As of August 2025, Tokyo Electron (8035.T) enters a volatile stretch. The stock has swung from a late‑July weekly close near 27,960 to 21,505 on August 15, and sits 26.59% below its 52‑week level despite durable profitability. The company’s trailing 12‑month revenue is 2.43T with a 22.08% profit margin and 26.33% operating margin; cash stands at 367.51B and the current ratio is 2.97. Short‑term pressure stems from a Digitimes‑reported profit forecast cut and an ongoing investigation into alleged TSMC technology leaks involving a TEL Taiwan employee, which the company says it is addressing. Dividend support remains meaningful (forward yield 2.26%; ex‑date 9/29/2025). This note outlines a three‑year outlook, balancing cycle dynamics in wafer‑fab equipment against headline risk, governance steps, and customer capex plans.

Key Points as of August 2025

- Revenue: trailing 12‑month revenue 2.43T; quarterly revenue growth (yoy) −1.00%.

- Profit/Margins: profit margin 22.08%; operating margin 26.33%; ROE 29.39%; EBITDA 742.58B; gross profit 1.14T.

- Sales/Backlog: equipment demand softer with China slowdown; company cut profit forecast (Digitimes, Aug 1, 2025); visibility mixed into FY3/2026.

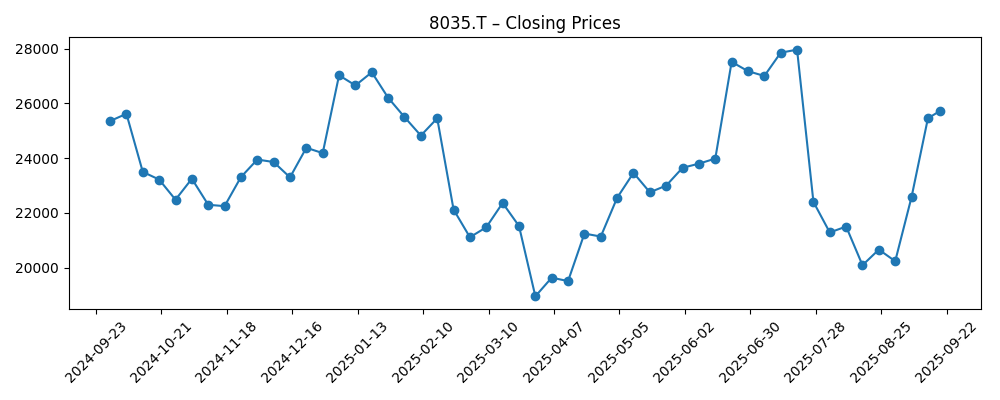

- Share price: 52‑week high 29,190 and low 16,560; 52‑week change −26.59%; recent weekly close 21,505 (Aug 15); 50‑day MA 25,281.60 vs 200‑day MA 23,698.10; beta 1.29; 10‑day avg volume 6.53M vs 3‑month 4.12M.

- Analyst/investor view: sentiment cautious as investigation headlines overshadow fundamentals; watch orders from TSMC and memory makers.

- Market cap/ownership: large‑cap Japanese WFE leader; institutions hold 51.30%, insiders 3.21%; shares outstanding 458.11M; float 437.61M.

- Balance sheet/cash flows: cash 367.51B; operating cash flow 473.35B; levered FCF 191.23B; current ratio 2.97; debt not disclosed in snapshot.

- Dividend/policy: forward rate 480 (yield 2.26%); trailing 592 (yield 2.79%); payout ratio 50.21%; last split 3:1 (3/30/2023); next ex‑date 9/29/2025.

Share price evolution – last 12 months

Notable headlines

- Tokyo Electron cuts profit forecast amid weaker semiconductor equipment demand and China slowdown (Digitimes)

- TSMC secrets leak puts Japan’s Tokyo Electron on hot seat (Fortune)

- Tokyo Electron confirms Taiwan unit employee's involvement in intellectual property case (CNA)

- Tokyo Electron fires Taiwan employee tied to TSMC leak (Digitimes)

- Tokyo Electron declines comment as TSMC 2nm tech leak investigation unfolds (Digitimes)

- Tokyo Electron Shock: Arrest Over TSMC Leak Triggers Investor Panic (Yahoo)

- Ex‑TSMC staff arrested over alleged chip trade secret theft (AppleInsider)

- Six arrests over attempted theft of trade secrets on iPhone 18 chip process (9to5Mac)

- Alleged sharing of 400 photos of TSMC’s 2 nm node with a Japanese firm (PC Gamer)

Opinion

The TSMC leak investigation has become the defining near‑term narrative for Tokyo Electron, crowding out otherwise resilient fundamentals. The company has confirmed a Taiwan unit employee’s involvement and, according to reporting, has taken disciplinary action while declining detailed public comment as investigations proceed. For investors, the perceived risk is twofold: reputational damage with a critical customer ecosystem and potential legal exposure. The share price reaction – from a weekly close of 27,960 on July 20 to 21,505 by August 15 – reflects headline‑driven de‑risking, amplified by elevated 10‑day trading volumes versus the 3‑month average. History in semiconductor capital equipment suggests such episodes can overshadow cycle signals temporarily. The question is less about long‑term competitive positioning and more about the pace at which procurement teams and customers regain comfort as facts are established and compliance enhancements are evidenced.

Beyond the probe, macro and industry currents set the three‑year stage. TEL’s exposure to leading‑edge foundry/logic, memory, and specialty nodes ties outcomes to AI infrastructure build‑outs, HBM‑driven memory spending, and the timing of 2 nm/advanced packaging ramps at key customers. Management’s profit forecast cut, alongside a China slowdown, flags softer near‑term tool demand and order visibility; yet margins remain robust with a 26.33% operating margin and solid cash generation (operating cash flow 473.35B). If AI server and edge device demand sustain, process tool intensity at advanced nodes should continue to rise, which historically benefits deposition/etch leaders. The next few quarters will likely be about digestion and compliance optics; the multi‑year arc hinges on normalized capex cycles resuming at foundries and memory suppliers.

Compliance and governance are now central to the equity case. Large, global customers typically respond to IP‑sensitive incidents with audits, additional contractual safeguards, and tight access protocols. TEL’s prompt personnel action and cooperation, as reported, are initial steps, but institutional investors will look for structural changes—training, monitoring, and third‑party certifications—to de‑risk recurrence. The operational impact could range from minimal (if customers treat the matter as contained) to procurement friction (if approvals slow or certain programs pause). The dividend profile—forward yield at 2.26% and a payout ratio of 50.21%—offers some carry for long‑horizon holders, though income support alone rarely offsets headline volatility. Successful governance remediation would likely compress the risk premium faster than any single quarter’s result.

Technically and tactically, the stock is below its 50‑day moving average (25,281.60) and 200‑day (23,698.10), a setup that often implies continued choppiness until a catalyst resets expectations. With a 52‑week range of 16,560–29,190 and beta of 1.29, swings can be material around news flow. Over three years, base‑case normalization looks plausible if the probe concludes without structural customer fallout and if AI‑driven capex persists. Upside could come from stronger‑than‑expected 2 nm and advanced packaging adoption lifting tool spend and mix, while downside would likely involve an extended China trough or customer procurement delays linked to compliance findings. Patience and position sizing matter: the path may be jagged, but the franchise’s process technology depth still underpins a credible recovery narrative.

What could happen in three years? (horizon August 2028)

| Scenario | Operations | Financials | Stock implications |

|---|---|---|---|

| Best | Probe resolved without customer penalties; strong AI‑led foundry and HBM memory upcycle; share gains in deposition/etch at advanced nodes. | Revenue and margins resume a multi‑year climb, with profitability broadly consistent with current margin levels amid favorable mix and utilization. | Re‑rating as risk premium fades; sustained interest from institutions supports improved liquidity and lower volatility. |

| Base | Compliance enhancements satisfy customers; demand recovers gradually with staggered ramps at leading customers; China stabilizes but remains uneven. | Steady cash generation supports dividends; investment in R&D and capacity maintained without stressing the balance sheet. | Range‑bound to moderately higher, tracking order momentum and headline cadence; dividends contribute 2–3% annual carry. |

| Worse | Prolonged investigation or customer procurement frictions; weaker China and slower memory recovery; competitive pressure at key process steps. | Revenue softness and mix headwinds compress profitability; discretionary spend trimmed to protect cash. | De‑rating persists; higher beta dynamics amplify downside on negative news and macro shocks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Outcome and timing of the TSMC‑related intellectual property investigation and any customer responses.

- Order trends from leading foundry and memory customers, especially tied to AI, HBM, and 2 nm/advanced packaging ramps.

- China demand trajectory and export‑control developments impacting tool shipments and service.

- Gross margin mix and operating discipline relative to the current 22.08% profit and 26.33% operating margin profile.

- Capital allocation consistency—dividends around the stated payout ratio and sustained R&D to defend process leadership.

- Market risk appetite and sector flows, with beta of 1.29 amplifying reactions to macro data and rates.

Conclusion

Tokyo Electron’s three‑year outlook is a balance between transitory headline risk and durable secular drivers. The reported profit forecast cut and the TSMC leak probe have understandably weighed on sentiment, pushing shares below key moving averages and widening the risk premium. Yet the franchise retains strong profitability, cash generation, and a solid dividend framework, positioning it to participate when wafer‑fab capex normalizes. The base path to value creation runs through clear compliance remediation, steady customer reassurances, and improving order intake as AI‑related nodes and HBM memory underpin the next leg of tool intensity. Upside depends on faster‑than‑expected leading‑edge ramps and mix benefits; downside centers on prolonged procurement caution or a deeper China slump. For investors with multi‑year horizons, disciplined sizing and a focus on catalysts—the investigation’s closure, order inflections, and margin resilience—are key to navigating a potentially choppy but investable recovery.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.