As of August 2025, Siemens AG enters the next three years with steady fundamentals and renewed share-price momentum. The stock has climbed 38.87% over 12 months, closing recently near €236.60 and within reach of its €244.85 high. On trailing figures, revenue stands at €78.3B with a 12.65% profit margin and 13.49% operating margin, supported by €12.42B in EBITDA and €7.87B in net income. Balance-sheet liquidity (current ratio 1.50) offsets a sizable €56.69B debt load and €14.64B cash. Dividend discipline remains intact with a forward rate of €5.20 (2.20% yield) and a 52.63% payout ratio. While headlines point to a new 12‑month high and a “Hold” consensus, modest quarterly growth (revenue +2.5% y/y; earnings +3.3% y/y) implies execution remains key. The next leg likely hinges on demand in automation, electrification, and software-driven efficiency.

Key Points as of August 2025

- Revenue: Trailing 12‑month revenue at €78.3B; quarterly revenue growth at 2.5% y/y, with headlines noting Q3 growth.

- Profit/Margins: Profit margin 12.65%; operating margin 13.49%; EBITDA €12.42B; ROE 14.30% underscores capital efficiency.

- Sales/Backlog: Orders/backlog not disclosed here; investors should track quarterly order intake and segment mix for visibility.

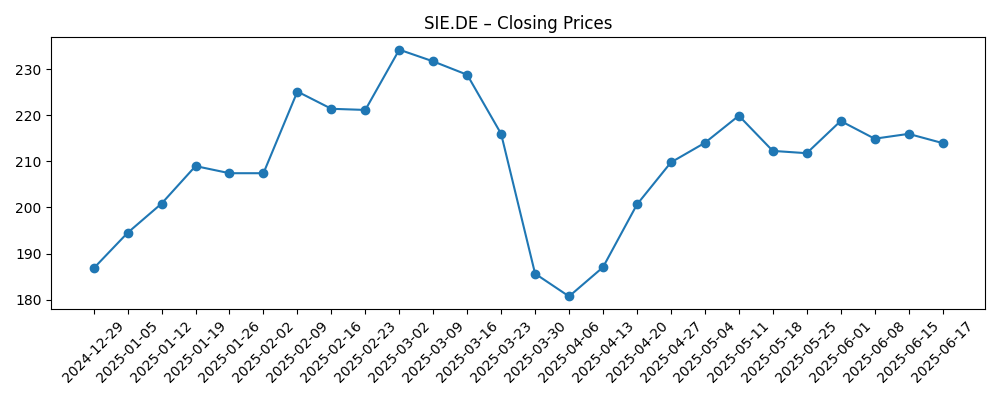

- Share price: Last close ~€236.60; 52‑week high/low €244.85/€160.24; 50‑day/200‑day MAs at €224.51/€210.86; 52‑week change +38.87%.

- Analyst view: Recent coverage flags a “Hold” consensus even as the stock set a 12‑month high.

- Market cap: Approximately €185B (latest close × 783.22M shares outstanding).

- Balance sheet: Cash €14.64B vs. debt €56.69B; current ratio 1.50; debt/equity 85.84%.

- Dividend: Forward dividend €5.20 (2.20% yield); payout ratio 52.63%; last ex‑date 14 Feb 2025.

Share price evolution – last 12 months

Notable headlines

- Siemens (OTCMKTS:SIEGY) Hits New 12-Month High

- Siemens AG (SIEGY) Given Consensus Recommendation of “Hold” by Brokerages

- Siemens books Q3 revenue of €19.4B, up 5%

Opinion

Siemens’ new 12‑month high, reached alongside a “Hold” consensus, suggests the market is rewarding resilient execution but remains cautious on upside drivers. With trailing revenue at €78.3B and mid‑teens margins, the company is positioned to benefit from secular demand in factory automation, electrification, and digital optimization. The modest pace of quarterly growth implies that incremental operating leverage and disciplined cost control will matter more than broad market beta from here. In this context, investors may focus on mix shift toward higher‑margin software and services, which can support valuation if topline acceleration proves uneven through the cycle.

The dividend framework—€5.20 forward per share at a 2.20% yield and a 52.63% payout—adds a measure of total‑return resilience, particularly if global industrial activity cools. Siemens’ balance sheet shows ample liquidity (current ratio 1.50) against material gross debt of €56.69B, implying that cash generation and prioritization of capex versus buybacks will remain under scrutiny. If orders in electrification and grid‑adjacent offerings stay healthy, free cash flow could continue to fund both reinvestment and dividends without stretching leverage.

Headline Q3 growth points to stable customer demand, but the slope of the next leg likely depends on Europe’s industrial capex, North American onshoring, and selective strength in automation. A steady 50‑day/200‑day moving average uptrend indicates constructive technicals; however, after a 38.87% 12‑month rise and proximity to the €244.85 high, valuation sensitivity increases. Execution on pricing, supply chain reliability, and software attach rates could be the levers that keep margins in the 12–14% zone even if growth remains mid‑single‑digit.

Over a three‑year horizon, the base case is gradual compounding: modest revenue growth supported by software, with stable to slightly higher margins. Upside comes from stronger order intake in digital industries and power‑grid modernization, where software integration can deepen moats and expand recurring revenue. Downside risks include a cyclical capex pause, euro strength weighing on reported results, or slower order conversion in key regions. In all cases, the dividend policy provides ballast, while share performance will likely track the cadence of orders and margin progression rather than multiple expansion alone.

What could happen in three years? (horizon August 2025+3)

| Scenario | Trajectory | Share-price drivers | Strategic outcomes |

|---|---|---|---|

| Best | Consistent demand in automation/electrification; margins trend higher on software mix and pricing discipline. | Durable uptrend sustained by improving ROE and cash conversion; dividend growth complements capital returns. | Portfolio focus deepens in digital/industrial software; selective M&A bolsters recurring revenue and scale. |

| Base | Modest revenue growth with stable margins; order intake choppy but service/software provide resilience. | Range‑bound valuation; total return driven by dividend plus steady EPS compounding. | Disciplined capex and bolt‑on deals; operational excellence offsets cost inflation. |

| Worse | Cyclical slowdown pressures orders; margin compression from mix and pricing; delayed project starts. | De‑rating toward cycle trough; share consolidates until visibility on orders and costs improves. | Heightened cost control; defer non‑core investments; prioritize balance‑sheet flexibility. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Industrial capex cycle in Europe/US and order intake in automation and electrification.

- Margin trajectory versus costs (components, labor) and pricing power in key segments.

- Cash generation versus leverage (debt €56.69B; cash €14.64B) and capital allocation priorities.

- FX (euro strength/weakness) and macro sensitivity across export markets.

- Execution on software/services mix and potential portfolio reshaping or bolt‑on M&A.

Conclusion

Siemens enters the next three years with healthy fundamentals and multiple self‑help levers. Trailing revenue of €78.3B, mid‑teens operating margins, and steady free‑cash‑flow support the dividend (2.20% yield) while allowing for selective reinvestment. The stock’s 38.87% rise and approach to the €244.85 high reflect confidence in execution and durable secular trends, yet the “Hold” consensus underscores a demand for proof of sustained acceleration. We think the base path is measured growth with stable margins, driven by automation, electrification, and software. Upside requires stronger order momentum and mix benefits that lift returns without excess leverage; downside centers on a cyclical pause and cost pressures. For long‑term investors, the risk‑reward skews toward disciplined compounding rather than aggressive multiple expansion, with total return anchored by operational delivery and dividend continuity.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.