Ferrari N.V. (RACE) enters late 2025 with premium margins and a product pivot toward electrified supercars. Trailing-12-month revenue stands at $6.96B, with a 30.74% operating margin and 22.91% net margin, supporting $10.46 in diluted EPS. Shares trade near $486, within a 52‑week range of $391.54–$519.10, after a volatile spring that briefly topped $500 in February. Cash of $1.47B against $3.16B of total debt and a 1.99 current ratio indicate manageable leverage, while beta of 0.70 underscores lower volatility than the market. With quarterly revenue and earnings up 4.40% and 2.90% year over year, Ferrari maintains steady growth and a forward dividend yield of 0.69% (payout ratio 33.51%). This three‑year outlook weighs new hybrid launches, margin durability, and brand strength against macro and regulatory risks.

Key Points as of September 2025

- Revenue (ttm): $6.96B; quarterly revenue growth (yoy): 4.40%.

- Profitability: operating margin 30.74%; profit margin 22.91%; ROE 48.02%; EPS (ttm) 10.46.

- Sales/Backlog: quarterly earnings growth (yoy) 2.90%; no disclosed backlog metrics in this snapshot.

- Share price: last close ~$486.50 (9/23/2025); 52‑week range $391.54–$519.10; 50/200‑day MAs 477.07/461.90; beta 0.70.

- Balance sheet: cash $1.47B; debt $3.16B; current ratio 1.99; operating cash flow $2.35B; levered FCF ~$0.57B.

- Dividend/Returns: forward yield 0.69% (rate $3.38); trailing yield 0.63% (rate $2.99); payout ratio 33.51%.

- Market cap/Ownership: ~$86.6B (177.96M shares); float 118.73M; insiders 30.51%; institutions 41.76%; avg 3‑mo vol ~407k; short ratio 4.76.

- Investor context: 52‑week change +2.61% vs S&P 500 +16.33% – underperformance despite margin leadership.

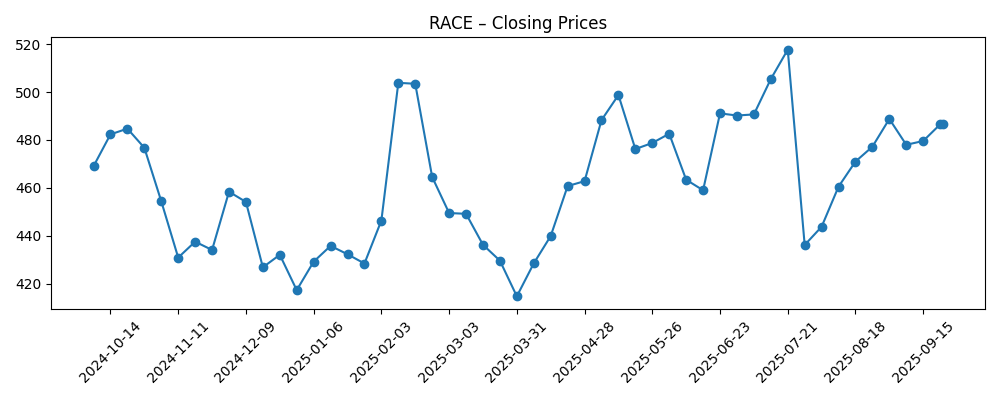

Share price evolution – last 12 months

Notable headlines

- The Ferrari Testarossa returns as a plug-in hyrbid with 1035hp (The Verge)

- Ferrari revives wedge-shaped car Testarossa with the hybrid super sports berlinetta (Designboom)

Opinion

Ferrari’s revival of the Testarossa nameplate as a plug‑in hybrid is strategically important. It aligns the marque’s heritage with electrified performance, supporting the company’s transition pathway without diluting exclusivity. For a brand that competes on scarcity, design, and emotional appeal, a halo hybrid can underpin pricing power and option monetization while easing regulatory pressures. The move also gives Ferrari a platform to iterate software, battery management, and electric‑assist tuning across future models. In a three‑year lens, successful execution could lengthen product cycles, widen customization revenue, and stabilize margins in a tightening emissions regime. The headline launches matter less for absolute volume than for reinforcing brand desirability, which historically translates into robust order books and disciplined allocation. On balance, this product strategy supports the premium multiple already implied in the shares, provided launch quality and waitlist discipline remain intact.

Margin durability is central to the equity story. With a 30.74% operating margin and 22.91% net margin, Ferrari has room to absorb higher input costs or battery‑related capex without sacrificing returns, aided by ROE of 48.02% and strong operating cash flow of $2.35B. The hybrid roadmap can protect mix and pricing, but execution risk exists around complexity, homologation timetables, and customer acceptance of electrified drivetrains in legacy nameplates. The company’s measured capacity planning is a tailwind for pricing, though it can cap near‑term growth. Over the next three years, investors are likely to focus on option take rates, special‑series cadence, and software‑feature monetization as incremental margin levers. Any evidence that hybridization enhances performance without compromising the brand’s visceral appeal would strengthen confidence in sustained high‑20s to low‑30s operating margins.

Share performance has been choppy in 2025: the stock spiked above $500 in February, then consolidated, and now trades near $486 with a 52‑week range of $391.54–$519.10. Despite lower beta (0.70), RACE has underperformed the S&P 500 on a 52‑week basis (+2.61% vs +16.33%), suggesting valuation digestion after a strong multi‑year run. The 50‑ and 200‑day moving averages at 477.07 and 461.90 offer a sense of trend support, while average three‑month volume near 407k indicates moderate liquidity. Short interest is limited relative to market cap, and insider/institutional holdings remain significant. Over a three‑year horizon, catalysts tied to product unveilings, capital return cadence, and brand milestones may matter more than quarterly beats. Stability in margins combined with visible launch schedules could help the stock reclaim momentum, but macro shocks can still overwhelm idiosyncratic strengths.

Capital allocation and brand halo effects round out the thesis. Ferrari’s forward dividend yield of 0.69% with a 33.51% payout ratio leaves room for disciplined cash returns alongside investment in hybrid platforms. Motorsport visibility can amplify brand equity even when titles are elusive, but competitive dynamics and regulatory changes in racing can vary the halo effect. Currency and luxury taxation policies may influence regional mix and pricing corridors, while supply chain reliability remains a practical constraint. If the company maintains scarcity, elevates the hybrid lineup with signature design cues (as seen in the Testarossa relaunch), and sustains high conversion on personalization, the equity case remains anchored by quality and cash generation. Conversely, any erosion of perceived exclusivity or delays in technology integration could compress the multiple and dull the long‑term premium.

What could happen in three years? (horizon September 2025+3)

| Case | Possible outcome by late 2028 |

|---|---|

| Best | Hybrid launches resonate strongly; order visibility remains robust; margins stay at premium levels; brand heat increases via successful halo models; disciplined capital returns complement investment; share performance outpaces broader market on sustained quality and scarcity. |

| Base | Steady rollout of electrified models with stable demand; pricing power offsets input costs; margins hold near recent ranges; valuation premium persists; stock tracks earnings progression with periodic volatility around launches and macro headlines. |

| Worse | Execution hiccups or regulatory shifts weigh on deliveries; customer pushback on electrification; supply constraints or cost inflation pressure margins; brand halo softens; multiple compresses and the shares underperform luxury and market benchmarks. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Product execution and reception of new hybrids (e.g., Testarossa relaunch) and cadence of special‑series models.

- Margin resilience amid input costs, battery sourcing, and regulatory compliance spending.

- Macro luxury demand, taxation policies, and foreign exchange effects on regional mix and pricing.

- Supply chain reliability and capacity planning relative to order intake and delivery timing.

- Capital allocation (dividends and potential buybacks) versus reinvestment in technology and manufacturing.

Conclusion

Ferrari’s investment case over the next three years hinges on translating brand equity into a successful electrified portfolio without compromising exclusivity. Current fundamentals show healthy profitability (30.74% operating margin; 22.91% net margin), solid cash generation, and a measured balance sheet, supporting both innovation and returns to shareholders. The Testarossa hybrid relaunch underscores a strategy to blend heritage with modern performance, a formula that can sustain pricing power and option monetization. While the stock has underperformed the S&P 500 over the last year, its premium characteristics and lower beta indicate resilience through cycles. Key watch items include launch quality, personalization uptake, capital allocation discipline, and macro sensitivity in luxury demand. If Ferrari preserves scarcity and executes on hybridization, the valuation premium can endure; if brand heat or execution falter, multiple compression is the primary risk to the equity story.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.