LVMH Moët Hennessy Louis Vuitton (MC.PA) has staged a volatile six‑month stretch, with shares sliding into early summer before rebounding into October as investors reassessed the durability of global luxury demand. Under the surface, growth cooled: quarterly revenue growth fell 4.5% year over year, while profit trends reflected heavier investment and a less favorable mix. The reset largely traces to a normalization after the post‑pandemic surge, softer aspirational spending in parts of Asia and the U.S., and foreign‑exchange swings that can amplify or mute reported figures. Yet the core thesis—brand equity and scale across fashion, wines & spirits, perfumes, watches and selective retail—remains intact, and a forward P/E of 22.57 signals the market still assigns a quality premium. For investors across the sector, LVMH’s trajectory matters because it anchors sentiment on pricing power, tourist flows and the health of the high‑end consumer; when the leader tightens or loosens the purse strings on marketing and store openings, peers tend to follow. The next three years hinge on whether demand re‑accelerates, margins stabilize, and FX stops working against comparables.

Key Points as of October 2025

- Revenue – Trailing twelve‑month revenue is 82.82B, with quarterly revenue growth down 4.50% year over year.

- Profit/Margins – Profit margin 13.26% and operating margin 22.58%; diluted EPS (ttm) 21.99; quarterly earnings growth down 21.60% year over year.

- Sales/Backlog – No order backlog metric disclosed; revenue per share 166.01. Demand visibility is tied to retail footfall, tourist flows, and product drops.

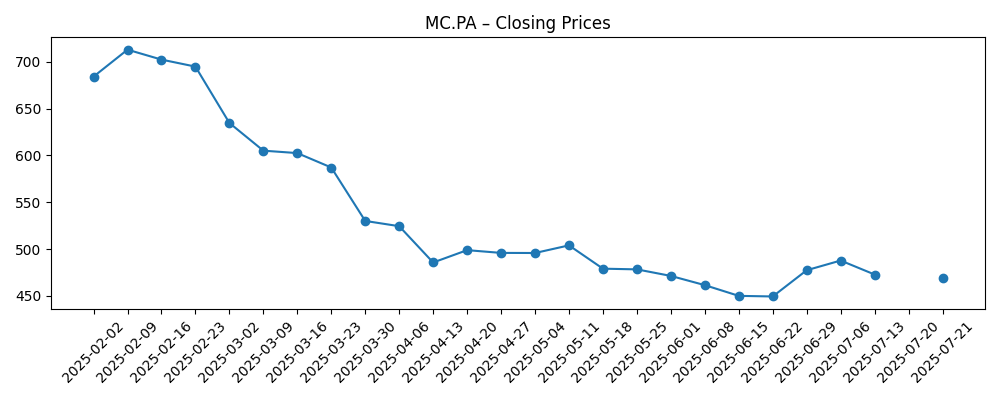

- Share price – Shares troughed in June before recovering to 612.5 by Oct 24; 52‑week change −3.10% with a 436.55–762.70 range; beta 1.01.

- Analyst view – No consensus provided in the data. Valuation multiples (forward P/E 22.57; PEG 3.43) imply growth expectations are still priced in.

- Market cap & income – Market capitalization 274.73B; forward annual dividend yield 2.12% on a 13 dividend, payout ratio 59.09%; ex‑dividend date 12/2/2025.

- Balance sheet & liquidity – Total debt 39.71B vs total cash 12.33B; current ratio 1.48; debt/equity 59.37%.

- Ownership & float – Shares outstanding 496.54M; insiders hold 49.44% and institutions 17.37%, a structure that can dampen float‑driven volatility.

Share price evolution – last 12 months

Notable headlines

Opinion

LVMH’s latest trend line shows demand normalization rather than a structural break. A 4.5% year‑over‑year revenue decline paired with a steeper 21.6% earnings contraction suggests operating deleverage and heavier brand investment, not an erosion of brand equity. Mix likely played a role: categories with higher fixed costs and marketing intensity can compress margins when volumes cool. Foreign exchange (FX – currency translation) also matters; swings can inflate or deflate reported sales without changing underlying demand. The rebound in the share price into October indicates investors were willing to look past mid‑year softness toward holiday and travel‑related demand, while the stock’s 52‑week change remains modestly negative. In short, the figures depict a high‑quality business absorbing a cyclical pause and protecting franchises through spend—an approach that tends to protect long‑term pricing power at the expense of near‑term margins.

Quality of earnings looks supported by cash generation. Operating cash flow of 19.52B and levered free cash flow of 13.22B provide ample coverage for a 13 dividend and a 59.09% payout ratio. Balance sheet flexibility appears manageable with a 1.48 current ratio, 39.71B total debt and 12.33B cash, plus a 59.37% debt‑to‑equity reading. These metrics frame a company that can fund store renovations, selective expansion and marketing while navigating macro bumps. Valuation is not cheap—trailing P/E 25.14 and EV/EBITDA 11.83—but a forward P/E of 22.57 implies the market expects stabilization and a return to growth. If that pathway materializes, today’s premium could hold; if not, the multiple will likely do the adjusting.

Industry context tilts in LVMH’s favor over a multi‑year horizon. The group’s breadth across fashion & leather goods, wines & spirits, perfumes & cosmetics, watches & jewelry, and selective retail (including beauty chains) allows it to rotate focus when a region or category cools. Pricing power in heritage maisons tends to be resilient, though the “aspirational” customer is more sensitive to macro and credit conditions. Tourist flows remain a swing factor: travel retail strengthens brand heat and basket sizes, but is vulnerable to visa, flight capacity and FX dynamics. Meanwhile, scale in media buying and real estate helps LVMH secure prime windows and footfall, an advantage smaller rivals struggle to match when traffic slows.

How that translates into the stock’s narrative: a premium multiple requires evidence of steady mid‑term growth and margin discipline. ROE of 16.96% and an operating margin of 22.58% support the quality story; ownership concentration (49.44% insiders) aligns capital with long‑term brand stewardship but can dampen liquidity and index‑driven flows. The key swing variables are demand in Greater China and the U.S. aspirational tier, FX trends that influence reported growth, and execution at the store level, especially in beauty. Clear signs of re‑acceleration, stable gross margins, and disciplined investment could sustain or lift the forward multiple; a prolonged slowdown or heavier‑than‑expected opex would likely compress it.

What could happen in three years? (horizon October 2025+3)

| Scenario | Narrative |

|---|---|

| Best case | Global luxury demand re‑accelerates as China’s outbound travel normalizes and the U.S. aspirational consumer stabilizes. Beauty and selective retail gain share, flagship maisons hold pricing, and FX turns neutral. Operating discipline rebuilds margins without sacrificing brand investment, supporting a sustained premium valuation. |

| Base case | Growth is choppy but positive. Europe and the Middle East offset softer months in North America and Asia. Tourism and beauty drive steady traffic, while fashion cycles produce mixed sell‑throughs. Margins stabilize as cost inflation eases and store productivity improves, keeping the multiple broadly range‑bound. |

| Worse case | Prolonged weakness in China and the U.S. aspirational tier combines with unfavorable FX and higher promotional intensity across the industry. Inventory turns slow, gross margin pressure persists, and the market de‑rates the shares until demand visibility clears. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- China and U.S. aspirational demand trends, including tourism recovery and retail footfall.

- FX moves (EUR vs USD/CNY), which can distort reported growth and margins.

- Brand heat and product cadence across major maisons; marketing effectiveness and pricing power.

- Execution in beauty/selective retail and travel‑related channels that drive incremental traffic.

- Input costs and wage inflation in Europe; supply chain availability for key materials.

- Capital allocation (dividends, store capex, selective M&A) and integration discipline.

Conclusion

LVMH enters the next three years balancing a premium valuation with evidence of near‑term slowdown. Revenue contraction and sharper earnings pressure point to cyclical normalization and investment‑led margin compression, while cash generation, liquidity, and brand strength underpin resilience. The stock’s recovery into October suggests the market is willing to underwrite stabilization, but sustaining a forward P/E near the low‑20s will require consistent organic growth, steady gross margins, and disciplined opex. Industry leadership gives LVMH leverage over real estate, media, and talent, yet it also makes the group a bellwether for macro, FX, and tourist flows. Watch next 1–2 quarters: mainland China demand and U.S. aspirational spending; FX translation effects on reported growth; gross margin and marketing intensity; store traffic in beauty and travel retail; pricing and inventory discipline around holiday periods. If these indicators firm, the narrative can remain one of quality at a premium; if they wobble, the multiple likely bears the adjustment.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.