Koninklijke BAM Groep’s stock has rerated sharply in 2025 as investors price a cleaner balance sheet, improving execution, and a steadier mix tilted to infrastructure, while the company’s trailing revenue of €6.69 billion underscores scale but also the thin margins typical of European contractors. Shares have nearly doubled over the past year on evidence of tighter bidding and positive cash generation, after several cycles where cost inflation and legacy projects pressured returns. The forward P/E near 9.5 suggests the market expects earnings to rise as projects mature and working capital normalizes, but it also embeds a discount for the sector’s inherently low returns and episodic risk. In the construction and civil engineering sector, input-cost volatility is easing and public infrastructure pipelines in the Netherlands and the UK remain supportive, yet execution discipline remains the primary differentiator. For investors, the three‑year question is whether BAM can convert solid order intake into cash-backed profits without fresh provisions, sustaining dividends while maintaining a net-cash posture.

Key Points as of October 2025

- Revenue – Trailing 12‑month revenue: €6.69B; quarterly revenue growth (yoy): 7.30%.

- Profit/Margins – Profit margin: 1.93%; operating margin (ttm): 2.87%; EPS (ttm): 0.41; quarterly earnings growth (yoy): 84.90%.

- Sales/Backlog – Backlog (value of contracted work not yet delivered) data not disclosed; watch order intake quality and conversion.

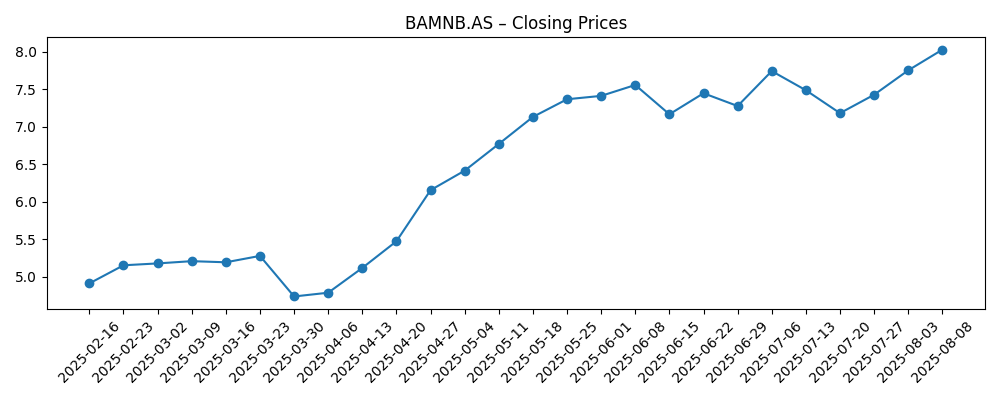

- Share price – Recent close: 8.54 (Oct 7, 2025); 52‑week high/low: 8.56/3.86; 52‑week change: 89.58%; 50‑day/200‑day MAs: 7.86/6.31; beta: 1.32.

- Analyst/valuation lens – Trailing P/E: 19.70; forward P/E: 9.50; EV/EBITDA: 7.31; Price/Sales: 0.32; Price/Book: 2.37. (EV/EBITDA compares enterprise value to EBITDA, a proxy for operating cash earnings.)

- Market cap – Market capitalization: €2.10B; enterprise value: €1.94B.

- Balance sheet/liquidity – Cash: 500.6M vs debt: 347.4M; current ratio: 0.97; total debt/equity: 39.21%.

- Cash generation & returns – Operating cash flow (ttm): 287.19M; levered free cash flow (ttm): 138.54M; forward dividend: 0.25 (yield 3.01%); payout ratio: 60.98%; last ex‑div: 5/12/2025.

- Qualitative setup – Exposure to Netherlands/UK infrastructure; FX mix (EUR–GBP) adds translation risk; public budgets and risk‑sharing contracts remain pivotal to margin stability.

Share price evolution – last 12 months

Notable headlines

Opinion

What the numbers say, the picture is of a contractor exiting a repair phase. Revenue is growing again while profit metrics, though thin, are improving: a 1.93% profit margin alongside 2.87% operating margin is consistent with early‑cycle repair in European construction. The sharp improvement in quarterly earnings growth (yoy) suggests legacy drag is receding and that bid discipline is holding. Positive operating cash flow and levered free cash flow support this view, indicating that profits are not merely accounting. Liquidity is acceptable but tight, as a current ratio below 1 signals working capital still tied up in projects. Cash exceeding debt offers resilience against project volatility, but it increases the onus on converting work‑in‑progress into cash. With return on equity at 11.88%, execution improvements are reaching the P&L, yet sustaining this will depend on avoiding cost overruns that historically eroded margins in the sector.

Valuation implies an earnings inflection is in sight: the gap between a 19.70 trailing P/E and 9.50 forward P/E indicates the market expects materially higher earnings as projects mature and provisions normalize. EV/EBITDA of 7.31 is within a typical mid‑cycle band for quality European contractors, suggesting neither distress nor exuberance. The dividend yield of 3.01% with a 60.98% payout signals a commitment to shareholder returns, but also limited room for surprises if cash conversion slips. Balance‑sheet optionality exists given cash above debt, yet a current ratio of 0.97 underlines the importance of disciplined working‑capital management. In short, the current multiple backs a margin‑rebuild story that must be confirmed by steady cash generation and the absence of new one‑off charges.

And the Sector lens, industry conditions are incrementally supportive: input‑cost volatility has cooled from the 2022–2023 spikes, and public infrastructure agendas tied to energy transition and resilience remain visible in the Netherlands and the UK. That backdrop can sustain volume, but it does not guarantee pricing power; European contractors often operate on thin margins with risk‑sharing models that cap upside. Success therefore hinges on selecting projects with balanced risk transfer, robust subcontractor networks, and digital project controls that catch deviations early. For BAM, a steadier civil‑infrastructure mix should lower earnings volatility versus large, fixed‑price building projects, helping narrow the spread between gross profit and operating profit over time.

Sector lens, part 2. Currency (EUR–GBP) introduces translation swings, and public‑sector procurement can shift with budgets, elections, and regulatory reforms. Meanwhile, sustainability requirements and permitting complexity lengthen lead times but can favor experienced contractors with strong compliance processes. Competitive dynamics remain rational in core markets, but any resurgence of aggressive bidding would pressure sector margins. If BAM can show consistent backlog conversion into cash, maintain project selection discipline, and demonstrate stable margins through an inflation and wage‑pressure cycle, the narrative could migrate from “repair” to “compounding,” which typically supports a sturdier multiple versus peers. Conversely, a single problematic megaproject or a working‑capital squeeze would quickly pull the story back toward caution.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Order intake tilts to infrastructure and energy‑transition work with balanced risk sharing. Cost control and digital delivery reduce overruns, and cash conversion stays solid, supporting a stable, growing dividend. Margins trend modestly higher than today and earnings quality improves, easing volatility across cycles. |

| Base case | Revenue tracks low growth with steady public demand in the Netherlands/UK. Project mix remains disciplined; occasional small charges are offset by better execution. Cash generation is adequate to fund maintenance capex and a sustained dividend, with valuation anchored near mid‑cycle. |

| Worse case | A macro slowdown and one or two adverse projects strain working capital and compress margins. FX and input‑cost swings reappear, backlog conversion slows, and management prioritizes balance‑sheet defense. Dividend flexibility is tested and the equity narrative reverts to capital preservation. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Project execution discipline – absence or emergence of cost overruns and provisions on large contracts.

- Backlog quality and conversion – visibility of awards, mix of infrastructure vs. fixed‑price building, and timing of cash receipts.

- Input costs and labor/subcontractor availability – inflation, productivity, and supply‑chain stability.

- Working‑capital dynamics – billing, advances, and inventory movements affecting operating cash flow.

- Public‑sector budgets and regulation – Netherlands/UK infrastructure funding, procurement rules, and permitting timelines.

- Capital allocation – dividend policy versus reinvestment, and any portfolio pruning or selective M&A.

Conclusion

BAM enters the next three years with improving fundamentals, a supportive infrastructure backdrop, and a valuation that assumes earnings progress but still prices in sector risk. Revenue growth is back, margins remain thin but directional, and cash generation is credible—yet liquidity and working‑capital tightness argue for continued prudence. The setup is a classic “prove‑it” phase for European contractors: consistent execution, clean quarters, and cash‑backed profits will determine whether the story migrates from repair to resilience. For now, the balance of evidence supports a cautiously constructive narrative tied to disciplined bidding and steady public demand in core markets. Watch next 1–2 quarters: backlog disclosure and conversion; operating‑margin progression; working‑capital and cash conversion; bid discipline on large tenders; dividend sustainability; any early signs from Netherlands/UK infrastructure budgets. How these datapoints evolve will shape whether today’s forward multiple compresses or holds as earnings step up.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.