Subaru Corporation (7270.T) enters the next three years with a cash‑rich balance sheet, visible revenue growth, and low share‑price volatility, but also faces margin pressure and strategic choices on electrification and software. Over the past 12 months the stock is up 21.59% and trades near its 52‑week high, supported by solid top‑line expansion (ttm revenue roughly ¥4,810B) even as quarterly earnings growth dipped year over year. Liquidity and leverage metrics are conservative (¥1.92T cash vs ¥391B debt; current ratio 2.52), enabling sustained dividends and investment in product and ADAS features. With a forward dividend of ¥115 (3.71% yield) and beta of 0.12, Subaru offers defensive traits in a cyclical industry. The three‑year outlook hinges on U.S. demand, currency, execution on hybrids/EVs and software features, and maintaining discipline on costs and pricing.

Key Points as of September 2025

- Revenue: trailing twelve months about ¥4,810B; quarterly revenue growth (yoy) 11.20%; revenue per share ¥6,553.92.

- Profit/margins: net margin 6.42%; operating margin 6.29%; gross profit ¥978.39B; EBITDA ¥622.94B; net income ¥308.9B; ROE 11.60%.

- Sales/cash generation: operating cash flow ¥599.4B; levered free cash flow ¥90.39B supports ongoing investment.

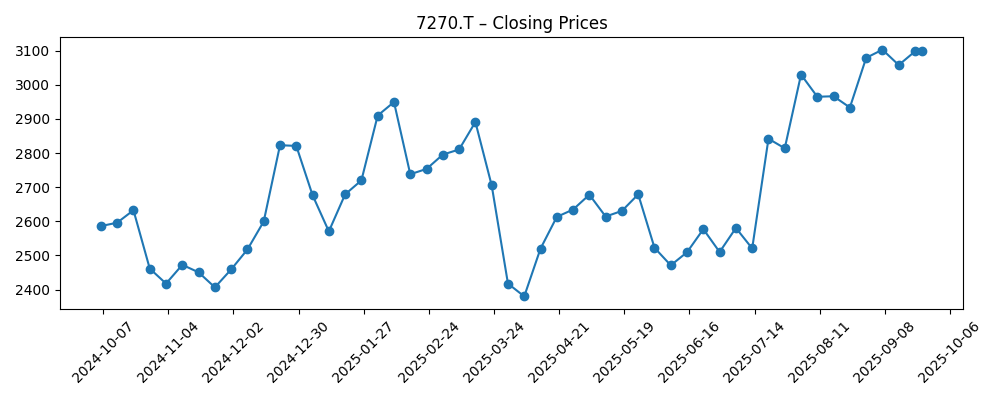

- Share price: ¥3,099 (9/24/2025) near 52‑week high ¥3,175; 52‑week low ¥2,174; up 21.59% over 12 months; 50‑DMA ¥2,903.68; 200‑DMA ¥2,713.10; beta 0.12.

- Balance sheet: cash ¥1.92T vs total debt ¥391B; debt/equity 14.51%; current ratio 2.52 (ample liquidity).

- Dividend: forward annual ¥115 (3.71% yield); payout ratio 25.11%; next ex‑dividend date 2025‑09‑29.

- Ownership/liquidity: shares outstanding 727.97M; float 544.25M; insiders 21.32%; institutions 39.29%; 3‑month avg volume 3.58M.

- Market cap: implied around ¥2.26T (shares outstanding × recent price).

- Analyst view: recent third‑party comparisons spotlight competitive positioning versus BMW, Suzuki and Isuzu; no formal consensus provided here.

Share price evolution – last 12 months

Notable headlines

- Bayerische Motoren Werke (OTCMKTS:BAMXF) and Subaru (OTCMKTS:FUJHY) Critical Analysis – ETF Daily News

- Analyzing Subaru (OTCMKTS:FUJHY) and Isuzu Motors (OTCMKTS:ISUZY) – ETF Daily News

- Analyzing Subaru (OTCMKTS:FUJHY) and Suzuki Motor (OTCMKTS:SZKMY) – ETF Daily News

Opinion

Subaru’s shares have climbed from a late‑March trough to trade near the 52‑week high, with the 50‑ and 200‑day moving averages sloping upward. The combination of low beta (0.12) and improving trend momentum suggests investors are rewarding defensiveness plus earnings visibility. The technical backdrop is also supported by steady liquidity (3‑month average volume 3.58M). That said, the stock’s proximity to the 52‑week high may cap near‑term upside without incremental catalysts such as stronger margin prints or product news. Given the ex‑dividend date on September 29, income‑oriented flows could modestly support the shares, followed by a typical post‑dividend drift. Over a three‑year horizon, the path will likely be determined less by technicals and more by whether Subaru can translate revenue growth into sustainably higher returns on capital.

Fundamentally, top‑line momentum is intact (11.20% yoy revenue growth in the most recent quarter), but earnings growth turned negative year over year, pointing to cost inflation, mix, incentives, or currency effects pressuring margins. Even so, profitability remains respectable: 6.42% net margin and 6.29% operating margin on ¥4,810B ttm revenue, while ROE sits at 11.60%. Importantly, operating cash flow of ¥599.4B and positive free cash flow provide the fuel for electrification, software/ADAS upgrades, and capacity maintenance without stressing the balance sheet. The key question for 2026–2028 is whether Subaru can improve pricing power and scale benefits in hybrids/EVs while defending its brand strengths in safety and all‑wheel drive.

The balance sheet offers flexibility. With ¥1.92T in cash versus ¥391B in total debt and a current ratio of 2.52, Subaru can keep investing through the cycle while paying a consistent dividend (¥115 forward; 25.11% payout). That optionality could extend to selective partnerships or tooling for new drivetrains and driver‑assist systems. If execution is tight, modest margin expansion is plausible even without outsized unit growth. Conversely, sustained input‑cost pressure or aggressive price competition could keep margins flat despite volume gains. Against this backdrop, a prudent base case is one where operating efficiency and product mix do the heavy lifting, supported by gradual software feature monetization and disciplined capex.

Comparative coverage in recent months has centered on how Subaru stacks up against BMW, Suzuki, and Isuzu. The takeaway for equity holders is less about chasing segment extremes and more about playing Subaru’s middle‑weight advantages: focused lineup, brand loyalty, and conservative finances. If management leans into differentiated AWD and safety technology while pacing its electrification roadmap to demand, the company can defend returns without overreaching. On the other hand, if peers accelerate software‑defined vehicle rollouts or cut prices to gain share, Subaru may need to trade margin for competitiveness. Over three years, execution, not headline comparisons, is likely to determine whether today’s valuation near the 52‑week high proves a springboard or a ceiling.

What could happen in three years? (horizon September 2025+3)

| Scenario | Implications by September 2028 |

|---|---|

| Best | Steady demand in core markets, successful hybrid/EV introductions, and incremental software/ADAS monetization lift pricing power. Margins improve from operational efficiency and stable input costs. Strong cash generation funds capex and dividends while preserving net cash. |

| Base | Revenue grows modestly with stable share in North America and Japan. Product refreshes offset competitive pricing, keeping margins around recent levels. Cash remains ample, supporting consistent dividends and selective investments. |

| Worse | Slower consumer demand and intensified price competition weigh on mix and margins; currency shifts or supply disruptions add pressure. Elevated spend on electrification outpaces returns, compressing free cash flow and limiting capital returns. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on electrification and ADAS/software features relative to peers’ timelines and customer adoption.

- North American demand and pricing discipline in the crossover/SUV segments that anchor Subaru’s mix.

- Cost inflation, supply chain stability, and currency moves that affect margins and earnings translation.

- Capital allocation consistency (dividend sustainability, potential buybacks) supported by cash generation.

- Regulatory and safety developments that could trigger recalls or accelerate feature content requirements.

- Competitive responses from global automakers, including pricing and technology bundling.

Conclusion

Subaru’s investment case into 2028 blends defensive balance‑sheet strength with operational execution risk. The company is growing revenue, generates solid cash, and maintains conservative leverage, enabling it to invest through the cycle while paying a reliable dividend. Near term, the stock’s climb toward its 52‑week high reflects improving sentiment and low volatility, but future upside likely depends on converting sales momentum into higher, more durable margins. If management paces electrification and software features to customer demand and maintains pricing discipline, Subaru can defend returns despite a competitive landscape. Conversely, prolonged cost pressure, currency headwinds, or aggressive price cuts across the sector could cap earnings and compress valuation. For now, the base path favors steady operations backed by strong liquidity and disciplined capital allocation—leaving Subaru well‑placed to navigate industry change, but with execution still the swing factor for three‑year shareholder returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.