Embraer S.A. (ERJ) enters September 2025 with strong operational momentum and a sharply higher share price. Trailing-12-month revenue is 39.8B, gross profit 7.39B and EBITDA 4.08B, supporting an operating margin of 9.97% and net margin of 5.37%. Quarterly revenue grew 30.90% year over year, though quarterly earnings fell 13.80%, highlighting a mix of scale and cost pressures. The stock is up 64.14% over 52 weeks, trading near its 52-week range of 32.26–62.09, with a recent close around 56.71. Balance sheet liquidity is adequate (current ratio 1.33; cash 6.86B versus debt 12.68B), and ROE at 11.32% points to improving capital efficiency. A token dividend (0.09% forward yield, 2.40% payout ratio) suggests emphasis on reinvestment. With beta at 1.12 and short interest moderate, the next three years hinge on execution, supply chain stability, and order conversion, as analysts recalibrate forecasts after a notable re-rating.

Key Points as of September 2025

- Revenue (ttm) 39.8B; Gross Profit (ttm) 7.39B; EBITDA 4.08B; Operating Cash Flow 5.59B; Levered FCF 2.37B.

- Margins and returns: Operating margin 9.97%; Profit margin 5.37%; ROE 11.32%; ROA 3.56%.

- Sales/Backlog: Commercial and executive jet demand appears resilient; order pipeline remains a central driver (no backlog figure disclosed here).

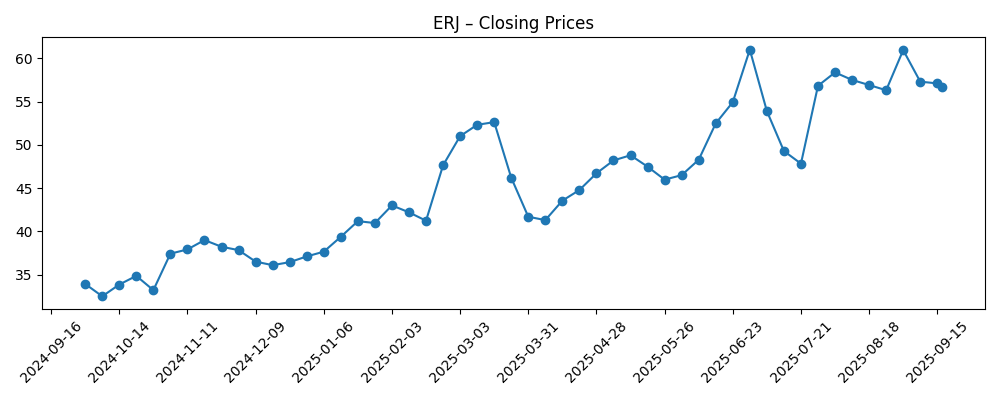

- Share price: Recent close ~56.71 (9/17/2025); 52-week range 32.26–62.09; up 64.14% vs S&P 500 up 17.59%; 50-day MA 55.62; 200-day MA 47.54; Beta 1.12.

- Analyst view: Fresh estimates and coverage updates in recent weeks point to active recalibration of FY2025 and near-term earnings expectations.

- Market cap: ≈$10.4B implied (price ~56.71 × 183.39M shares outstanding).

- Balance sheet: Cash 6.86B; Debt 12.68B; Debt/Equity 64.42%; Current ratio 1.33.

- Trading/ownership: Avg vol (3M) 2.02M; Short interest 3.55M (1.94% of shares outstanding; 2.15% of float); Short ratio 1.57; Institutions hold 46.74%.

- Dividend: Forward annual rate 0.05 (0.09% yield); payout ratio 2.40%; last ex-dividend 5/16/2025; dividend date 6/2/2025.

Share price evolution – last 12 months

Notable headlines

- Equities Analysts Offer Predictions for ERJ FY2025 Earnings

- What is Zacks Research’s Estimate for ERJ Q3 Earnings?

- Embraer-Empresa Brasileira de Aeronautica $ERJ Shares Purchased by Quantbot Technologies LP

- Hsbc Holdings PLC Acquires 67,034 Shares of Embraer-Empresa Brasileira de Aeronautica $ERJ

Opinion

ERJ’s multi-quarter re-rating has been brisk. Weekly closes show a climb from the low–mid 30s in late 2024 to a June 2025 peak above 60, before consolidating around the mid–high 50s. The 50-day moving average has risen above the 200-day, underscoring positive momentum, while the 52-week change of 64.14% far outpaces the S&P 500. Such a move typically invites digestion: profit-taking, tighter trading ranges and a reset of expectations. With beta at 1.12, pullbacks can be sharp but often short-lived if fundamentals continue to trend well. The 32.26–62.09 range provides an objective backdrop for risk framing, and the recent close near 56.71 suggests the stock still trades close to its upper decile. Over the next three years, sustaining this premium likely requires consistent delivery growth, margin discipline and credible visibility on supply chain reliability.

Fundamentally, the mix is constructive. Revenue rose 30.90% year over year in the most recent quarter, but earnings contracted 13.80%, signaling near-term cost and mix headwinds amid rapid scaling. Even so, TTM operating margin at 9.97% and profit margin at 5.37% indicate improving operational leverage, while ROE at 11.32% shows better capital efficiency. Cash generation (5.59B OCF; 2.37B levered FCF) helps balance a still-material debt load (12.68B) against 6.86B cash, with a current ratio of 1.33 supporting liquidity. The minimal payout (0.09% forward yield; 2.40% payout) keeps capital focused on production cadence, customer support and potential product refreshes. If management can translate strong revenue growth into steadier earnings progression, the equity story shifts from rerating to compounding, which is a healthier long-run phase.

Recent headlines reflect an active sell-side and institutional audience. New earnings previews and estimate updates suggest tighter scrutiny of 2H25 delivery pacing and cost normalization. Reported share purchases by institutional investors can signal confidence in execution, though these are incremental rather than thesis-defining. Short interest remains modest at 1.94% of shares outstanding (2.15% of float) and a short ratio of 1.57, limiting the chance of squeeze-driven spikes and implying price discovery will be earnings-led. For investors, the key watch items over the next 12–18 months are cadence of deliveries, pricing power in regional and executive jets, after-market contribution, and consistency of cash conversion. These will determine whether 2025’s strong stock performance was pulled forward or sets a base for another leg higher.

From a strategic lens, the company benefits from structural airline fleet renewal, the popularity of right-sized regional jets in network optimization, and a healthy business jet replacement cycle. Defense exposure can add diversification and multi-year visibility, although it often carries milestone and delivery timing risk. The path to 2028 will likely hinge on bottleneck management—everything from suppliers to skilled labor—while safeguarding margins. With average volume at 2.02M (3-month) vs 1.43M (10-day), liquidity is ample for institutions to adjust positions as new information surfaces. In this context, valuation discipline matters: after a 64% 12-month rise, upside may increasingly require evidence of sustainable double-digit operating margins and stable free cash flow, rather than simply macro tailwinds.

What could happen in three years? (horizon September 2028)

| Scenario | Demand and orders | Operations and margins | Equity view by 2028 |

|---|---|---|---|

| Best case | Steady airline and corporate demand; multiple marquee orders; aftermarket growth strengthens visibility. | Supply chain stable; cost discipline holds; operating margins improve with scale and mix. | Shares maintain leadership vs peers; volatility persists but trend is upward on compounding cash flows. |

| Base case | Healthy but uneven order intake; deliveries broadly on plan with periodic timing shifts. | Margins fluctuate within a narrow band; cash conversion adequate to fund reinvestment and low dividend. | Stock tracks earnings growth; returns cluster around sector averages with periodic swings. |

| Worse case | Softening demand in key end-markets or delays in large campaigns; muted aftermarket contribution. | Supply constraints and cost inflation compress margins; working capital absorbs cash. | Multiple compresses; shares test lower end of historical range until execution re-accelerates. |

Projected scenarios are based on current trends and may vary based on market conditions.

Factors most likely to influence the share price

- Delivery cadence vs guidance and the mix between commercial, executive and defense programs.

- Margin trajectory amid supplier performance, labor availability and pricing power.

- Cash generation and leverage management (cash 6.86B vs debt 12.68B; Debt/Equity 64.42%).

- Order announcements or cancellations by major airline and government customers.

- Analyst estimate revisions and institutional ownership shifts following quarterly results.

- Macro factors impacting air travel demand and financing conditions for aircraft buyers.

Conclusion

ERJ’s equity story in 2025 is defined by re-accelerating growth, better operating discipline and a share price that has already repriced to reflect improved execution. The data show a business with rising revenue (ttm 39.8B), positive operating leverage (9.97% operating margin) and improving capital efficiency (ROE 11.32%), balanced against a still-meaningful debt load and near-term earnings variability (−13.80% yoy in the last quarter). Liquidity is adequate and cash generation supports reinvestment, while the small dividend underscores management’s growth focus. Over the next three years, delivery reliability, supply chain stability and aftermarket expansion will likely determine whether ERJ transitions from a rerating phase into a compounding phase. With valuation increasingly dependent on sustained margins and free cash flow, investors should watch estimate revisions and order-related news closely. Net, the setup skews constructive but execution-sensitive, with the stock likely to track fundamentals more tightly after 2025’s strong run.

This article is not investment advice. Investing in stocks carries risks and you should conduct your own research before making any financial decisions.