Taiwan Semiconductor Manufacturing (2330.TW) enters the next three years with strong operational momentum and policy uncertainty in focus. The foundry leader’s trailing‑twelve‑month revenue of 3.4T and double‑digit year‑over‑year growth underscore robust demand from AI and high‑performance compute, while profitability remains elevated with a 49.63% operating margin and 42.48% profit margin. Liquidity is solid (2.63T cash; current ratio 2.37) against 1.01T of total debt, supporting continued investment and dividends (forward yield 1.76%; payout ratio 30.51%). Shares have rebounded from an April dip to trade near the 52‑week high, with the 50‑ and 200‑day moving averages trending higher. Over the coming 36 months, investor focus is likely to center on capacity ramps, advanced packaging execution, and evolving U.S. trade and export rules. Recent company‑specific headlines on July revenue and IP protection add near‑term context to an otherwise structurally favorable AI cycle.

Key Points as of August 2025

- Revenue: TTM revenue stands at 3.4T, with quarterly revenue growth (yoy) at 38.60%; July 2025 net revenue update was released.

- Profit/Margins: Profit margin 42.48% and operating margin 49.63%; EBITDA 2.35T; TTM net income 1.44T; ROE 34.20% and ROA 15.96%.

- Sales/Backlog: Momentum supported by AI/HPC demand; July revenue disclosure signals healthy order flow into 2H25.

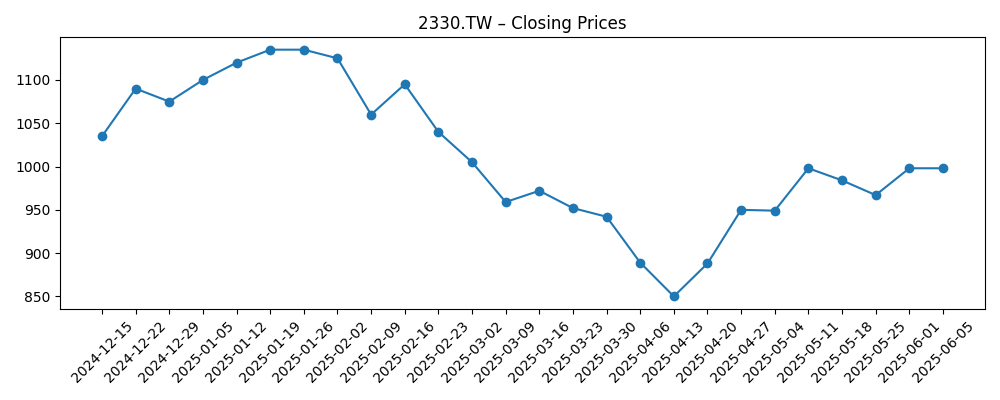

- Share price: Last six months ranged roughly 850–1,180, closing 1,170 on Aug 25, 2025; 52‑week range 780–1,200; beta 1.20.

- Trend indicators: 50‑day moving average 1,115.80 vs 200‑day 1,039.53, indicating an upward trend.

- Analyst view: Focus remains on advanced nodes and packaging; TTM EPS 55.73 and quarterly earnings growth (yoy) 60.70% support constructive sentiment.

- Market cap/Ownership: 25.93B shares outstanding; float 23.36B; institutions hold 42.59%.

- Balance sheet & dividends: Cash 2.63T vs debt 1.01T; current ratio 2.37; forward dividend yield 1.76% (ex‑dividend 9/16/2025); payout ratio 30.51%.

Share price evolution – last 12 months

Notable headlines

- Taiwan Semiconductor Manufacturing (TSM) Announces Net Revenue for July 2025

- Three People Detained for Alleged Theft of Technology Trade Secrets from Taiwan Semiconductor Manufacturing (TSM)

- Taiwan Semiconductor Stocks: Analyzing TSM Vs. TSMY For Your Investment Strategy

Opinion

The July revenue update helps confirm that demand for leading‑edge wafers and advanced packaging is still tracking ahead of broader semis. That aligns with the 38.60% quarterly revenue growth (yoy) and 60.70% earnings growth (yoy) in the latest prints, suggesting mix uplift from AI accelerators and high‑performance compute remains intact. Technically, the stock has recovered from the April trough to trade near the 52‑week high, with the 50‑day above the 200‑day moving average, a setup that often supports trend continuation. Over a three‑year horizon, sustaining this trajectory hinges on yield ramp discipline and cycle management as hyperscaler spending normalizes. With cash of 2.63T and a current ratio of 2.37, TSMC retains balance‑sheet flexibility to fund capex while maintaining a 1.76% forward dividend yield and a 30.51% payout ratio, which can cushion volatility.

Policy remains the principal swing factor. Potential U.S. import tariffs on semiconductors and evolving export controls could alter customer sourcing and regional mix, affecting utilization and margins. The market will parse any exemptions tied to local manufacturing, as these could blunt tariff impacts and influence long‑term footprint strategy. In a supportive case, regulatory clarity allows customers to lock in multi‑year supply, keeping fabs well‑loaded and margins near current levels. In a tougher case, uncertainty delays orders, extends qualification cycles, or forces incremental costs that pressure profitability. Given TSMC’s scale and ecosystem role, it is better placed than smaller peers to absorb shocks, yet even a global leader can see valuation multiple shifts when headline risk rises, especially with beta at 1.20 indicating moderate sensitivity to market swings.

The alleged trade‑secret theft underscores the importance of IP protection in a node‑transition cycle. While the immediate operational impact appears limited based on current disclosures, such events can prompt tighter internal controls, legal actions, and incremental compliance costs. For investors, the key question is whether governance and security enhancements keep pace with expanding production and packaging capacity. The company’s track record and resources suggest it can manage these risks, but repeat incidents would weigh on sentiment and could invite greater regulatory scrutiny. On balance, protecting process know‑how and customer roadmaps is as material to long‑term margins as factory efficiency; the former safeguards pricing power, the latter lowers cost per wafer—both vital to sustaining returns on equity at the current 34.20% level.

Capital returns look steady rather than aggressive. The forward dividend yield of 1.76% (near the 5‑year average yield of 1.84) and a 30.51% payout signal capacity to raise distributions gradually while prioritizing reinvestment. With net income at 1.44T and operating cash flow at 2.13T, internal funding should cover technology migrations and packaging expansions without straining the balance sheet (debt 1.01T). Over three years, valuation is likely to track earnings more than multiple expansion unless policy headwinds fade decisively. If the AI investment cycle broadens beyond early leaders and regulatory noise subsides, upside could come from a mix of modest multiple lift and dividend growth. Conversely, any slowdown in hyperscaler orders or incremental trade frictions could cap upside even if fundamentals remain solid, keeping the stock range‑bound around long‑term trend levels.

What could happen in three years? (horizon August 2025+3)

| Scenario | Revenue/Margins | Operations & Strategy | Valuation & Stock |

|---|---|---|---|

| Best | AI/HPC demand compounds; utilization stays high; margins hold near current TTM levels supported by mix and scale. | Policy clarity and partial exemptions reduce friction; capacity ramps and advanced packaging execute smoothly. | Multiple expands modestly; shares sustain above long‑term averages and challenge prior highs; dividend growth continues. |

| Base | Growth normalizes from 2025 peaks; profitability remains robust but flattish; cash generation funds capex and payouts. | Selective regional diversification; manageable regulatory compliance; steady customer commitments. | Stock largely tracks earnings; yield gravitates around its longer‑term average; volatility near beta of 1.20. |

| Worse | Policy shocks and order push‑outs reduce utilization; pricing pressure compresses margins. | Higher friction costs and delays in qualifications; added security/compliance spend after IP incidents. | Multiple de‑rates; shares trade at a discount to recent moving averages and retest the lower end of the past‑year range. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Tariff and export‑control outcomes affecting U.S. and allied‑market shipments and any exemptions tied to local manufacturing.

- Execution on advanced packaging and leading‑edge capacity ramps relative to AI/HPC demand growth.

- Customer concentration and capex cycles among hyperscalers and top handset/PC vendors.

- IP protection and legal/regulatory developments following recent trade‑secret allegations.

- Macro/FX and geopolitical risk surrounding Taiwan and supply chain resiliency.

Conclusion

TSMC’s investment case into August 2028 rests on balancing exceptional fundamentals against elevated policy risk. Today’s setup is favorable: strong revenue growth, high profitability, and ample liquidity to fund technology transitions while maintaining a disciplined dividend. The stock’s recovery toward the 52‑week high, supported by improving moving averages, indicates the market is rewarding AI‑driven mix and execution. From here, upside likely relies on policy clarity, sustained AI server demand, and smooth capacity ramps; downside risks center on trade frictions, normalization in hyperscaler spending, and any repeat IP/security setbacks. Given cash of 2.63T versus 1.01T in debt, TSMC has the flexibility to invest through volatility and protect returns on equity. A base‑case path implies the shares track earnings growth with periodic swings around macro headlines. Long‑term holders may find the risk‑reward reasonable, provided they can tolerate policy‑driven volatility and a dividend profile geared to reinvestment.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.