As of May 2025, Toyota Motor Corp (7203.T) continues to build its reputation as a leader in the automotive industry, though the company faces increasing scrutiny amid evolving market conditions and competitive pressures. With a recent full-year net income of $33.1 billion, Toyota remains strong, yet the impact of tariffs and market shifts raises questions about future growth. Recent announcements of new electric vehicles in collaboration with Subaru and a notable pivot to hybrid vehicles could reshape the company's trajectory. Market analysts are closely watching Toyota as it navigates these landscape changes, particularly amid the backdrop of fluctuating share prices and broad economic influences.

Key Points as of May 2025

- Revenue: $33.1 Billion net income for the latest fiscal year

- Profit/Margins: Concerns over profit drop due to tariffs

- Sales/Backlog: Booming U.S. sales growth reported

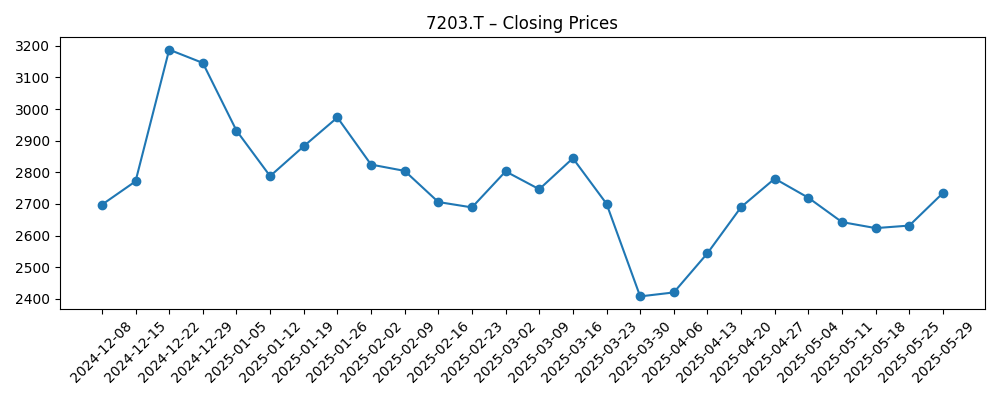

- Share price: Recent volatility with a range between 2407.5 – 3188.0 JPY

- Analyst view: Mixed sentiment due to tariffs and new EV launches

- Market cap: Approximately ¥20 trillion

Share price evolution – last 6 months

Notable headlines

- US consumer watchdog cancels Toyota settlement early – Yahoo Entertainment

- Toyota Industries to accept Toyota group's planned tender offer, Kyodo says – CNA

- Toyota to release new EV with Subaru in North America, Japan in 2026 – Japan Today

- Toyota Takes All-Hybrid Plunge With Its Best-Selling US Vehicle – Financial Post

- Toyota warns of profit drop as tariff chaos threatens carmakers – Financial Post

- Toyota reports booming sales but stays cautious on profit because of various costs – Financial Post

Opinion

The recent headlines highlight a period of adjustment for Toyota as it responds to both regulatory challenges and consumer demands. The cancellation of the settlement with the US consumer watchdog could indicate a shifting regulatory landscape, posing potential risks to Toyota's operations. This turbulence comes alongside enhanced sales figures in the U.S., suggesting strong consumer interest in Toyota vehicles. Yet, significant pressures remain from tariffs which the company has flagged could dampen future profitability.

The decision to pivot heavily into hybrid technology reflects a strategy to align with global shifts towards electric vehicles (EVs). The collaboration with Subaru for a new EV is particularly promising, as both companies could leverage shared technology to innovate effectively. Should these efforts succeed, they could allow Toyota to regain a competitive edge and solidify market presence.

Nevertheless, the challenges posed by ongoing geopolitical tensions and tariff uncertainties remain critical. Analysts predict that these factors could lead to volatility in the stock price, which has already seen a decline from its peaks. Investors will need to remain vigilant about how these external factors may play into Toyota’s financial health and share performance moving forward.

In the context of steady competition from players like Nissan, who are also investing in hybrid technologies, Toyota must generate clear differentiation in the features and technology of its vehicles. The upcoming launches of new models could be pivotal as the company seeks to capture consumer interest in an increasingly competitive market.

What could happen in three years? (horizon May 2025+3)

| Scenario | Outcome |

|---|---|

| Best | Strong EV sales growth leads to increased market share and profitability. |

| Base | Stabilization of earnings with moderate growth through hybrid and EV markets. |

| Worse | Profit margins suffer from tariffs and competitive pressures, leading to decreased valuation. |

Factors most likely to influence the share price

Factors most likely to influence the share price

- Impact of tariffs on profit margins

- Success of new EV product launches

- Regulatory changes affecting operations in key markets

- Consumer response to hybrid vehicle lineup

- Overall economic conditions influencing automotive demand

Conclusion

In conclusion, Toyota Motor Corp faces a complex landscape as it endeavors to maintain its leadership position in the global automotive industry. The potential for growth through new electric and hybrid vehicle offerings is significant; however, the external pressures from tariffs and market competition present ongoing challenges. Companies like Toyota must not only innovate but also adapt to changing regulations and consumer preferences. As the next few years unfold, how Toyota navigates these factors will be critical to its overall performance and investor confidence.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.