Visa Inc. enters September 2025 with fundamentals that remain among the strongest in large-cap payments. Over the last 12 months, the stock outperformed the S&P 500, supported by double-digit revenue growth and industry-leading margins. Trailing-12-month revenue stands at $38.89B and net income at $20.06B, with operating cash flow of $23.48B. The shares closed at about $351.78 in late August, near a 50-day moving average of $347.93 and above the 200-day at $339.22, with beta of 0.94 suggesting below-market volatility. With a 0.67% forward dividend yield and a 22.36% payout ratio, Visa retains flexibility to invest while returning cash to shareholders. This three-year outlook assesses potential drivers, risks, and scenarios that could shape returns through 2028.

Key Points as of September 2025

- Revenue: TTM revenue $38.89B and revenue per share $21.10; quarterly revenue growth (yoy) 14.30%.

- Profit/Margins: Profit margin 52.16% and operating margin 66.77%; TTM net income $20.06B; EBITDA $27.24B.

- Sales/Backlog: Quarterly earnings growth (yoy) 8.20%; growth indicators remain positive based on reported revenue and earnings trends.

- Share price: Last weekly close $351.78 (Aug 29, 2025); 52-week change 26.29% vs S&P 500 16.84%; range 268.23–375.51; 50-day MA 347.93; 200-day MA 339.22.

- Analyst view/positioning: Short interest 28.04M shares (1.65% of float; short ratio 4.53); ownership concentrated in institutions (90.54%).

- Market cap: Roughly $600B based on ~1.7B shares outstanding and the latest price.

- Balance sheet: Total cash $19.18B; total debt $25.14B; debt/equity 65.02%; current ratio 1.12.

- Cash returns: Forward annual dividend rate $2.36 (0.67% yield); payout ratio 22.36%; ex-dividend 8/12/2025; dividend date 9/2/2025.

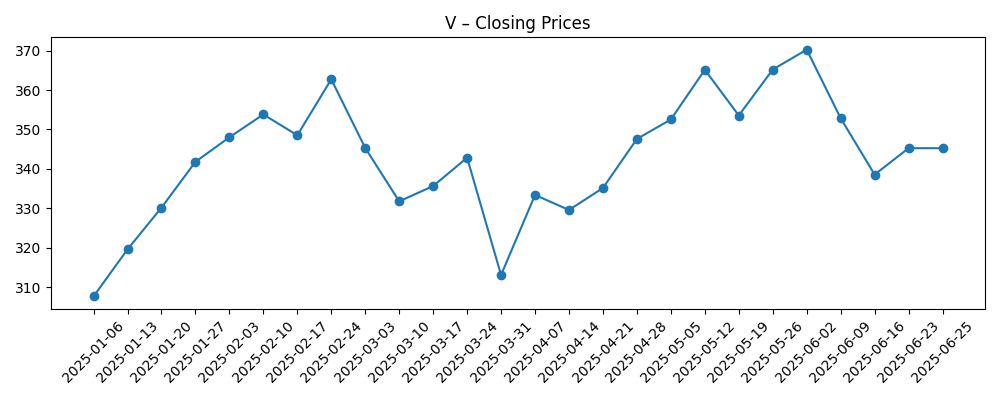

Share price evolution – last 12 months

Notable headlines

Opinion

Visa’s share price has trended higher in 2025, punctuated by healthy consolidations. From early February’s $353.81 to the late-May/early-June highs near $365.19–$370.22, the stock tested prior peaks before a March dip to $313.13 and subsequent recovery. The 50-day and 200-day moving averages at $347.93 and $339.22, respectively, are rising and stacked positively, while a 52-week gain of 26.29% outpaces the S&P 500’s 16.84%. This price action aligns with fundamentals: trailing revenue of $38.89B, a 52.16% profit margin, and 14.30% yoy revenue growth provide a cushion against macro chop. With beta at 0.94, the shares have exhibited slightly lower volatility than the market. Over a three-year horizon, that combination of steady growth and high margins supports a constructive risk/reward, provided competitive and regulatory pressures remain manageable.

Operationally, the investment case still rests on network scale, broad acceptance, and secular digitization of commerce. While the data here do not break out payment volume or cross-border metrics, the reported double-digit revenue growth and 8.20% yoy earnings expansion imply continued demand for Visa’s capabilities across consumer, merchant, and issuer partners. High operating margin of 66.77% underscores an efficient, asset-light model that historically converts revenue to cash with consistency (TTM operating cash flow $23.48B; levered free cash flow $18.05B). Over three years, incremental growth could come from deeper penetration of under-digitized spend categories and ongoing adoption of tap-to-pay and online checkouts, alongside security and tokenization layers that reduce fraud and improve authorization. These are evolutionary, not revolutionary, drivers—favoring steady compounding rather than step-change outcomes.

Risks to that trajectory are familiar. Competitive intensity from alternative rails and account-to-account schemes can pressure pricing and economics if adoption scales quickly. Regulatory shifts targeting interchange, routing, or network rules could affect take rates in key markets. Macro cycles—especially those impacting discretionary spending and cross-border activity—can sway results, even if Visa’s model historically shows resilience. From a market standpoint, sentiment could turn if growth decelerates from current double-digit revenue trends, prompting a multiple reset. Short interest is modest (1.65% of float; 4.53 days to cover), suggesting limited embedded bearishness, but that can change if policy headlines or litigation risk re-emerge. Over three years, we would watch for consistency in revenue growth, stability of margins, and signals on regulation and competition as primary drivers of relative performance.

Capital returns are an important part of the story. The forward annual dividend rate is $2.36, implying a 0.67% yield, with a 22.36% payout ratio that leaves ample headroom for reinvestment and potential further capital return. Visa’s balance sheet is solid (cash $19.18B vs debt $25.14B; debt/equity 65.02%; current ratio 1.12), supporting flexibility through cycles. Without ascribing a specific multiple, strong returns on equity (51.75%) and assets (17.05%) argue for a premium valuation relative to slower-growing financial peers. If management sustains double-digit revenue growth while keeping margins near current levels, the stock could continue to compound, even from an elevated base. Conversely, any sustained slowdown or regulatory reset could compress the premium. On balance, the next three years favor disciplined compounding, with downside protected by cash generation and network advantages.

What could happen in three years? (horizon September 2025+3)

| Scenario | Business outcomes | Share price implications | What we’d watch |

|---|---|---|---|

| Best | Consistent demand for digital payments; stable or improving take rates; margins remain robust; cash generation strengthens capital returns. | Outperforms the market; premium valuation sustained or modestly expands. | Steady double-digit revenue growth, durable authorization/fraud performance, benign regulation. |

| Base | Steady growth with normal variability; margins broadly stable; incremental efficiency gains offset cost inflation. | Performs in line to slightly ahead of market; valuation broadly stable. | Trend consistency in quarterly revenue and earnings growth; balanced pricing and incentives. |

| Worse | Macro slowdown or regulatory pressure reduces growth and compresses economics; competitive alternatives gain traction. | Underperforms; valuation premium narrows until growth visibility improves. | Policy actions on fees/routing, notable merchant defections, or sustained weakness in cross-border activity. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Regulatory actions affecting interchange, routing, or network rules in large markets.

- Macro conditions impacting consumer spending and travel-related cross-border volumes.

- Competitive dynamics from alternative payment rails and real-time account-to-account systems.

- Margin durability and operating efficiency versus investment needs in security and technology.

- Capital allocation signals, including dividend policy and overall cash return capacity.

Conclusion

Visa’s investment case heading into the next three years combines durable growth, exceptional margins, and strong cash generation. TTM revenue of $38.89B, a 52.16% profit margin, and 14.30% yoy revenue growth showcase structural advantages that have supported long-term compounding. The stock’s 52-week gain of 26.29% versus the S&P 500’s 16.84% reflects this strength, while a 0.67% yield and a 22.36% payout ratio preserve flexibility to invest and return capital. Key swing factors are largely exogenous—regulation and macro—while competition from alternative rails warrants ongoing monitoring. If growth and margins remain broadly consistent with recent trends, Visa should continue to earn a premium, with downside buffered by cash flow and network scale. Conversely, any regime change in fees or a prolonged demand slowdown could compress the premium. On balance, the setup favors steady compounding with measured risk management.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.