EssilorLuxottica’s shares have rerated over the past year as investors leaned into the group’s blend of prescription eyewear and luxury frames. What changed is sentiment: steady demand in eye care and tighter control over retail operations improved confidence that growth can endure across cycles. The stock now trades at a forward P/E of 34.72, which embeds a premium for resilient cash generation and pricing power. With a 41.91% gain over the past year, the debate is no longer about recovery but about durability. This matters because eyewear straddles discretionary fashion and non‑discretionary vision correction, a mix that tends to cushion downturns compared with broader apparel. If execution keeps lens innovation, brand storytelling, and store productivity aligned, the multiple can be defended; if FX volatility, tourism softness, or slower consumer traffic bite, it can be tested. For investors in the sector, the next phase hinges on whether EssilorLuxottica converts a solid top‑line into consistent earnings acceleration without overreliance on promotions.

Key Points as of November 2025

- Revenue – trailing twelve months at 27.24B; quarterly revenue growth (yoy) at 5.50%, pointing to steady demand in lenses and frames.

- Profitability – profit margin 8.74% and operating margin 14.25%; EBITDA at 5.63B; quarterly earnings growth (yoy) of 1.60% shows modest flow‑through.

- Cash generation – operating cash flow 4.91B and levered free cash flow 3.07B support ongoing reinvestment and dividends.

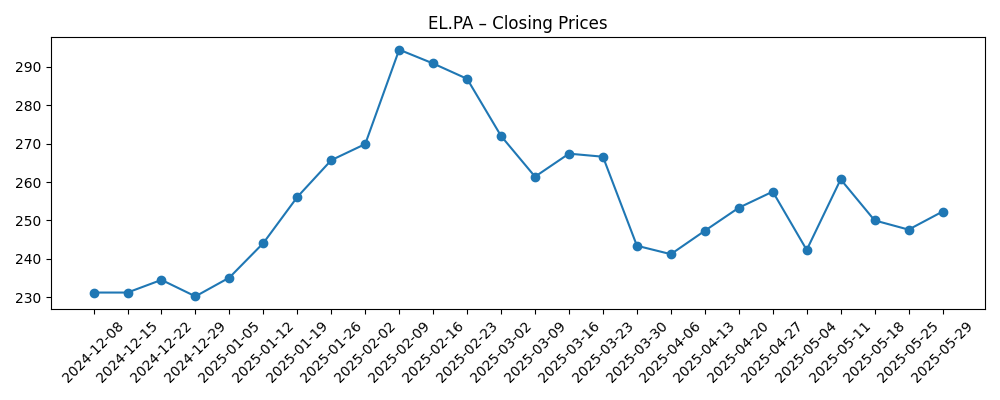

- Share price – latest weekly close at 317.0 (Nov 3, 2025); 52‑week high 320.55; 52‑week change 41.91%; 50‑day MA 279.70 vs 200‑day MA 262.84; beta 0.76.

- Valuation – market cap 130.42B; trailing P/E 54.91, forward P/E 34.72; PEG (5yr) 2.87; Price/Sales 4.79; EV/EBITDA 21.07.

- Balance sheet – total debt 14.05B vs cash 2.79B; current ratio 0.97; total debt/equity 36.58%.

- Sales/Backlog – backlog data not disclosed; visibility underpinned by recurring prescriptions and sunwear seasonality.

- Dividend – forward annual dividend 3.95 per share (1.24% yield); payout ratio 76.70%; last ex‑dividend date 5/7/2025; 5‑year average yield 1.28.

- Qualitative – vertical integration across lenses, frames, and retail; FX – foreign exchange – exposure from global footprint; brand/licensing and vision‑benefit regulation remain watchpoints.

Share price evolution – last 12 months

Notable headlines

Opinion

Top‑line momentum looks intact, with quarterly revenue growth of 5.50% year over year. Earnings grew more slowly at 1.60%, suggesting a mix shift and reinvestment dampened operating leverage despite a solid 14.25% operating margin. The quality of the advance appears operational rather than one‑off: eyewear demand is tethered to medical need in prescription lenses and refreshed by fashion cycles in sunwear. Currency likely played a part in reported growth, and the vertical model helps price discipline. The market rewarded this consistency, pushing shares toward the 52‑week high and compressing the risk premium implied by a 0.76 beta. The key question for the next leg is whether margins can expand without leaning on promotions or extraordinary licensing contributions.

Cash‑flow health underpins the current premium. Operating cash flow of 4.91B and levered free cash flow of 3.07B are robust relative to investment needs, while a 76.70% payout ratio and a 1.24% forward yield keep income investors engaged. The balance sheet shows 14.05B of total debt against 2.79B of cash and a current ratio just under 1, all manageable so long as retail traffic and Rx volumes remain stable. That gives management options to keep funding store productivity and lens innovation. The trade‑off is that slower EPS conversion versus sales, if persistent, could limit scope for multiple expansion from already elevated forward P/E levels.

Within the global eyewear industry, EssilorLuxottica’s end‑to‑end control—lenses, frames, retail—supports pricing power and supply certainty versus peers that rely on third parties. This structure can capture value from premiumization and protect service levels when supply chains tighten. Competitive intensity remains real: branded peers and value operators are pushing harder online and in wholesale, while some retailers grow private‑label offerings. In that environment, the company’s differentiation will hinge on lens technology, brand curation, omni‑channel convenience, and in‑store exam integration, not just advertising spend.

For the stock’s narrative and multiple, macro conditions will frame the next three years: a resilient consumer and stable tourism support premium sunwear, while demographics sustain optical prescriptions. If management converts store traffic and fitting capacity into higher average ticket and mix, earnings growth can re‑align with sales, keeping the PEG ratio defensible. Conversely, if FX headwinds, Asia tourism softness, or category down‑trading persist, consensus may gravitate to a slower path, inviting de‑rating toward sector averages. The premium can endure, but it likely requires visible self‑help—simpler assortments, better retail labor productivity, and faster digital refills—to turn steady demand into compounding EPS.

What could happen in three years? (horizon November 2025+3)

| Scenario | Narrative |

|---|---|

| Best | Lens innovation and premium frame mix accelerate; retail productivity improves through omni‑channel scheduling and faster fulfillment; FX is neutral; margins edge higher as scale benefits accrue; free cash flow comfortably covers dividends and reinvestment, sustaining a premium valuation. |

| Base | Mid‑single‑digit sales growth continues; operating margins remain broadly stable; cash generation funds steady capex and dividends; valuation stays at a modest premium to sector given predictable growth and defensiveness. |

| Worse | Consumer softness and unfavorable FX trim reported growth; tourism‑exposed sunwear underperforms; retail wage and input costs pressure margins; earnings trail sales for several quarters, prompting multiple compression toward industry norms. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- FX volatility versus the euro and U.S. dollar affecting reported revenue and margins.

- Retail traffic and conversion in key markets (U.S., Europe, Asia) and the balance between sunwear and prescription categories.

- Execution on vertical integration benefits—pricing, sourcing, and store productivity—driving EPS conversion.

- Regulatory or reimbursement changes in vision benefits and any shifts in brand/licensing agreements.

- Input costs and supply chain stability for lenses and frames, including labor and materials.

- M&A or portfolio actions that alter growth and capital allocation priorities.

Conclusion

EssilorLuxottica enters the next three years with steady revenue growth (5.50% yoy in the most recent quarter), disciplined profitability (14.25% operating margin), and cash generation that supports its dividend. The premium multiple—forward P/E 34.72 against a 41.91% one‑year share gain—signals confidence in a durable blend of medical need and brand appeal. To sustain that premium, the company must convert store traffic and lens innovation into faster EPS growth than the recent 1.60% pace, while managing FX and retail cost inflation. A balanced setup follows: defensiveness from prescriptions, cyclicality in sunwear, and self‑help from vertical integration. Watch next 1–2 quarters: pricing and mix in lenses; retail productivity and traffic; operating margin progression; FX translation on reported growth; cash conversion (OCF to FCF); any updates on brand/licensing or channel strategy. These will shape whether the narrative holds at a premium or re‑rates closer to sector averages.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.