Airbus SE enters October 2025 with strong equity momentum and stabilizing fundamentals. The shares have gained 52.03% over 12 months, approaching a 52-week high of 198.34 and trading above the 50- and 200-day moving averages. On the fundamentals side, trailing‑twelve‑month revenue stands at 70.02B, with a 7.04% profit margin and 6.23% operating margin; net income is 4.93B and EBITDA 7.14B. Liquidity and leverage look balanced with 12.01B in cash, 13.35B in total debt and a 1.16 current ratio, though levered free cash flow remains negative (‑3.73B) despite 6.17B in operating cash flow. A dividend of 2.00 (1.02% yield; 32.05% payout) complements sentiment tailwinds from recent analyst actions, including an upgrade and fresh coverage. The key questions now center on deliveries, cash conversion and sustaining backlog‑driven growth.

Key Points as of October 2025

- Revenue: Trailing revenue 70.02B; gross profit 10.75B; quarterly revenue growth (yoy) 0.50%.

- Profit/Margins: Profit margin 7.04%; operating margin 6.23%; ROE 24.11%; diluted EPS (ttm) 6.24; EBITDA 7.14B.

- Sales/Backlog: Backlog not disclosed in provided data; demand conditions supportive; quarterly earnings growth (yoy) 218.30% signals improving operating leverage.

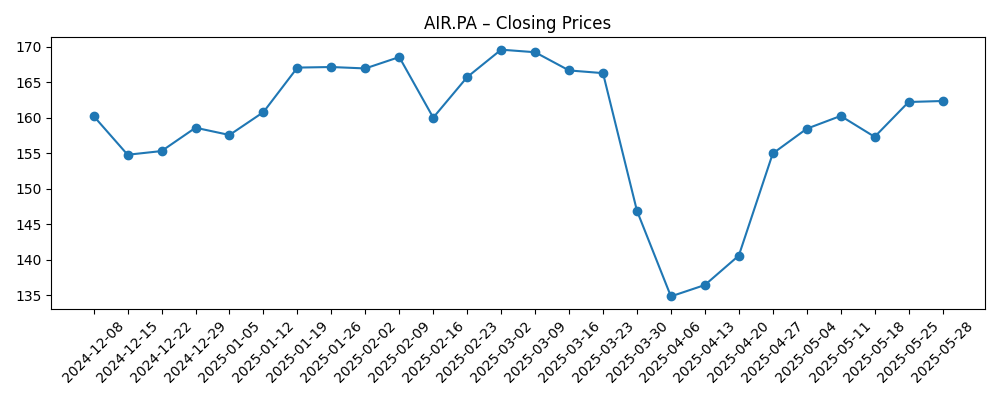

- Share price: 52‑week change 52.03%; high/low 198.34/124.72; 50‑day MA 183.85 vs 200‑day MA 167.63; beta 1.23; recent volumes 913.79k (3‑month) and 1.1M (10‑day).

- Analyst view: Reports indicate a Moderate Buy average rating; recent upgrade at UBS and new coverage at Goldman Sachs.

- Market cap: Not stated; implied large‑cap given 787.33M shares outstanding and shares near their 52‑week high; float 588.17M; insiders hold 25.70%, institutions 32.38%.

- Balance sheet: Cash 12.01B; total debt 13.35B; total debt/equity 57.69%; current ratio 1.16.

- Cash returns: Dividend rate 2.00 (1.02% yield); payout ratio 32.05%; last ex‑dividend 4/22/2025.

- Cash flow: Operating cash flow 6.17B; levered free cash flow −3.73B indicates ongoing investment and working‑capital needs.

Share price evolution – last 12 months

Notable headlines

- Airbus SE — unsponsored ADR receives average rating of Moderate Buy from brokerages [ETF Daily News]

- Airbus (OTCMKTS:EADSY) Upgraded at UBS Group [ETF Daily News]

- Airbus (OTCMKTS:EADSY) Now Covered by Analysts at The Goldman Sachs Group [ETF Daily News]

- Reviewing Conrad Industries (OTCMKTS:CNRD) & Airbus (OTCMKTS:EADSY) [ETF Daily News]

- Space Launch Services Industry Outlook 2025–2034 Featuring Profiles of Key Players Airbus SE… [GlobeNewswire]

- Aircraft MRO Industry Report 2025–2034… [GlobeNewswire]

Opinion

Airbus’s share price resilience into late September 2025 reflects a blend of improving profitability metrics and constructive sell‑side sentiment. The stock has climbed above both its 50‑ and 200‑day moving averages, a technical configuration that typically supports trend continuity when fundamentals cooperate. Reported quarterly earnings growth of 218.30% year over year highlights how operating leverage can swing results as production stabilizes and mix normalizes. The lingering weak spot is cash conversion: levered free cash flow remains negative despite solid operating cash flow, implying working‑capital absorption and ongoing investment. In our view, the near‑term share driver is whether management can convert backlog execution into consistently positive free cash flow while maintaining margins near current levels. With the 52‑week high close at hand, expectations look elevated, making delivery cadence and supply assurance pivotal to justify the rerating.

Analyst developments add an important layer. A Moderate Buy consensus alongside an upgrade and new coverage increases visibility among global investors and can broaden the shareholder base. That matters for a company with 787.33M shares outstanding and substantial float, as incremental institutional demand often follows new initiations. Still, ratings alone do not power a three‑year story. Investors will likely probe the durability of the 7.04% profit margin and 6.23% operating margin in the face of input‑cost variability and complex multi‑year contracting. If Airbus sustains mid‑single‑digit revenue growth while defending pricing and controlling disruption costs, equity holders could see a path toward steadier free cash flow and a healthier balance between growth investment and shareholder returns. Conversely, any wobble in deliveries or rework could quickly erode confidence at today’s valuation backdrop.

Strategically, Airbus’s diversified exposure across commercial aircraft, defense and space, and services provides multiple levers. Industry commentary featuring Airbus in space‑launch and MRO contexts underscores optionality in adjacencies, though these segments must ultimately translate into consolidated cash generation. With cash of 12.01B versus debt of 13.35B and a 1.16 current ratio, liquidity appears adequate for continued investment and supplier support. Management’s challenge is to balance production ramp commitments with supply‑chain resilience, ensuring on‑time delivery without tying up excessive working capital. Over the next three years, investors will watch for gradually improving inventory turns, stable unit costs, and measured capital spending. Progress here could offset cyclical swings, allowing the company to compound earnings and resume more predictable free‑cash‑flow delivery despite episodic shocks common to aerospace supply ecosystems.

Income investors will note the dividend of 2.00 (1.02% yield) and a 32.05% payout ratio, which sets a conservative floor under total return potential. A sustainable dividend, however, hinges on converting operating cash flow of 6.17B into positive levered free cash flow. If Airbus can sustain the current trajectory of earnings growth and reduce working‑capital drag, dividend cover should improve, possibly allowing incremental distributions over time. If not, management may prioritize balance‑sheet flexibility given debt of 13.35B and the cyclical nature of large programs. Taken together, the next three years likely hinge less on demand—which appears robust—and more on execution: supplier health, delivery reliability, and cost discipline. These operational threads will determine whether today’s premium versus long‑term averages is warranted or whether the share price consolidates while fundamentals catch up.

What could happen in three years? (horizon October 2025+3)

| Case | Revenue outlook | Profitability & cash | Share‑price drivers |

|---|---|---|---|

| Best | Steady demand supports multi‑year production increases; services mix expands. | Margins hold or improve; operating cash reliably converts to positive free cash flow. | Confidence builds on deliveries and cash; dividend credibility strengthens; multiple expands. |

| Base | Moderate growth as supply chain normalizes; deliveries broadly in line with plans. | Margins stable; intermittent working‑capital swings; free cash flow turns modestly positive. | Range‑bound multiple; returns driven by earnings growth and dividends. |

| Worse | Supply disruptions or program slippage constrain output. | Margin pressure from rework and costs; free cash flow remains uneven or negative. | De‑rating toward caution; focus shifts to balance‑sheet protection over distribution. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on deliveries and program milestones amid supply‑chain constraints and quality assurance demands.

- Cash conversion trajectory – turning operating cash flow into sustained positive free cash flow.

- Input‑cost inflation and contract pricing dynamics affecting operating margin stability.

- Regulatory and certification timelines across civil and defense programs.

- Capital allocation – dividend sustainability versus investment needs and balance‑sheet prudence.

- Sell‑side sentiment and coverage breadth following recent rating changes and initiations.

Conclusion

Airbus’s investment case into 2028 hinges on converting healthy demand into dependable cash flow while safeguarding margins. The company enters this period with solid reported profitability (7.04% profit margin; 6.23% operating margin), meaningful operating cash flow (6.17B), and adequate liquidity (12.01B cash vs 13.35B debt). The share price has rerated materially over the past year and hovers near a 52‑week high, aided by constructive analyst actions, which raises the bar for execution. We think a base‑case outcome involves moderate growth, gradual supply‑chain normalization, and a transition to steady—if not spectacular—free cash flow, supporting a dependable dividend. Upside requires cleaner deliveries and working‑capital discipline; downside stems from disruption and cost creep. Given the setup, patient investors may favor a quality‑at‑a‑reasonable‑price mindset, watching cash conversion, production cadence, and any updates that alter the visibility of multi‑year earnings and returns.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.