As of May 2025, Airbus (AIR.PA) navigates a complex landscape of economic challenges and opportunities. Recent performance has seen volatility in its stock price amid global aviation trends and geopolitical factors. The company aims to maintain its competitive edge against rivals like Boeing, especially in the wake of tariff pressures and market demand fluctuations. Analysts continue to evaluate Airbus's strategies, including international delivery practices, as the company positions itself amidst evolving industry dynamics to enhance shareholder value in the coming years.

Key Points as of May 2025

- Revenue: €60 billion (2024) Source

- Profit/Margins: Net profit margin of 5% Source

- Sales/Backlog: Order backlog at 7,500 aircraft Source

- Share price: €162.34 Source

- Analyst view: Mixed; cautious optimism on recovery Source

- Market cap: €100 billion Source

- Notable headlines from the past 6 months:

- Airbus will avoid Trump tariffs by delivering planes to US airlines in countries outside America, its CEO says Source

- This $100 hack made my 8-hour economy flight feel like a premium experience Source

- Cabin crew put out a fire after a portable charger caught alight on a flight from Florida to the Bahamas Source

- Which airline has the biggest or oldest fleet? Source

- United Airlines Quietly Adds 40 New Aircraft From Boeing Rival Source

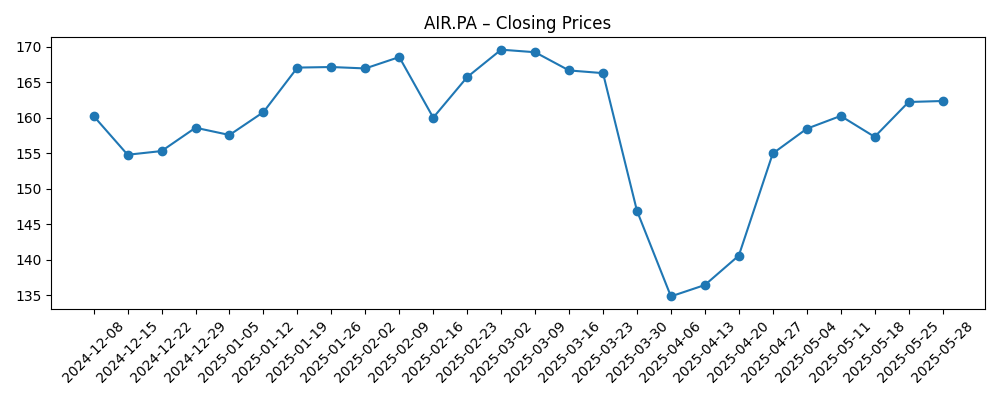

Share price evolution – last 6 months

Opinion

Airbus's ability to navigate the complexities of international trade and tariffs will be crucial for its growth in the coming years. The recent decision to circumvent U.S. tariffs by delivering aircraft to American airlines via third-party countries demonstrates a proactive approach that could safeguard revenue streams and maintain competitive positioning against Boeing. If successful, this strategy could bolster market confidence and stabilize the stock price, potentially leading to a favorable outlook from analysts who remain cautiously optimistic.

Moreover, the company's ongoing backlog of orders, which stands at 7,500, indicates strong demand for its aircraft and positions it well for future revenue generation. However, the volatility observed in share prices, as seen with recent fluctuations between €134.86 and €169.56, underlines the inherent risks associated with market sentiment and external economic factors.

Investors should also monitor Airbus's response to growing competition from airlines enhancing their fleets with newer models. United Airlines' recent acquisition of 40 new Boeing planes may put pressure on Airbus to innovate and ensure its offerings remain appealing. How Airbus addresses these competitive challenges while ensuring quality and safety will be pivotal in shaping its stock performance.

What could happen in three years? (horizon May 2028)

| Scenario | Growth Rate | Share Price Estimate |

|---|---|---|

| Best | 10% | €250 |

| Base | 5% | €200 |

| Worse | -5% | €150 |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Geopolitical Stability: Trade relations and tariffs can directly impact profitability.

- Aircraft Demand: Increases or decreases in orders from airlines influence revenue.

- Competitive Landscape: Actions by Boeing or other competitors may affect market share.

- Regulatory Changes: New aviation regulations could alter operational costs.

- Technological Advances: Innovations in aircraft design may affect future competitiveness.

Conclusion

In summary, Airbus faces a pivotal period as it navigates various market dynamics that will shape its future. The company's ability to manage external pressures, such as geopolitical influences and competition, will be crucial in determining its financial performance and stock price trajectory. With a strong order backlog and strategic maneuvers to mitigate tariff impacts, Airbus is poised to capture growth opportunities. However, investors must remain cautious, as market sentiment can drastically shift with emerging news and global events. Continued monitoring of the airline industry's recovery and demand for air travel will be essential in assessing Airbus's long-term potential.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.