Samsung Electronics (005930.KS) has surged in 2025 as AI infrastructure demand reshapes the memory and foundry cycle. Weekly closes show the stock rising from roughly 55,200 KRW in early April to 89,000 KRW on October 2, near a late‑September peak, and about 50% higher than mid‑October 2024. Momentum accelerated after headlines pointing to collaboration with OpenAI on data center build‑outs in Korea, with investors extrapolating stronger HBM DRAM, advanced packaging, and server SSD orders. On the consumer side, rumors around an XR “Moohan” headset, camera innovations, and OLED supply wins underscore multi‑engine growth potential. This three‑year outlook (2025–2028) weighs how those drivers could translate into earnings durability, capital intensity, and valuation, and what could derail the story, including competition, geopolitics, and execution risk.

Key Points as of October 2025

- Revenue – Recovery appears underway on the memory upcycle and component strength; specific figures are not provided in this snapshot.

- Profit/Margins – Improving DRAM/NAND pricing and richer HBM mix likely support margin expansion, but gains remain cycle‑sensitive.

- Sales/Backlog – AI server demand points to stronger order visibility; formal backlog details are not disclosed here.

- Share price – Closed at 89,000 KRW on 2025‑10‑02; up roughly 60% since early April and about 50% year‑over‑year based on provided weekly closes.

- Analyst view – Sentiment has improved following OpenAI data‑center partnership headlines, with focus on AI leverage across memory and foundry.

- Market cap – Not provided in this data; valuation support stems from the semiconductor upcycle and AI infrastructure narrative.

- Foundry – Competing for advanced AI nodes and packaging; yields and customer wins are the key execution watch‑outs.

- Mobile/Device – XR headset chatter and camera advances aim to bolster premium Galaxy differentiation and ecosystem engagement.

- Capital allocation – Dividend/buyback details are not included here; investors monitor consistency through the cycle.

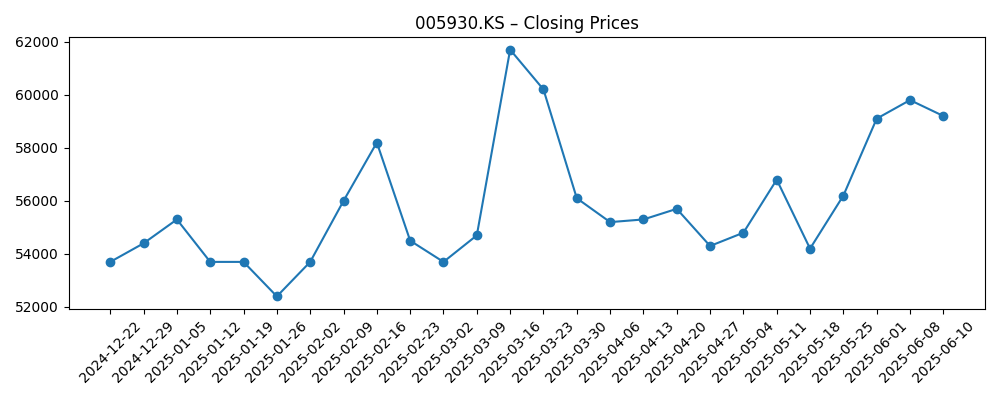

Share price evolution – last 12 months

Notable headlines

- Samsung's XR Moohan headset might launch soon — but US buyers may have to wait (Android Central)

- Samsung Wallet seeks 'premium' crypto with Coinbase One access on Galaxy (Android Central)

- Samsung is working on a continuous zoom camera, but Galaxy phones don’t have first dibs (Android Authority)

- Samsung Electronics, SK Hynix Shares Soar On OpenAI’s Korean Data Center Push (Forbes)

- Samsung, SK Hynix Rally on Partnership With OpenAI for Stargate Project (The Wall Street Journal)

- Samsung partners up with OpenAI to "accelerate advancements in global AI infrastructure" (GSMArena)

- A remarkable Samsung comeback that’s still flying under the radar (SamMobile)

- Samsung’s cutting-edge OLED to power 20th anniversary iPhone (SamMobile)

Opinion

The recent rally has been catalyzed by headlines linking Samsung to OpenAI’s data‑center expansion in Korea. For memory, that strengthens the case for sustained HBM DRAM and high‑capacity SSD demand across 2025–2027, pushing mix toward premium parts where pricing and margins are structurally better. The strategic angle is broader: advanced packaging and foundry engagement around AI accelerators could create multi‑year pathways beyond commodity memory cycles. Yet allocation is competitive—SK Hynix has incumbency in parts of the HBM stack, and hyperscalers often dual‑source. For Samsung, scale and vertical integration are tailwinds, but execution on yield, thermal design, and packaging throughput will determine how much of the incremental AI wallet share it captures. Investors should expect lumpy orders and capex intensity that tests near‑term free cash flow even as medium‑term earnings power improves.

Price action corroborates the narrative. From an early‑April weekly close near 55,200 KRW to 89,000 KRW on October 2, the stock has re‑rated alongside AI‑linked peers, with a late‑September high just shy of that mark. Such a move implies that the market is already discounting a sizable portion of the memory upturn and some foundry optionality. In the next 12–18 months, progress on HBM qualifications, packaging capacity adds, and marquee AI customer wins likely become the main share‑price drivers. Conversely, any delay in AI infrastructure build‑outs or a pause in hyperscaler spending could trigger a consolidation after the sharp run. While the trajectory appears favorable, the velocity may moderate as expectations converge with delivery milestones.

On the consumer front, the XR “Moohan” headset rumors, camera module innovation (continuous zoom), and Samsung Display’s OLED wins for high‑end smartphones diversify the story beyond semis. These vectors can help stabilize earnings in down‑memory years by supporting premium Galaxy ASPs and platform stickiness through services like Samsung Wallet’s Coinbase One access. XR remains a nascent category; the timing, content ecosystem, and regional rollouts—US buyers may need to wait—will shape revenue impact. Camera technology leadership can differentiate flagships even if first deployments land outside Galaxy, reinforcing component monetization across the Android OEM base. Meanwhile, OLED supply to a major competitor underscores Samsung’s role as a critical enabler across the broader handset market, providing counter‑cyclical buffers when device unit growth is uneven.

Over a three‑year horizon, strategic execution will hinge on balancing capex with returns. In foundry, competing at advanced nodes against TSMC requires consistent yield improvements and packaging integration that resonate with AI chip designers. In memory, steering the product mix toward HBM and DDR5 while managing cyclical inventory is vital to sustaining margins. Policy and geopolitics—export controls, cross‑border subsidies, and supply‑chain localization—could reshape cost curves and customer allocation. Capital returns will remain in focus; while specifics aren’t in this snapshot, predictability through cycles typically supports valuation. Net‑net, Samsung’s multi‑engine model—memory, foundry, and devices—positions it to participate in AI infrastructure growth while leveraging component leadership in consumer markets. Delivery on AI‑linked milestones would validate the premium narrative; missed steps could compress multiples swiftly.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative by October 2028 |

|---|---|

| Best | Samsung secures major AI customer wins across HBM, advanced packaging, and select foundry nodes. Memory mix shifts durably to premium parts with stable pricing; devices benefit from XR and camera leadership. Cash generation supports disciplined capex and steady capital returns; valuation reflects sustained ROIC improvement and confidence in AI exposure. |

| Base | AI demand remains strong but competitive; Samsung captures a meaningful, shared slice of HBM and packaging while ramping a few foundry programs. Mobile holds share with incremental innovation. Earnings are cyclical but trend upward; valuation normalizes as milestones are delivered with occasional delays. |

| Worse | HBM/packaging ramps face yield or qualification setbacks; AI build‑outs slow or consolidate to rivals. Foundry win rate lags; XR traction is limited. Elevated capex and pricing pressure compress margins, prompting multiple derating until execution improves and inventory normalizes. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- HBM DRAM qualifications, yields, and capacity additions relative to AI demand.

- Foundry customer wins at advanced nodes and progress in advanced packaging.

- Hyperscaler capex cycles and timing of AI data‑center build‑outs in Korea and abroad.

- Premium mobile momentum: XR launch cadence, camera innovation deployment, and OLED supply dynamics.

- Geopolitics and regulation: export controls, subsidies, and supply‑chain localization impacting costs and customer mix.

Conclusion

Samsung Electronics enters late‑2025 with momentum grounded in AI infrastructure build‑outs and a strengthening memory cycle, as evidenced by a roughly 60% share‑price rise since early April and about 50% year‑over‑year. Over 2025–2028, the core debate centers on how much of the AI wallet Samsung can capture across HBM, packaging, and foundry, and whether devices can compound value through XR, camera, and display leadership. The path to higher, more durable earnings exists but is execution‑heavy: yields, qualifications, and supply alignment with hyperscalers will dictate outcomes. Competitive intensity from SK Hynix, Micron, and TSMC, plus policy risks, argues for balanced expectations after the sharp re‑rating. If Samsung converts today’s headlines into repeatable contracts and disciplined capital deployment, the multi‑engine model can support a higher quality of earnings; if milestones slip, volatility likely returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.