Fagron N.V. enters the next three years with healthier momentum but a higher bar. Through mid‑2025 the pharmaceutical compounding specialist delivered double‑digit top‑line expansion (10.90% year‑over‑year in the most recent quarter) and firmer earnings, while the share price rallied into mid‑year before consolidating as investors weighed execution on several initiatives. Management has moved to expand capacity in Belgium, announced a bolt‑on compounding acquisition, and refreshed the finance function with a new CFO — all consistent with a scale‑and‑discipline playbook. Cash generation has remained solid and the dividend intact, supporting confidence in the business model. Valuation sits in a mid‑teens forward multiple (forward P/E 14.39), leaving upside if growth proves durable and leverage trends improve, yet also limiting tolerance for execution slips. Sector context matters: compounding and outsourced pharmacy services increasingly help hospitals and pharmacies navigate shortages and cost pressures, but outcomes remain sensitive to regulatory standards and payer behavior. Against that backdrop, Fagron’s next leg depends on clean capacity ramp‑up, integration quality, and margin mix.

Key Points as of October 2025

- Revenue: trailing twelve months revenue of 918.75M; quarterly revenue growth (yoy) at 10.90% indicates healthy demand.

- Profit/Margins: profit margin 9.33% and operating margin 15.38%; EBITDA 158.25M underscores decent operating leverage.

- Sales/Backlog: order book/backlog data not disclosed; sales momentum reflected in double‑digit quarterly revenue growth.

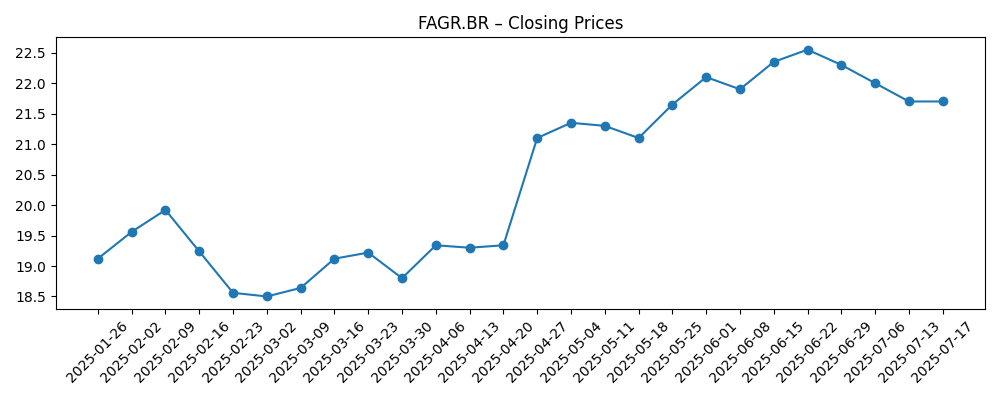

- Share price: last weekly close 20.60 (2025‑10‑16); 52‑week range 15.14–23.50; 50D/200D moving averages 20.42/20.27; low beta at 0.28.

- Analyst view: formal consensus not provided; valuation markers — forward P/E 14.39 and EV/EBITDA 10.52 — suggest the market prices in moderate, sustainable growth.

- Market cap & ownership: market capitalization 1.48B; institutions hold 65.86% and insiders 5.10%; float 64.91M shares.

- Balance sheet & cash: total debt 404.44M (debt/equity 80.02%) and cash 89.27M; current ratio 1.76; operating cash flow 120.42M; levered free cash flow 57.06M.

- Dividend: forward dividend 0.35 per share (1.69% yield); payout ratio 29.91%; ex‑dividend date was 5/19/2025.

- Qualitative: Belgium capacity expansion, a bolt‑on acquisition, and a new CFO point to execution focus; regulatory standards in compounding remain a key external variable.

Share price evolution – last 12 months

Notable headlines

- Fagron N.V. Announces Q2 2025 Earnings Results

- Fagron to Expand Manufacturing in Belgium

- Fagron Announces Acquisition of Compounding Pharmacy

- Fagron Reports Strong Organic Growth in 2025 First Quarter

- Fagron Taps into New Markets with Innovative Solutions

- Fagron N.V. Annual General Meeting 2025 Voting Results

- Fagron Drives Sustainability Initiatives

- Fagron Appoints New CFO to Enhance Financial Strategy

Opinion

Fagron’s recent figures point to a business that is compounding (literally and figuratively) through disciplined execution. Double‑digit revenue growth alongside positive earnings momentum suggests demand from hospitals and pharmacies remains resilient. Margins at the operating level indicate good cost control and mix, and cash conversion supports both dividends and balance‑sheet flexibility. The valuation framework — mid‑teens forward earnings multiple and EV/EBITDA around low double digits — implies investors trust the earnings quality but expect consistent delivery. In that sense, 2025’s share‑price consolidation looks more like a pause for verification than a thesis change.

The sustainability test will center on capacity ramp‑up and integration. The Belgium expansion can enhance sterile and non‑sterile throughput, but it also introduces ramp costs and validation timing risk typical in regulated environments. The bolt‑on acquisition can add local share and portfolio breadth, though integration discipline will dictate whether synergies show up in margins or get offset by complexity. With a new CFO, capital allocation signals — organic investments versus additional M&A — will influence how much free cash flow reaches deleveraging and dividends.

Within the broader healthcare‑services ecosystem, compounding competes on reliability, compliance, and speed rather than pure price. Drug shortages and hospital staffing constraints continue to favor outsourcing, while evolving standards can raise the bar for smaller competitors. That dynamic tends to support scale players with quality systems and diversified product sets, which can underpin pricing power and steadier utilization. If Fagron demonstrates consistent service levels through its expansion, the narrative could shift from “volume‑led recovery” to “quality‑led share gains,” which typically commands a sturdier multiple.

Conversely, the industry’s sensitivity to regulation and payer behavior caps complacency. Tighter standards, changes in reimbursement workflows, or normalization in drug‑shortage intensity could slow volumes or increase compliance costs. FX and input‑cost volatility add noise to margins, and any delay in project validation could stretch working capital. These are manageable with conservative leverage and cash discipline, but they will shape the near‑term narrative — and, by extension, whether the market is willing to move the valuation band meaningfully higher or simply hold it in place pending proof.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Belgium capacity comes online smoothly, integration of the acquired pharmacy enhances local density and product breadth, and service reliability during drug‑shortage episodes enables share gains. Operating discipline lifts margins, cash generation supports steady deleveraging and a growing dividend, and regulatory clarity favors scaled operators. The equity narrative shifts toward a quality growth compounder. |

| Base case | Growth normalizes as new capacity ramps and demand remains solid but not frothy. Margins stay broadly stable as mix and efficiency offset inflation. Management balances selective bolt‑ons with organic investments, maintaining prudent leverage and a consistent dividend. The market maintains a mid‑range multiple pending continued execution. |

| Worse case | Regulatory changes or validation delays slow volumes, integration synergies underwhelm, and pricing tightens as shortages ease. Input‑cost and FX headwinds compress margins and working capital stretches. Management prioritizes remediation and balance‑sheet protection, and the market assigns a risk‑discounted multiple until operational momentum is restored. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Execution on Belgium capacity ramp‑up, validation timelines, and quality metrics.

- Integration outcomes from the recent compounding acquisition and any further M&A.

- Regulatory and standard‑setting changes affecting compounding workflows and costs.

- Hospital/pharmacy demand trends amid drug‑shortage dynamics and reimbursement behavior.

- Margin resilience versus input‑cost and FX volatility; cash conversion and working‑capital discipline.

- Capital allocation signals under the new CFO — balance between growth investment, deleveraging, and dividends.

Conclusion

Fagron’s setup into 2026–2028 blends solid fundamentals with identifiable execution gates. Recent double‑digit sales growth and healthy operating margins indicate a business capturing durable demand drivers, while strong cash generation, a modest dividend, and manageable leverage frame a disciplined capital story. The share‑price pause since mid‑year reflects a market waiting for proof that new capacity and M&A can convert into sustained margin and cash gains without regulatory hiccups. Sector dynamics — outsourcing to improve resilience and costs — still favor scaled, compliant operators. If Fagron validates and ramps Belgium on schedule, integrates its acquisition cleanly, and preserves cash conversion, the narrative can shift toward quality‑led expansion within a stable valuation band. Watch next 1–2 quarters: capacity ramp milestones; acquisition integration updates; margin mix and pricing; cash conversion versus working‑capital needs; regulatory or standard‑setting signals.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.