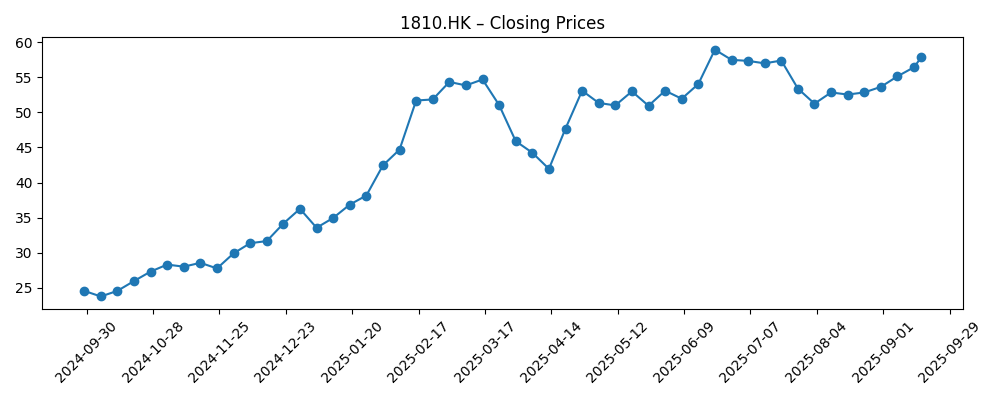

Xiaomi (1810.HK) enters the next three years after a powerful rerating. Over the past year, the stock is up 185.10%, and it now trades near 57.85, close to its 52‑week high of 61.45. Underneath the rally, fundamentals have improved: trailing‑twelve‑month revenue is 428.76B with profit margin of 8.68% and operating margin of 8.61%. Growth has reaccelerated, with quarterly revenue up 30.50% year over year and quarterly earnings growth of 133.50%. The balance sheet shows 111.93B in cash against 28.91B in debt, a current ratio of 1.29, and operating cash flow of 64.82B. With leaks highlighting an upcoming flagship cycle, investors are debating whether premiumization and AI‑centric features can sustain momentum. This note outlines key drivers, scenarios, and risks through September 2028.

Key Points as of September 2025

- Revenue: TTM 428.76B; quarterly revenue growth (yoy) 30.50%.

- Profit/margins: profit margin 8.68%; operating margin 8.61%; gross profit 92.84B; diluted EPS 1.570.

- Sales/backlog: no formal backlog disclosed; demand signals hinge on the next flagship cycle and channel inventory health.

- Share price: recent close ~57.85; 52‑week change +185.10%; 52‑week high 61.45; 50‑day MA 54.724; 200‑day MA 47.856; beta 1.01.

- Balance sheet: cash 111.93B vs debt 28.91B; current ratio 1.29; total debt/equity 11.43%.

- Cash generation: operating cash flow 64.82B; levered free cash flow 59.32B.

- Ownership: insiders hold 20.37%; institutions 25.72%; float 17.38B shares.

- Market cap: implied ~1.24 trillion based on recent price and 21.51B shares outstanding.

Share price evolution – last 12 months

Notable headlines

- Xiaomi's next phone might outshine the competition with a second screen on the back – Android Central

- Leaked Xiaomi 17 'Pro' render might entice you with its huge external screen – Android Central

- Here's how Xiaomi plans to directly compete with iPhone 17 – Android Police

- This Android brand is skipping an entire generation to rival the iPhone 17 – Android Authority

Opinion

The leaks around the Xiaomi 17 series point to a deliberate premium push: distinctive industrial design (including a possible secondary display) to anchor mindshare ahead of a high‑stakes upgrade cycle. The strategic logic is clear. Xiaomi’s financials show profitable growth and ample cash, but long‑term rerating requires sustained pricing power. Moving higher in the stack can lift average selling prices, improve mix, and support operating leverage if bill‑of‑materials costs are contained. The risk is that differentiators that look exciting in render leaks must translate to everyday utility, reliability, and ecosystem cohesion to justify premium price points. Aesthetics alone rarely sustain a franchise; camera consistency, battery life, and software update cadence will decide whether the 17 family expands Xiaomi’s addressable high‑end base or simply sparks a one‑off upgrade bump.

Silicon and software will be just as decisive as hardware flourishes. With top‑tier Android chipsets advancing compute and on‑device AI, the next wave of features—image processing, offline assistants, and smarter power management—can elevate user experience while lowering churn. For investors, the question is margin capture: can Xiaomi keep component costs balanced with richer features, and can software and services attach rates rise enough to smooth hardware cyclicality? The company’s cash position provides flexibility for component procurement and marketing, while modest leverage limits balance‑sheet risk. Execution will likely hinge on launch sequencing, channel discipline, and after‑sales support—areas that determine both near‑term sell‑through and long‑term brand equity.

The share price has already embedded meaningful optimism. The stock sits above its 50‑ and 200‑day moving averages after a 185.10% 12‑month surge and trades not far from its 52‑week high. That backdrop raises the bar for each data point in the coming quarters. Positive surprises on gross margin, mix, or software monetization can sustain the uptrend; any stumble in flagship reception or inventory control could prompt consolidation. Liquidity remains healthy with active turnover, which can amplify reactions to news. Near term, investors may watch for confirmation that early demand for the 17 series is broad‑based geographically, not just concentrated in enthusiastic core markets, and that promotional intensity is measured rather than margin‑dilutive.

Over a three‑year horizon to September 2028, the path likely depends on whether Xiaomi converts a premium cycle into a repeatable playbook. A stable cadence of high‑end launches, tighter integration across devices, and a more compelling services layer would make cash flows more durable and reduce reliance on any single hero device. Conversely, if the flagship cycle underdelivers or competitors out‑innovate at similar price points, margins could compress and working‑capital needs could rise. With a solid cash buffer and improving returns on equity, Xiaomi has room to invest through the cycle. But the valuation now demands evidence of sustained execution: consistent product excellence, disciplined costs, and more predictable monetization beyond initial hardware sales.

What could happen in three years? (horizon September 2025+3)

| Case | Narrative | Share‑price setup |

|---|---|---|

| Best | Premium flagships gain traction across multiple regions; mix shifts up, services attach improves, and operating discipline preserves margin. Cash generation remains strong with limited balance‑sheet risk. | Re‑rating sustained as investors price in durable growth and resilience; momentum supported on pullbacks. |

| Base | Healthy but competitive cycle; sales grow steadily with contained promotions; profitability stable as cost controls offset component inflation. | Range‑bound trade with episodic swings around product launches and quarterly updates. |

| Worse | Flagship reception is muted; competition intensifies; higher component costs and heavier promotions pressure margins; inventory turns slow. | De‑rating toward more conservative expectations until evidence of recovery emerges. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Reception and sell‑through of the Xiaomi 17 family, including camera, battery, and software update performance post‑launch.

- Gross‑margin trajectory versus component costs, FX, and promotional intensity.

- Supply security and timing for leading‑edge chipsets and key components.

- Competitive responses from global and domestic peers during the same cycle.

- Regulatory and geopolitical developments affecting manufacturing, distribution, or app/services availability.

- Capital allocation discipline and transparency around investment priorities.

Conclusion

Xiaomi’s setup into 2028 pairs improving fundamentals with elevated expectations. Trailing metrics show profitable growth, strong cash, and solid returns, while the share price strength and proximity to a 52‑week high reflect optimism that a premium flagship cycle can extend the story. The next phase requires execution: translating design buzz into durable advantages, maintaining margin discipline, and raising the value of the software and services layer to smooth hardware cyclicality. With cash of 111.93B against debt of 28.91B and consistent free‑cash‑flow generation, Xiaomi has the resources to invest and iterate. Yet the re‑rating makes the stock more sensitive to any missteps in launch quality, inventory management, or competitive positioning. For investors, tracking early demand signals, pricing discipline, and margin resilience across the Xiaomi 17 cycle will be key to assessing whether the current momentum can compound over the next three years.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.