As of October 2025, NVIDIA enters the next phase of its AI cycle with record-scale financials: trailing 12‑month revenue of 165.22B, a 52.41% profit margin and 60.84% operating margin. Net income is 86.6B, supported by 77.04B in operating cash flow, 56.79B in cash and just 10.6B in total debt (current ratio 4.21). Shares trade near the top of their 52‑week range of 86.62–191.05, with a recent weekly close around 186.70, a 50‑day average of 178.34 and a 200‑day average of 143.33; beta is 2.12. Quarterly revenue growth stands at 55.60% year over year. Offsetting strengths are China-related headline risks (reported bans and competition findings) and supplier concentration at TSMC, even as headlines point to a potential Intel foundry “bet.” With a minimal dividend (0.02% yield) and a 10‑for‑1 split in 2024, the stock’s three‑year path hinges on sustaining AI demand while navigating geopolitics and execution.

Key Points as of October 2025

- Revenue: Trailing 12‑month revenue of 165.22B; most recent quarter showed 55.60% year‑over‑year revenue growth.

- Profit/Margins: Profit margin 52.41%; operating margin (ttm) 60.84%.

- Earnings: Net income (ttm) 86.6B; diluted EPS (ttm) 3.51.

- Cash & Balance Sheet: Total cash 56.79B vs. total debt 10.6B; current ratio 4.21; debt/equity 10.58%.

- Cash Generation: Operating cash flow 77.04B; levered free cash flow 52.44B.

- Share price: 52‑week range 86.62–191.05; recent weekly close near 186.70; 50‑day MA 178.34; 200‑day MA 143.33; beta 2.12; 52‑week change 39.62% vs. S&P 500 17.20%.

- Analyst view: Not provided here; debate centers on durability of data‑center growth vs. normalization and regulatory risk; short interest 217.49M shares (0.89% of outstanding) as of 9/15/2025.

- Capital returns: Dividend yield 0.02% (annual rate 0.04; payout ratio 1.14%); last split 10:1 on 6/10/2024; ex‑dividend 9/11/2025.

- Market cap: Among the world’s largest by value; shares outstanding 24.35B; float 23.33B; insiders hold 4.33%, institutions 68.95%.

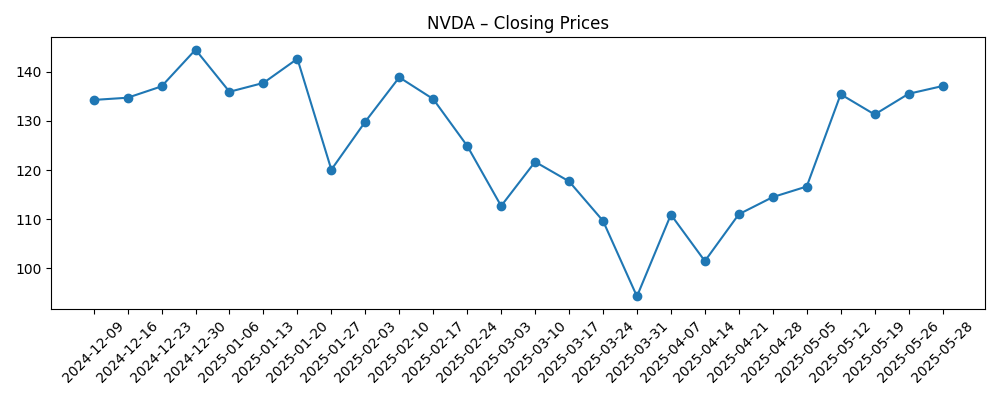

Share price evolution – last 12 months

Notable headlines

- Nvidia CEO Jensen Huang Says 'You Can’t Overstate the Magic' That is Taiwan Semiconductor

- China Bans Top Tech Firms From Buying Nvidia Chips, Report Says

- Nvidia Slips as China Says It Broke Competition Rules

- Stock market today: ... Nvidia's Intel bet lift markets

- This Nvidia Challenger Just Issued a Big AI Warning in China. What Should You Do With NVDA Stock Here?

Opinion

China remains the swing factor in the near term. Reports that top Chinese tech firms face bans on buying certain NVIDIA chips, alongside a claim that the company broke competition rules, underline a regulatory overhang that could interrupt shipments, force product re‑bins or delay approvals. While NVIDIA’s growth is presently driven by ex‑China demand, the headlines can weigh on sentiment and complicate channel planning. Over three years, downside risk stems less from a one‑time revenue interruption and more from sustained restrictions that shift share toward local or alternative suppliers. The company’s strong profitability (52.41% profit margin) and cash generation (77.04B OCF; 52.44B FCF) give it room to adjust offerings and support customers, but the opportunity cost of reduced access to a large market is real and may increase reliance on the rest‑of‑world data‑center cycle for incremental growth.

Supply chain concentration is the second lever. CEO Jensen Huang’s public praise of TSMC highlights the foundry’s critical role. At the same time, headlines about an “Intel bet” suggest NVIDIA continues to evaluate secondary sources for leading‑edge capacity. Multi‑sourcing could prove a strategic hedge, reducing geopolitical concentration risk and improving bargaining power. The trade‑off is execution: migrating advanced GPUs across process nodes and fabs requires tight design, software and packaging alignment. Over a three‑year horizon, even partial diversification would be a catalyst for multiple stability, whereas any hiccup in ramp yields or packaging throughput could elongate lead times. Given 56.79B in cash and modest debt (10.6B), NVIDIA has financial flexibility to co‑invest in capacity and advanced packaging where needed, which helps protect shipment cadence against unexpected shocks.

The stock’s path has showcased high beta dynamics. After notable softness into late Q1–Q2 2025, shares rebounded and now sit near the 52‑week high (191.05) with a recent weekly close around 186.70, well above the 200‑day average of 143.33. With a 39.62% 52‑week gain versus the S&P 500’s 17.20%, expectations are elevated. This positioning amplifies sensitivity to any deceleration from the 55.60% quarterly revenue growth pace or to regulatory headlines. Short interest remains modest (0.89% of outstanding), implying a market that is long‑biased and focused on fundamental delivery rather than a squeeze. Over three years, valuation could remain resilient if margins stay near current levels and demand broadens across inference, networking and software, but volatility is likely to persist given the 2.12 beta and the sector’s cyclical capex patterns.

Competition is intensifying, including from challengers signaling caution in China. While the CUDA software ecosystem and full‑stack approach remain differentiators, rivals and custom silicon efforts by large buyers can pressure pricing, supply allocations and feature roadmaps. NVIDIA’s operating margin (60.84%) and scale provide a buffer to invest through competition—whether in networking, interconnects or software—but the bar for incremental innovation stays high. A prudent three‑year view assumes growth normalizes from hyper‑scale peaks while the company expands its addressable market via new architectures, platforms and services. In this setup, execution—delivering successive product cycles on time, sustaining developer adoption, and managing supply—matters more than any single headline. If NVIDIA threads these needles, it could defend share and premium economics; if not, speed of competitive fast‑followers may compress both growth and the multiple.

What could happen in three years? (horizon October 2025+3)

| Scenario | Three‑year narrative |

|---|---|

| Best | Export restrictions ease at the margin; NVIDIA secures incremental leading‑edge capacity (including supplemental foundry/packaging sources) and ramps successive architectures on time. AI infrastructure spending broadens globally, sustaining high utilization and keeping margins at or above current ttm levels. Shares compound with periodic volatility but outperform sector peers. |

| Base | AI demand normalizes from peak growth; China remains constrained but manageable. NVIDIA maintains leadership in accelerators and networking, with stable margins near current levels and solid cash generation funding capacity and R&D. Shares track earnings growth with swings around macro and product‑cycle news. |

| Worse | Restrictions in China tighten and extend; competitive offerings and custom silicon erode pricing power. Supply chain disruptions or slower ramps at key foundry/packaging partners lead to shipment delays. Margins fall meaningfully below current ttm levels, free cash flow declines, and the stock de‑rates toward sector averages. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory outcomes in China and other export‑controlled markets, including competition rulings and procurement bans.

- Supply chain resilience and diversification across leading‑edge foundry and advanced packaging capacity.

- AI infrastructure demand cadence at hyperscalers and enterprises relative to current growth levels.

- Competitive intensity from rivals and custom silicon, including pricing and product availability.

- Macro conditions and rates affecting risk appetite, valuation multiples and capex budgets.

Conclusion

NVIDIA’s three‑year setup combines rare fundamentals with visible external risks. The company enters the period with 165.22B in trailing revenue, margins above 50%, robust cash generation and a strong balance sheet (56.79B cash vs. 10.6B debt). Shares have outperformed over the past year and sit near their 52‑week high, reflecting confidence in continued AI infrastructure investment. The counterpoints are meaningful: China‑related headlines can disrupt demand visibility, supplier concentration raises execution stakes, and competition is intensifying. Against this backdrop, the most probable path is that growth decelerates but remains healthy, supported by successive product cycles and broader adoption, while margins hold near current levels thanks to scale and full‑stack advantages. If NVIDIA executes on supply diversification and delivery, the stock can track earnings with ongoing volatility; conversely, persistent regulatory pressure or ramp setbacks would likely compress both growth and the multiple.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.