ArcelorMittal (MT.AS) is one of the world’s largest integrated steel and mining groups, operating across Europe, the Americas and Asia. It supplies flat and long steel to automotive, construction, machinery, packaging and energy markets, supported by captive iron‑ore assets. Key competitors include China Baowu, Nippon Steel, POSCO, Tata Steel and leading U.S. producers. The group’s strategy balances cost efficiency, higher‑value products and decarbonization investments.

Financially, the latest trailing‑twelve‑month snapshot shows revenue of 60.63B, gross profit of 4.92B and EBITDA of 4.7B. Net income is 2.5B, a 4.11% profit margin; operating margin remains thin at 0.47%. Liquidity looks adequate with total cash of 5.36B, current ratio 1.40, and total debt of 13.73B. Despite quarterly revenue growth of −2.0% year over year, quarterly earnings growth surged 255.8%. The share price is up 34.06% over the past year, recently around 30.36, with 50‑ and 200‑day moving averages at 28.66 and 26.60. Forward dividend yield stands at 1.74%.

Key Points as of September 2025

- Revenue and scale – TTM revenue 60.63B; gross profit 4.92B; EBITDA 4.7B.

- Profitability – Net income 2.5B; profit margin 4.11%; operating margin 0.47%; ROE 4.59%.

- Sales/demand – Quarterly revenue growth −2.0% YoY; backlog not disclosed in the snapshot.

- Share price and momentum – Latest weekly close 30.36; 52‑week range 20.54–32.18; 52‑week change 34.06%; beta 1.67; 50‑/200‑day MAs 28.66/26.60.

- Balance sheet – Total cash 5.36B; total debt 13.73B; current ratio 1.40; debt/equity 24.32%.

- Dividend – Forward annual dividend rate 0.52 (yield 1.74%); payout ratio 16.01%; next ex‑dividend date 11/12/2025.

- Ownership – Insiders hold 39.87%; institutions 21.65%; float 419.53M shares.

- Market cap – Approximately 23.1B (price 30.36 × 760.49M shares outstanding).

- Analyst/Street focus – Consensus rating not provided; focus on steel spreads, energy costs and capex discipline.

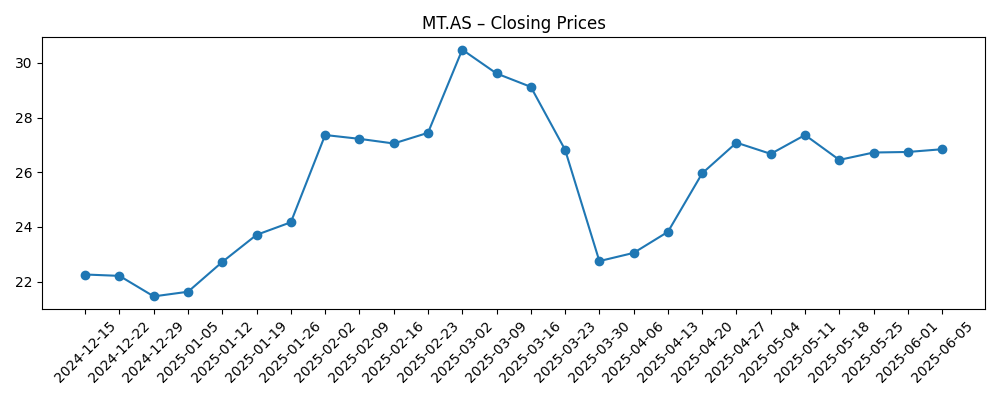

Share price evolution – last 12 months

Notable headlines

Opinion

MT.AS has reclaimed momentum in 2025, with the share up 34.06% over 12 months and trading above both the 50‑day (28.66) and 200‑day (26.60) moving averages. The latest weekly close near 30.36 leaves the stock within sight of its 52‑week high (32.18), suggesting the market is discounting firmer steel spreads and improved operational execution. In our view, the key question for the next three years is whether this momentum is cyclical or sustainable. A sustained move above the prior high would likely require confirmation that margins can expand from today’s thin 0.47% operating level without relying solely on steel price tailwinds. Conversely, a pullback toward the 200‑day average would not be surprising if macro growth wobbles or Chinese exports pressure European pricing.

Fundamentally, ArcelorMittal’s earnings recovery outpaced revenue, as evidenced by 255.8% quarterly earnings growth despite −2.0% revenue contraction. That speaks to mix, cost actions and lower input volatility, but it also exposes fragility: with a 4.11% profit margin and modest ROE of 4.59%, the equity story still leans on operational leverage. If raw materials or energy costs rise, or if demand in autos and construction softens, spreads can compress quickly. Over a three‑year horizon, we think the company’s integrated footprint and product upgrades can cushion the cycle, but investors should expect greater earnings variability than revenue suggests, and the beta of 1.67 underscores this sensitivity.

Capital allocation will also shape the path to 2028. Liquidity is solid (5.36B cash; current ratio 1.40) against 13.73B of debt, and the dividend looks serviceable with a 16.01% payout ratio and 1.74% forward yield. The near‑term ex‑dividend date on 11/12/2025 is a tactical catalyst. That said, levered free cash flow is currently negative (−220.5M), which can constrain buybacks if spreads weaken. Sustained operating cash flow (4.94B TTM) provides flexibility to fund maintenance and targeted growth, but major decarbonization projects could require phasing to avoid balance‑sheet stress. We expect management to prioritize returns on invested capital in higher‑value automotive grades and electrical steels.

Strategically, ArcelorMittal’s global reach and captive mining assets remain advantages as the steel industry navigates decarbonization. Success in low‑carbon technologies and premium products could expand margins through the cycle, especially if customer willingness‑to‑pay improves in autos, machinery and energy. Conversely, policy risk around carbon costs in Europe, the pace of green‑steel demand, and competitive responses from Asian and U.S. producers will influence pricing power. Over three years, we see a credible path for mix‑led growth and balance‑sheet resilience, but the investment case hinges on disciplined capex, stable spreads and execution on decarbonization without diluting returns.

What could happen in three years? (horizon September 2025+3)

| Scenario | What it looks like | Implications for MT.AS |

|---|---|---|

| Best case | Global demand in autos/construction improves, steel spreads normalize higher, and low‑carbon product premiums gain traction. Cost discipline sticks and input prices stay benign. | Margins expand from current levels; stronger cash generation supports dividends and selective buybacks while funding decarbonization. |

| Base case | Cycle remains mixed: modest growth in Americas and India offsets slower Europe. Spreads fluctuate within a mid‑range; execution and mix improvements carry most of the load. | Earnings remain volatile but trend stable; balance sheet stays sound; steady dividend with opportunistic capital returns. |

| Worse case | Demand weakens, exports pressure Europe, energy/raw‑material costs rise, and green‑capex outlays pinch cash flow. | Margins compress; capex is reprioritized; dividend preserved but growth pauses; shares trade closer to long‑term averages. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Steel price spreads versus raw‑material and energy costs across core regions.

- Execution on decarbonization and premium product strategy without eroding returns.

- Macro conditions in automotive and construction end‑markets, especially Europe and the Americas.

- Capital allocation discipline given current cash, debt and free‑cash‑flow profile.

- Trade policy, carbon regulation and currency movements affecting competitiveness.

Conclusion

ArcelorMittal enters the next three years with improving share price momentum, a solid liquidity position and meaningful operating leverage to any firming of steel spreads. The financial snapshot shows a sizeable franchise (60.63B revenue) but still‑thin operating margin, making execution and cost control critical. If the company sustains mix upgrades and progresses on lower‑carbon offerings, it can widen margins through the cycle and fund necessary investments from operating cash flow. However, the equity case remains cyclical: demand softness, input‑cost spikes or policy shifts could quickly pressure profitability. We think a balanced stance is warranted. For medium‑term investors, the setup favors disciplined exposure—monitoring spreads, cash conversion and capital allocation—while using volatility to build positions if fundamentals track the base‑to‑better scenarios. Dividend visibility and a measured investment program are likely to be the near‑term anchors of total return.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.