America Movil’s stock has re-rated in recent months, outpacing broader indices as investors price in steadier growth and dividends. The company enters this outlook with scale – trailing twelve‑month revenue of 935.68B – and visible operating momentum after a year of cost discipline and mix shift toward higher‑value customers. The share price has also benefited from improved sentiment around Latin American telecoms, where competition has eased in some markets and data usage continues to rise, though currencies remain volatile. Because the equity has already advanced 41.87%, the question for the next phase is whether cash generation can absorb network upgrades while keeping leverage in check. In our view, the setup hinges on three levers: pricing power in core markets, execution on fiber and next‑generation mobile rollouts, and the path of local interest rates that drive financing costs. For sector context, telecoms globally are prioritizing returns on invested capital over raw subscriber growth, favoring stable dividends and selective capex. That industry pivot should support America Movil’s narrative if operating discipline endures.

Key Points as of November 2025

- Revenue: trailing twelve‑month revenue of 935.68B; latest quarterly revenue growth of 4.20% year over year (data set).

- Profit/Margins: operating margin 21.52% and profit margin 7.24%; net income 67.76B; diluted EPS 1.21; gross profit 564.55B; EBITDA 316.66B.

- Cash flow and leverage: operating cash flow 267.93B; levered free cash flow 112.29B; total debt 751.89B; debt/equity 165.15%; current ratio 0.81; total cash 99.68B.

- Sales/Backlog: backlog not a core metric for telecom services; growth pace guided by service revenue trends – detailed subscriber data not disclosed in this dataset.

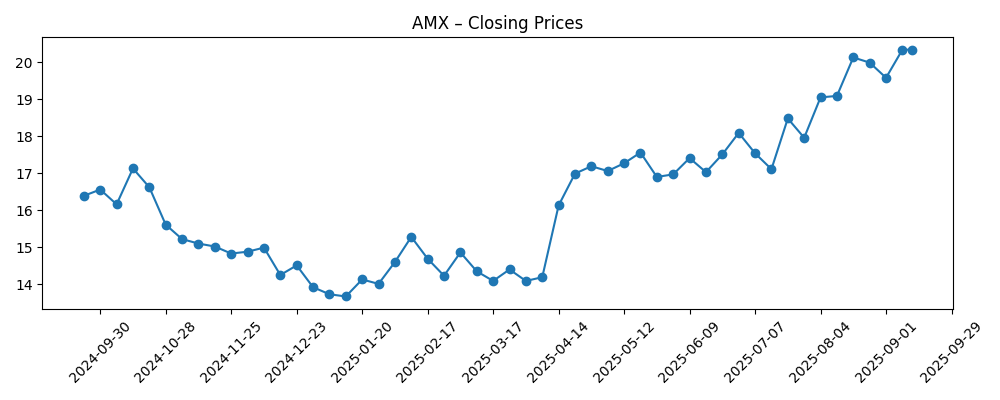

- Share price: recent weekly close 22.77 (Oct 31); 52‑week high 23.61 and low 13.10; 50‑day moving average 21.00 and 200‑day 17.43; beta 0.35; 52‑week change 41.87%.

- Analyst view: explicit rating/target data not provided; short interest appears modest at 0.29% of shares outstanding (short ratio 4.41; 0.56% of float); forward dividend yield 2.47% with payout ratio 44.91% (dividend date 11/17/2025; ex‑div 11/7/2025).

- Market cap: not explicitly disclosed; implied by shares outstanding (3.02B) and prevailing price; institutional ownership in data is 6.18%.

- Qualitative: leading multi‑country operator in Latin America; FX – foreign exchange – swings remain a major driver of reported results; regulation and spectrum terms in key markets can influence pricing, capex, and returns.

Share price evolution – last 12 months

Notable headlines

Opinion

AMX’s latest run‑rate shows a business balancing moderate top‑line growth with disciplined efficiency. Revenue grew 4.20% year over year on the latest read, and the operating margin at 21.52% signals pricing and cost control are doing the heavy lifting as data usage expands. Earnings momentum looks outsized on a year‑over‑year basis (quarterly earnings growth 253.20%), which in this sector can reflect a mix of FX translation, one‑offs, and leaner opex; the key test is whether this converts into recurring cash. Here the pairing of EBITDA at 316.66B and operating cash flow at 267.93B suggests healthy cash conversion to fund networks and shareholder returns without relying solely on external financing.

Sustainability rests on the balance sheet and capital allocation. Leverage is substantial (total debt 751.89B; debt/equity 165.15%) and liquidity is tight (current ratio 0.81), so the cadence of capex and spectrum payments matters as much as growth. The dividend profile is serviceable with a 2.47% forward yield and a 44.91% payout ratio, but management will likely stay selective on buybacks or incremental distributions until debt trends improve. A low beta of 0.35 and the defensive nature of telecom cash flows can cushion volatility, yet after a 41.87% share move, execution needs to stay crisp to preserve the multiple.

Within the industry, AMX benefits from scale, cross‑market procurement, and a broad footprint that can support pricing power in markets with rational competition. The strategic focus is shifting from subscriber adds to monetization – faster broadband, higher‑value postpaid, and converged bundles. That pivot typically lifts margins but raises operational demands around fiber buildouts and next‑generation mobile deployment, where timing and quality of service feed directly into churn and average revenue per user. Regulatory scrutiny on tariffs and spectrum conditions in core countries will shape how much of inflation and currency pressures can be passed through to end customers.

For the equity story, multiple expansion would likely require a period of consistent mid‑single‑digit service revenue growth, stable or rising margins, and visible deleveraging. Conversely, a stronger dollar or sharp local currency weakness could compress reported earnings and re‑ignite leverage concerns, weighing on the valuation narrative. Dividend stability and any signals on portfolio optimization (e.g., tower or fiber partnerships) could also influence sentiment. In short, AMX enters the next phase with solid cash generation and a defensible position, but the market will reward execution that converts that strength into lower leverage and more predictable returns.

What could happen in three years? (horizon November 2028)

| Scenario | Narrative |

|---|---|

| Best case | Service revenue compounds steadily as competition stays rational and FX is benign. Operating discipline holds margins near current levels while selective network investments lift broadband and postpaid mix. Strong cash conversion supports gradual deleveraging and a clearer total‑return story via sustainable dividends. |

| Base case | Growth remains moderate as markets digest pricing and macro volatility. Currency swings offset part of operational gains, but cash generation covers capex and dividends. Leverage edges down slowly, keeping the valuation anchored around a stable, income‑oriented narrative. |

| Worse case | FX headwinds and price competition intensify, pressuring margins and slowing cash accumulation. Higher local rates and regulatory constraints raise funding and spectrum costs, delaying deleveraging and constraining shareholder returns, leading to a de‑rating. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- FX moves across key markets relative to the U.S. dollar and their translation impact on reported earnings.

- Regulatory and spectrum decisions in core countries that affect pricing, competition, and capex timing.

- Execution on fiber and next‑generation mobile rollouts, including service quality and churn outcomes.

- Balance‑sheet trajectory – leverage management, interest costs, and access to funding.

- Sector demand/pricing trends in mobile data and fixed broadband, including competitive intensity.

- Portfolio actions (partnerships, asset monetizations) that could reshape cash flow visibility.

Conclusion

AMX’s three‑year setup looks grounded in steady operations and cash generation, tempered by balance‑sheet constraints and currency sensitivity. The company’s current profile – modest top‑line growth (4.20% yoy latest), strong operating margin (21.52%), and solid operating cash flow (267.93B) – can fund essential networks and a measured dividend while creating room to gradually reduce leverage (total debt 751.89B). The sector’s shift toward return discipline should help sustain pricing, yet the valuation after a strong share move will likely track the pace of deleveraging and the consistency of service revenue growth through FX cycles. Watch next 1–2 quarters: pricing resilience in core markets; service‑revenue trajectory; FX trends and local rates; capex execution on fiber and mobile; debt path and any signals on portfolio monetization; dividend cadence. If execution stays on plan and currencies cooperate, the narrative can remain one of stable income with incremental balance‑sheet improvement; if not, sensitivity to FX and regulation could cap the multiple.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.