SONY GROUP CORPORATION (6758.T) enters August 2025 with improving momentum. The stock has risen 46.32% over the past year, sitting above its 50-day and 200-day moving averages (¥3,779.52 and ¥3,553.58), and near a 52-week high of ¥4,298 after closing the latest week at ¥4,071. Fundamentals remain solid: trailing-12-month revenue is ¥13.01T with a 13.03% operating margin and 8.81% profit margin; cash and debt are roughly balanced at about ¥1.6T each, and the payout ratio is 10.18% on a forward dividend of ¥25 (0.61% yield). Recent headlines point to portfolio focus and innovation, including a sale of its EVO stake and new AI-driven audio tools. This note outlines a three-year outlook to August 2028, highlighting drivers, risks, and scenarios for shareholders.

Key Points as of August 2025

- Revenue: TTM sales of ¥13.01T; Q1 FY2025 headline indicates sales rose ~2% YoY to about ¥2.6T.

- Profit/Margins: Profit margin 8.81%; operating margin 13.03%; EBITDA ¥1.92T; net income attributable to common ¥1.19T.

- Sales/Backlog: Quarterly revenue growth YoY 2.20%; backlog not disclosed here.

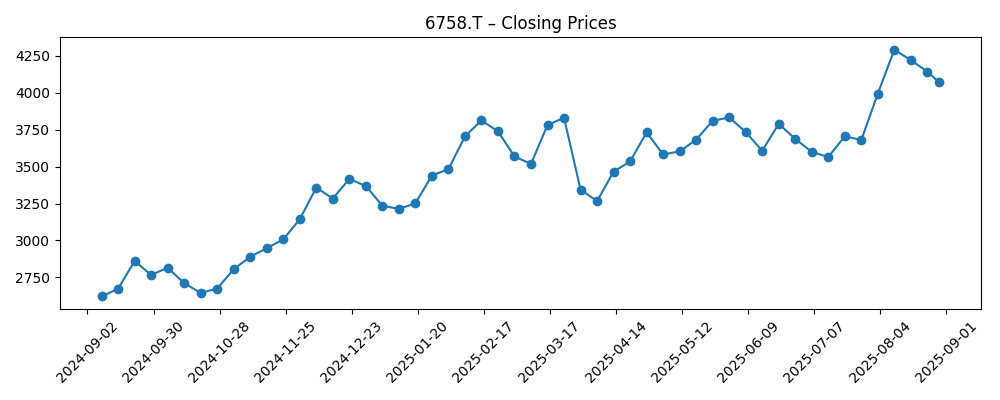

- Share price: Last weekly close ¥4,071; 52-week high/low ¥4,298/¥2,493; 50-day ¥3,779.52 vs 200-day ¥3,553.58; 52-week change 46.32%.

- Analyst view: Recent comparative coverage highlights positioning versus peers; no formal ratings in provided sources.

- Market cap: Large-cap profile implied by ~5.99B shares and the latest price; float ~5.95B.

- Balance sheet: Cash ¥1.6T vs debt ¥1.61T; current ratio 1.09; total debt/equity 18.76%.

- Capital returns: Forward dividend ¥25 (0.61% yield); payout ratio 10.18%; ex-dividend date 2025-09-29; last split 5:1 on 2024-09-27.

Share price evolution – last 12 months

Notable headlines

- Sony Interactive Entertainment sells stake in EVO to NODWIN Gaming

- NODWIN Acquires Sony's Stake in Evo To Become Major Shareholder

- Audiokinetic & Sony AI reveal Similar Sound Search

- Sony's Q1 sales rise by 2% to ¥2.6 trillion

- Near-Eye Display Company Evaluation Report 2025: Sony cited in AR/VR innovation

- Critical Review: Sony (NYSE:SONY) & Sharp (OTCMKTS:SHCAY)

Opinion

Recent data suggest Sony is entering a consolidation-and-invest phase rather than chasing hypergrowth. Headline Q1 sales increased about 2% year over year to roughly ¥2.6T, broadly consistent with the reported 2.20% YoY quarterly revenue growth, indicating steady demand amid mixed device and content cycles. With TTM revenue of ¥13.01T and an operating margin of 13.03%, the business is delivering resilient profitability across a diversified portfolio. The balance sheet reads steady—cash at ¥1.6T roughly offsets debt at ¥1.61T—while the current ratio of 1.09 underscores adequate liquidity. For the next three years, execution likely matters more than macro beta (0.76) given Sony’s broad mix. Investors should watch if incremental growth in services and sensors can compound on this base without sacrificing returns on capital (ROE 14.44%).

The sale of Sony Interactive Entertainment’s stake in EVO to NODWIN looks tactically consistent with portfolio pruning and focus. Tournament operations are strategically adjacent to, but not core to, platform economics; exiting can streamline attention on first-party content, subscriptions, and platform monetization. Divestment proceeds aren’t disclosed here, yet the signal aligns with measured capital discipline—especially relevant while levered free cash flow is negative (−¥1.98T TTM). Over a three-year horizon, selective divestitures and partnerships could simplify operations, reduce managerial distraction, and marginally improve cash conversion if fixed-cost intensity moderates. The dividend’s low payout ratio (10.18%) provides optionality to balance reinvestment and shareholder returns if underlying cash flow recovers toward operating cash flow levels (¥2.53T TTM).

On the innovation front, Audiokinetic and Sony AI’s Similar Sound Search highlights a practical, workflow-centric approach to AI. Enhancing creator tools can reinforce developer lock-in and increase the utility of Sony’s audio middleware, supporting higher-margin software and services over time. In parallel, inclusion in a 2025 near‑eye display evaluation underscores the company’s relevance in AR/VR components and ecosystems. While this does not guarantee monetization, it supports the thesis that Sony’s sensor, optics, and content assets can benefit as spatial computing and advanced audio proliferate. Over three years, incremental adoption of such tools could lift mix and margins at the segment level, even if group revenue growth remains measured. The key is translating R&D into attach rates across platforms where Sony already has scale advantages.

Technically and tactically, shares have positive momentum: the price sits above both 50‑day and 200‑day moving averages, with a 52‑week gain of 46.32% and proximity to the ¥4,298 high. Near term, upcoming catalysts include the 2025‑09‑29 ex‑dividend date and any updates on content pipelines, device cycles, or component demand. With a forward dividend of ¥25 (0.61% yield), income remains a secondary part of the return profile; total return will hinge on earnings and cash‑flow progression. Over the next three years, if Sony sustains double‑digit operating margins around current levels and nudges revenue higher from the ¥13.01T base, valuation could reward consistency. Conversely, if free‑cash‑flow remains pressured, investors may demand a wider margin of safety despite the company’s relatively low beta and diversified earnings mix.

What could happen in three years? (horizon August 2025+3)

| Scenario | Narrative (to August 2028) |

|---|---|

| Best | Gaming services, first‑party content, and image sensors outperform; AI‑enhanced creator tools deepen ecosystem stickiness; portfolio pruning improves focus and cash conversion. Operating margin improves from the current 13.03% level, and ROE holds near or above recent levels. Dividend flexibility remains supported by a 10.18% payout ratio, allowing prudent increases alongside reinvestment. |

| Base | Moderate, consistent revenue growth from the ¥13.01T base with stable margins around current levels. Innovation in audio/AI and AR/VR contributes incrementally, offsetting cyclical softness in some segments. Cash flow normalizes versus the current negative levered free cash flow, enabling steady dividends (forward ¥25) and selective buybacks or bolt‑on deals as conditions allow. |

| Worse | Competitive intensity in gaming and devices weighs on unit economics; content slippage and slower component demand pressure results. Margins dip below current levels, and levered free cash flow remains negative, constraining capital returns despite balance‑sheet stability (cash ~¥1.6T vs debt ~¥1.61T). Strategic divestitures prove insufficient to offset operational headwinds. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution in gaming platforms, services, and first‑party content following the EVO stake sale and broader portfolio focus.

- Demand and pricing for image sensors and optical components across smartphones, cameras, and emerging AR/VR devices.

- Ability to translate AI initiatives (e.g., Similar Sound Search) into higher‑margin software and services revenue.

- Cash‑flow trajectory versus current negative levered free cash flow and the balance between reinvestment and shareholder returns.

- Macro and competitive dynamics, including supply chain stability and regulatory developments across key markets.

- Share price momentum relative to 50‑day and 200‑day moving averages and proximity to the ¥4,298 52‑week high.

Conclusion

Sony enters the next three years from a position of operational resilience and market momentum. Revenue growth is modest but positive, profitability is solid at the group level, and liquidity appears balanced, with cash and debt near parity. Strategic signals—divesting the EVO stake and advancing AI‑enabled creator tools—point to a focus on higher‑return areas and ecosystem leverage. With a forward dividend of ¥25 and a low payout ratio, Sony retains flexibility to support growth while maintaining shareholder returns, provided cash generation improves from current levered free cash flow levels. The stock’s 52‑week rally and position above key moving averages suggest constructive sentiment, yet sustaining that confidence will depend on execution: consistent content pipelines, steady component demand, and measurable progress in software and services. On balance, a base‑case of steady compounding appears attainable, with upside tied to monetizing innovation and improving cash conversion.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.