CSL Limited (ASX: CSL) is an Australian biopharmaceutical company focused on plasma‑derived therapies (CSL Behring), influenza vaccines (CSL Seqirus) and specialty medicines for cardio‑renal and iron deficiency (CSL Vifor). It competes with global plasma and vaccine players such as Grifols, Takeda, Sanofi and Pfizer across key therapeutic markets.

Financially, CSL reports revenue (ttm) of 15.56B and net income of 3.00B, supported by a 19.30% profit margin and 18.83% operating margin. EBITDA totals 4.91B, operating cash flow 3.56B and levered free cash flow 1.88B. The balance sheet shows 2.16B in cash versus 11.5B in total debt (debt/equity 53.71%) and a 2.46 current ratio; ROE is 15.37%. Quarterly revenue grew 4.90% year over year and quarterly earnings increased 34.30% year over year. The forward dividend yield is 2.28% on a 4.52 distribution with a 45.49% payout ratio, and the shares have fallen 32.00% over 52 weeks with low beta at 0.26.

Key Points as of September 2025

- Revenue (ttm) stands at 15.56B with quarterly revenue growth of 4.90% year over year.

- Profitability: profit margin 19.30% and operating margin 18.83%; net income 3.00B, EBITDA 4.91B, ROE 15.37%.

- Cash flow remains robust with operating cash flow of 3.56B and levered free cash flow of 1.88B.

- Balance sheet: total debt 11.5B against cash of 2.16B; debt/equity 53.71%; current ratio 2.46.

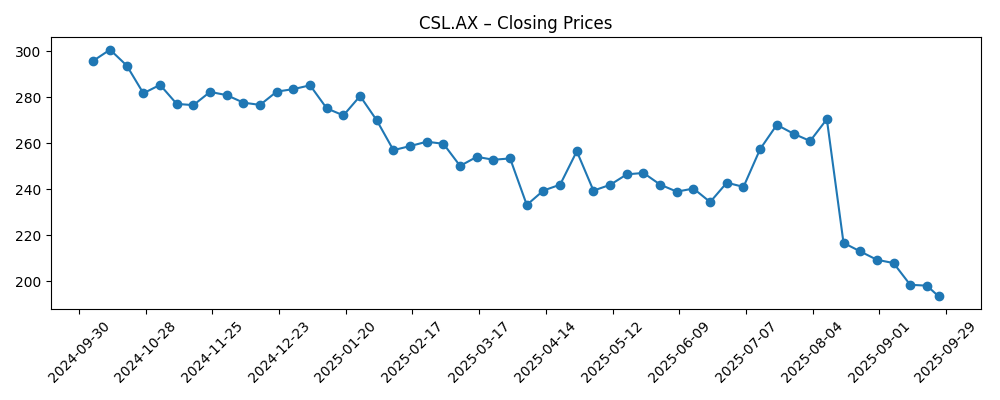

- Share price weakness: last close ~193.29 (2025‑09‑26); 52‑week change −32.00%; 52‑week low 189.80; 50‑day MA 234.39, 200‑day MA 249.84; beta 0.26.

- Dividend: forward rate 4.52 with a 2.28% yield; payout ratio 45.49%; ex‑dividend date 2025‑09‑09.

- Sales trend: modest topline growth while quarterly earnings growth is 34.30% year over year.

- Analyst view: not provided here; investor focus likely on growth durability, margins and leverage.

- Market cap: approx. 93.8B based on ~485.15M shares outstanding and the last close.

Share price evolution – last 12 months

Notable headlines

Opinion

CSL’s share price has undergone a sharp reset in the past six months, sliding from the mid‑260s in July to about 193 by late September and sitting near its 52‑week low. The stock now trades well below its 50‑day and 200‑day moving averages, signaling technical pressure alongside a broader de‑rating. Yet the underlying business still shows resilience: beta remains low, indicative of historically defensive characteristics, and cash generation is healthy. The juxtaposition is clear—investors have repriced expectations, but the franchise’s core demand drivers in plasma collections and seasonal influenza vaccines remain structurally relevant. In our view, the sell‑off reflects concern over the pace of growth rather than a collapse in fundamentals.

Financial metrics provide a mixed but constructive picture. Revenue (ttm) of 15.56B and EBITDA of 4.91B support a profit margin of 19.30% and operating margin of 18.83%. Operating cash flow of 3.56B and levered free cash flow of 1.88B suggest capacity to invest and service obligations, although total debt of 11.5B keeps leverage in focus. Quarterly revenue growth of 4.90% is modest, but quarterly earnings growth of 34.30% points to efficiency gains and mix benefits. The forward dividend yield of 2.28% with a 45.49% payout offers some downside cushion, though income alone is unlikely to spark a rerating without clearer evidence of accelerating top‑line growth.

Strategically, the breadth across CSL Behring, CSL Seqirus and CSL Vifor diversifies revenue and cash flows through different seasons and funding environments. Plasma‑based therapies are supported by chronic, non‑discretionary demand, while vaccines benefit from annual cycles. This diversification can smooth earnings volatility and improve planning for capital allocation. Assuming steady execution and no major regulatory or manufacturing setbacks, the company appears positioned to compound earnings over a multiyear horizon, albeit at a more measured pace than in prior cycles if sales growth remains in the mid‑single digits.

For equity holders, the next three years will likely hinge on three variables: the pace of revenue acceleration from the existing portfolio, the trajectory of margins as cost and collection dynamics normalize, and balance‑sheet flexibility given 11.5B of total debt. If CSL can demonstrate consistent growth and incremental margin expansion while maintaining strong cash conversion, a multiple recovery from current levels is plausible. Conversely, if revenue momentum stalls or unforeseen compliance events arise, the shares may continue to lag broader indices despite their defensive profile. With sentiment fragile after a 32.00% 52‑week decline, execution and communication around priorities should be powerful catalysts.

What could happen in three years? (horizon September 2025+3)

| Scenario | Revenue trajectory | Margins | Balance sheet | Share price view |

|---|---|---|---|---|

| Best | Consistent acceleration from plasma and vaccines; diversified portfolio sustains steady growth. | Gradual expansion driven by operating leverage and efficiency gains. | Deleveraging progress supported by strong free cash flow. | Re‑rating toward historical premium for defensive growth compounders. |

| Base | Moderate, steady growth from core franchises with normal seasonality. | Stable margins with incremental improvements through productivity. | Leverage broadly stable; investment funded by internal cash generation. | Total returns track earnings growth plus dividends. |

| Worse | Growth slows due to pricing, reimbursement or collection constraints. | Margin pressure from costs or adverse mix; efficiency benefits harder to realize. | Deleveraging delayed; higher funding costs constrain flexibility. | Sustained underperformance versus market and peers. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Plasma collection dynamics and cost efficiency across the network, affecting supply and unit economics.

- Influenza vaccine demand variability and competitive positioning across key markets.

- Regulatory and quality outcomes at manufacturing sites; compliance events can move sentiment quickly.

- Foreign‑exchange movements versus AUD and major revenue currencies, influencing reported growth and margins.

- Leverage and interest expense management given total debt of 11.5B and cash of 2.16B.

- Capital allocation choices, including dividend sustainability (payout ratio 45.49%) and any future M&A appetite.

Conclusion

CSL enters the next three years with defensible franchises, healthy cash generation and an improved income profile, set against a more demanding equity backdrop. The stock’s steep drawdown and position below key moving averages reflect a market that wants clearer evidence of sustained revenue acceleration. Today’s fundamentals—15.56B in revenue, 3.00B in net income, margins near 19%–19%, and 3.56B of operating cash flow—argue for resilience, while leverage at 11.5B keeps execution discipline in focus. If management can maintain mid‑cycle growth and preserve margin gains seen in recent quarterly earnings, the path to multiple repair is open, aided by a 2.28% forward yield. Absent that, the shares may continue to lag despite low beta. On balance, CSL looks positioned for steady, cash‑backed compounding, with the valuation reset creating a more balanced risk‑reward for patient investors.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.