA ¥1,924.05; beta 0.24.

- Dividend: Forward annual dividend ¥70 (3.06% yield); payout ratio 40.12%; next ex‑dividend date 29 Sep 2025.

- Returns: ROE 5.94%; ROA 0.31% (ttm), reflecting a conservative risk posture for a megabank.

- Market cap: Approximately ¥25.8T based on ¥2,265.5 share price and 11.38B shares outstanding.

- Investor/analyst signals: Media noted an upgrade at Wall Street Zen; institutional interest cited by incremental holdings.

- Trading depth: Average 3‑month volume 41.09M shares; 10‑day average 53.71M, supporting liquidity.

Share price evolution – last 12 months

Notable headlines

- MUFG Chief Calls for Earlier BOJ Rate Hike to Tackle Inflation (Yahoo)

- JPMorgan and MUFG eye $22B loan for Texas AI‑driven data hub (Yahoo)

- Japan's MUFG books 1.8% fall in Q1 profit, maintains record full‑year forecast (CNA)

- Mitsubishi UFJ Financial Group upgraded at Wall Street Zen (ETF Daily News)

- American Century Companies Inc. boosts holdings in MUFG (ETF Daily News)

Opinion

MUFG’s public call for earlier Bank of Japan rate hikes signals management’s view that modest normalization would be net positive for bank earnings. Higher short‑ and long‑term rates generally widen asset yields faster than deposit costs in Japan’s still‑sticky funding base, supporting net interest margins. However, a faster path also elevates risks: valuation losses on yen securities portfolios, potential funding repricing on wholesale liabilities, and slower loan demand from rate‑sensitive borrowers. MUFG’s low beta and diversified income streams should cushion volatility, but execution on interest‑rate risk management and hedging will be critical. The message for investors is straightforward: rate normalization can be a tailwind, yet the slope and communication of BoJ policy will determine whether the benefit shows up in earnings before market‑to‑market noise.

The contemplated $22B financing for a Texas AI‑driven data hub illustrates MUFG’s selective growth outside Japan. These large, structured deals can add fee income, anchor client relationships, and position MUFG in infrastructure supporting secular compute and data trends. Co‑arranging with a top‑tier peer may help balance underwriting risk and capital consumption. The flip side is concentration risk, elongated due‑diligence cycles, and cyclicality if capex plans cool. For the 2025–2028 horizon, a measured pace of cross‑border project finance and corporate lending could lift non‑interest income while keeping risk‑weighted assets disciplined. Investors should watch closing certainty, sell‑down progress, and fee visibility from mandates like this to judge whether growth is accretive without stretching capital or credit standards.

June‑quarter profit dipped 1.8% year on year, but management maintained a record full‑year forecast, which suggests confidence in core banking momentum and expense control. Against a trailing 23.10% profit margin and 38.26% operating margin, MUFG appears focused on mix improvement rather than volume‑at‑any‑price. The forward dividend of ¥70 and a 40.12% payout ratio indicate scope to keep distributions resilient through the cycle, as long as credit costs and securities marks remain manageable. With ROE at 5.94% and book value per share at ¥1,752.92, incremental improvements in margin and fee mix can compound shareholder value even if credit growth is steady rather than explosive. The near‑term test is delivering on the full‑year target while navigating rate volatility and maintaining cost discipline.

The share price has rerated toward the 52‑week high (¥2,374.50), supported by improving sentiment, higher trading liquidity, and incremental institutional interest. Technically, support from the 50‑day and 200‑day moving averages suggests buyers remain engaged, though a consolidation phase would be unsurprising after a 52.89% year‑on‑year move. For long‑horizon holders, MUFG’s low beta, solid cash position (¥151.08T), and consistent dividend create a defensive‑growth profile. The key debate through 2028 is whether domestic rate normalization and selective overseas growth can lift returns without materially elevating credit or market risk. Progress on that balance, more than any single headline, is likely to dictate whether the stock grinds higher, tracks sideways while compounding via dividends, or gives back some gains if macro winds shift.

What could happen in three years? (horizon August 2025+3)

| Scenario | Operating backdrop | Strategic moves | What investors might see |

|---|---|---|---|

| Best | Orderly BoJ normalization lifts margins; credit stays benign; global activity supports fee income. | Disciplined expansion in project finance and cross‑border lending; steady cost control; dividend maintained and signaled higher stability. | Improved profitability and return profile; sustained demand from domestic and global investors; stock holds gains with lower volatility. |

| Base | Gradual rates and mixed growth; episodic market volatility but manageable. | Selective dealmaking; moderate balance‑sheet growth; continued focus on risk management and technology efficiency. | Sideways‑to‑modest appreciation as earnings progress offsets macro noise; dividends provide a meaningful portion of total return. |

| Worse | Sharp rate or credit shock; mark‑to‑market losses on securities; slower loan demand. | De‑risking of portfolios; slower originations; heightened provisioning and expense restraint. | Multiple compression and drawdown toward book‑value anchors; preservation of capital takes priority over growth. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- BoJ policy path and communications around rate normalization, affecting margins and securities valuations.

- Credit quality trends across Japan, the U.S., and Asia, including corporate and project finance exposures.

- Market risk from yen rate moves and AFS/HTM portfolio marks, plus effectiveness of duration hedging.

- Execution on large cross‑border financings (mandate wins, sell‑downs, and fee realization).

- Capital and dividend policy decisions, including the pace and sustainability of the ¥70 forward dividend.

- Regulatory developments and macro growth in key end‑markets that drive loan demand and fee pools.

Conclusion

MUFG enters 2025–2028 with favorable technicals, a sturdy balance sheet, and tangible catalysts. The stock’s advance toward its 52‑week high, alongside a low beta and a forward yield of 3.06%, reflects investor confidence in a durable earnings mix and disciplined risk. The investment case hinges on two levers: domestic rate normalization that can expand margins, and selective overseas growth that lifts fee income without stretching capital. Management’s willingness to maintain a record full‑year forecast despite a mild Q1 profit dip underscores conviction, but it also raises the execution bar amid potential rate volatility and credit normalization. If MUFG continues to pair cautious growth with tight risk management, shareholders could see steady total returns dominated by dividends and incremental earnings gains; conversely, a sharp macro shock would likely direct focus toward capital preservation and book‑value resilience.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.